Bitcoin open interest dropped nearly 20% as speculators exited amid a $10,000 price crash from the Trump tariff war. Concerns about rising inflation, stagflation, and a general slowdown in the global economy could lead to a risk-on environment, forcing more capital into bonds and cash. Even so, could this be the right time to Buy BTCUSD?

Bitcoin and crypto prices are volatile. After a temporary push higher on April 7, prices edged lower yesterday, confirming losses from last week and perhaps setting the stage for even lower prices in the coming days.

While the momentary rebound to around $80,200 on April 8 could be a positive signal, the turbulence in current market conditions could quickly erase it as broader macroeconomic pressures remain tense.

(BTCUSDT)

Explore: Best New Cryptocurrencies to Invest in 2025

Bitcoin Open Interest Drops Nearly 20%

In the next few trading days, Bitcoin prices will be subject to intense macroeconomic pressures, and geopolitical escalations will shape market sentiment, impacting risky assets, particularly crypto.

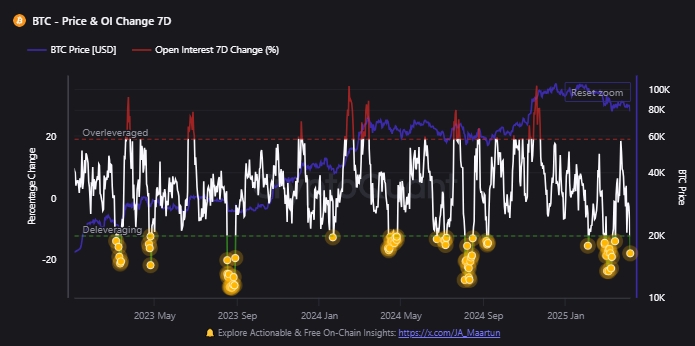

Given recent trends and the general turmoil that has seen the world’s most valuable coin shrink by over $10,000 since April 2, on-chain data now confirms a massive unwinding of leveraged Bitcoin positions across major perpetual exchanges like Binance, Bybit, and OKX.

One analyst on X notes that Bitcoin open interest is down nearly 20% in the past week of trading, signaling an aggressive flush-out of leveraged traders.

(Source)

The sell-off of the past few days was primarily accelerated by liquidations—including a $1.3 billion liquidation on April 7 alone—and sentiment is bearish at current spot rates.

This could throttle capital flowing into crypto and Bitcoin. The situation may worsen further as tensions from the Trump “Liberation Day” tariff war escalate rapidly.

On-chain data confirms a massive 17.8% drop in Bitcoin open interest, signaling an aggressive flush-out of leveraged traders. Billions in speculative positions have been closed in just seven days—a classic market reset that often precedes a fresh wave of accumulation.

However, with tensions from the Trump-era “Liberation Day” tariff war escalating rapidly, the timing of any potential recovery remains uncertain, further impacting even some of the best meme coins to buy in 2025.

Yesterday, China responded to Trump’s tariffs by dumping $50 billion in U.S. Treasuries.

In retaliation, the U.S. announced an escalated tariff rate of 104% on Chinese imports, effective today.

In response, Bitcoin prices dropped from around $80,200 to as low as $74,500 and continue to face pressure.

At this pace, open interest will likely decrease as traders close their positions. Others will likely reduce leverage rapidly to meet margin requirements.

With this happening, the market will become leaner and more capable of mounting a sustainable recovery, as history shows.

Whenever sharp losses are accompanied by a double-digit drop in open interest, market prices tend to recover as smart traders buy the dip, taking advantage of better prices.

Explore: 10 Best AI Crypto Coins to Invest in 2025

Time to Buy the BTC/USD Dip?

In a different post, another analyst on X said the short-term holder market value to realized value (MVRV) ratio is at 0.85.

This contraction signals that short-term holders—addresses that bought Bitcoin in the past 155 days—are down 15%.

Parallel data shows that nearly 26% of all Bitcoin in circulation is in negative territory.

Bitcoin in Loss: 5,124,348 BTC (25.8%)

That’s a significant chunk of the circulating supply sitting in the red.

While it might seem alarming, it’s not unprecedented.

In fact, we saw similar dips in 2024.

Jan 22, 2024: 24.1% – 4.72M BTC

July 06, 2024: 22.4% – 5.13M BTC… pic.twitter.com/PpmfAID3ZF

— CryptoQuant.com (@cryptoquant_com) April 7, 2025

However, with the STH MVRV ratio at 0.85—below the 0.90 threshold—it may indicate that Bitcoin is deeply undervalued.

When this metric fell below 0.90 in August and September 2024, Bitcoin prices recovered sharply. In turn, it drove even more capital to some of the hottest crypto presales.

If history serves as a guide, the Bitcoin price could be in textbook accumulation territory. Afterward, the coin could snap higher, above the $90,000 resistance.

DISCOVER: Next 1000x Crypto – 10+ Coins That Could 1000x in 2025

Bitcoin Open Interest Dropping: Will BTCUSD Recover?

- Bitcoin price drops driven by a wave of liquidation

- Bitcoin open interest plunges nearly 20% in a week, flushing out overleveraged traders

- China dumps U.S. Treasuries as U.S. hikes tariffs on Chinese goods in response

- Is it time to buy the BTCUSD dip in anticipation of price gains?

The post Bitcoin Open Interest Drops Nearly 20%, Speculators Flushed Out — But Will BTC/USD Bounce Higher? appeared first on 99Bitcoins.