When you’ve been watching markets and really feel like they’ve misplaced the plot, you’re not alone. Bitcoin jumped over 6% in 24 hours, breaking above $94,000 on April 23, its highest degree since March, earlier than easing barely to present ranges. It broke out of its month-long buying and selling vary simply as macro uncertainty peaked.

Alerts clashed. Logic folded. The standard correlations started to fray. Bitcoin, the digital wildcard as soon as written off as pure hypothesis, surged. Stocks rose, then fell, reacting extra to tweets and headlines than to earnings or knowledge. The greenback slipped, with the U.S. Greenback Index (DXY) hovering close to 99, down from over 105 in late March. And the Fed discovered itself again within the highlight, enduring a verbal barrage from the president, who branded its chair a “main loser.”

It’s tempting to learn crypto’s rise in isolation. However what’s occurring is larger. It’s a symptom of a market system the place danger, security, and technique not play by the foundations.

When risk-off turns into risk-on

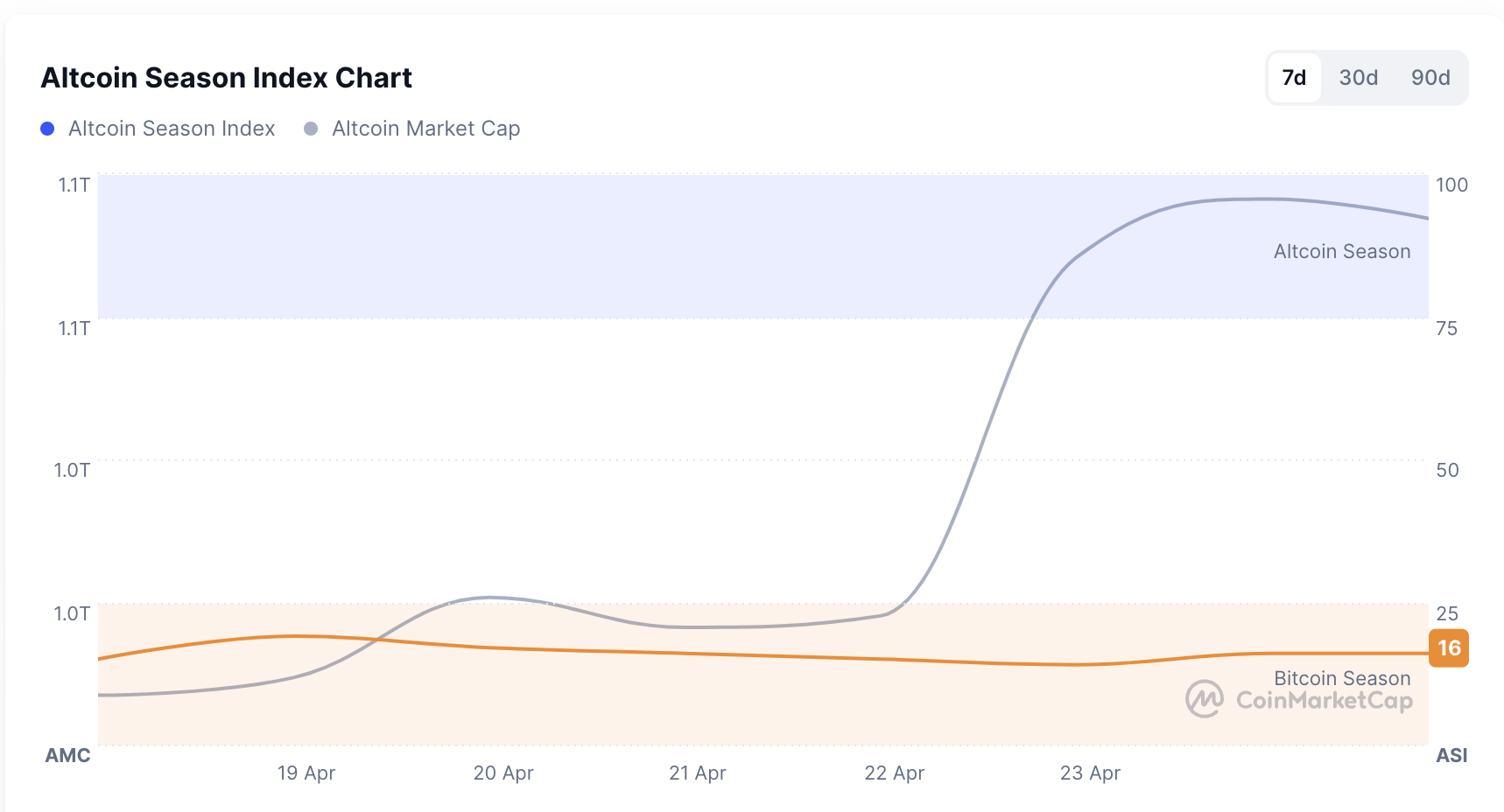

Usually, when equities drop and geopolitical tensions flare, buyers flock to secure havens, money, treasuries, gold. Not Bitcoin. And but right here we’re: BTC is up in a single day, and the broader altcoin market has adopted, the whole altcoin market cap rose from $997.56 billion on April 22 to $1.04 trillion on April 24.

The Altcoin Season Index sits at 12, proof that this can be a Bitcoin-led transfer. Traders aren’t rotating into crypto for enjoyable. They’re hedging towards politics, confusion, and a greenback shedding its grip. And towards the sensation that nobody, not even Powell or Trump, is aware of what occurs subsequent.

Bitcoin lastly goes its personal method?

A month in the past, Bitcoin’s 30-day correlation with the S&P 500 hovered round 0.9, nearly indistinguishable from the key inventory indexes. However by April 22, that determine had sharply declined. The correlation with the S&P 500 dropped to 0.35, with the Nasdaq Composite to 0.34, whereas the correlation with gold climbed to 0.39.

However right here’s the place it will get fascinating: gold spiked to a file $3,500 on April 22, then fell sharply because the greenback rebounded and shares rose. Bitcoin didn’t flinch. It held its floor, echoing equities greater than bullion. The takeaway is that Bitcoin isn’t copying gold or tech. It’s deciphering the noise in actual time, with its personal sort of logic.

This makes Bitcoin’s divergence all of the extra placing in a macro panorama formed by protectionism, tariff threats, and combined messaging on commerce. After Trump imposed a sweeping 145% tariff on Chinese language items, Beijing retaliated and accused the U.S. of unilateralism, demanding all tariffs be lifted. Treasury Secretary Scott Bessent denied any plans for unilateral cuts, calling the present setup “the equal of an embargo” and “unsustainable.”

In the meantime, Trump himself hinted at tariff de-escalation, calling 145% “too excessive” and promising to be “very good” to China, just for China to reject all overtures as “groundless.” The consequence? Market confusion and diplomatic gridlock. Traders noticed gold spike earlier than pulling again as Bessent’s feedback boosted the greenback and shares.

Amid the chaos, Bitcoin remained regular. Like a generator in a blackout, it held agency whereas sovereign property twisted with each headline. Untethered from coverage posturing, it’s exhibiting what it means to maneuver exterior the outdated script. So has Bitcoin lastly gone its personal method? It could be too early to say definitively, however the indicators recommend it’s starting to.

Powell, politics, and the Fed’s fragility

Political focusing on of central banks is new terrain. Fed Chair Jerome Powell is underneath direct assault from Trump, who accuses him of political sabotage and hints at his alternative.

But amid the backlash, Trump has additionally tried to reassure markets, stating he has “no intention” of firing the Fed Chair — not less than for now. The combined messages solely heighten the environment of uncertainty — forcing buyers to consider the place financial coverage would possibly go when the referee is being booed off the sphere.

Bitcoin, in the meantime, retains inching increased. It’s not that buyers out of the blue belief crypto extra — they only might belief it greater than the headlines.

Greed for Bitcoin returns

Alongside Bitcoin’s breakout, investor sentiment has flipped sharply. In only one week, the crypto market sentiment has jumped from Worry to Greed. As of April 24, 2025, the Bitcoin Worry & Greed Index sits at 63, firmly in “Greed” territory, whereas CNN’s Fear & Greed gauge for U.S. equities stays in “Worry” territory at 28.

However this isn’t traditional bull euphoria, it’s survival optimism. Traders aren’t shopping for Bitcoin as a result of the longer term appears shiny. They’re shopping for it as a result of all the pieces else appears worse.

This makes the shift in correlation with gold much more profound: it indicators that greed isn’t fueled by momentum, it’s fueled by macro nervousness.

The top of market logic?

This may very well be the actual takeaway: the cycle is likely to be useless. We used to anticipate post-halving rallies, altcoin seasons, and ETF-driven hype. However evidently this rhythm is gone and buyers aren’t enjoying the outdated recreation.

As an alternative, they’re getting ready for a distinct one, one the place the greenback weakens, commerce decouples, central banks turn out to be political battlegrounds, and the one rational wager is one thing that sits exterior the system.

Last ideas

Markets often transfer on patterns. However what if the sample now’s dislocation itself? What if Bitcoin’s power isn’t an indication of investor confidence, however of investor disillusionment?

That’s what makes this second so essential. It’s not only a rally. It’s a referendum.

And for now, Bitcoin, that outdated image of rise up, is likely to be the closest factor we’ve acquired to rationality in a world the place all the pieces else has gone mad.