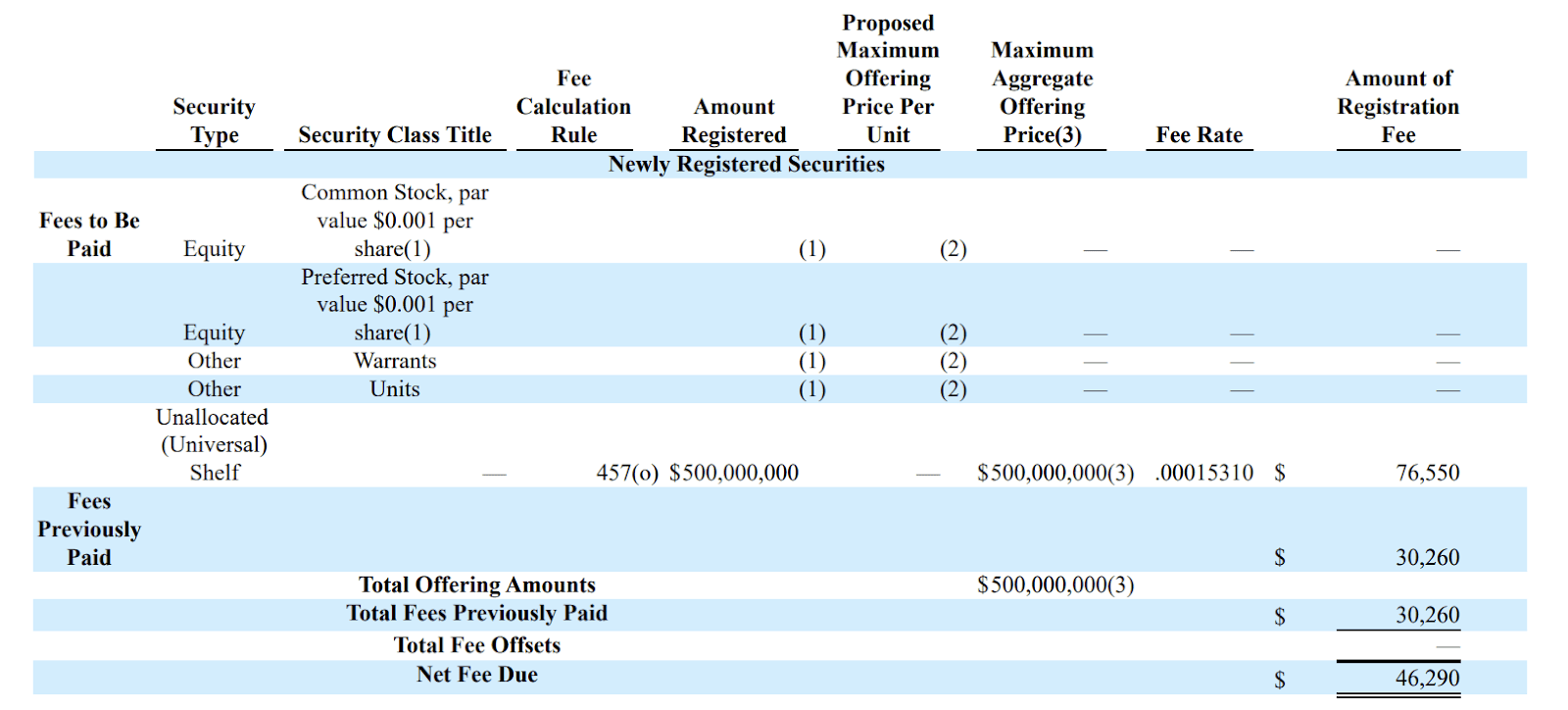

Thumzup Media Corporation (Nasdaq: TZUP) has filed an modification to its shelf registration on Form S-3 with the Securities and Change Fee, rising the utmost providing quantity from $200 million to $500 million. The transfer indicators a big ramp-up within the firm’s twin mission: scaling its social media branding platform and rising its Bitcoin holdings.

As of Could 5, 2025, Thumzup holds 19.106 BTC valued at roughly $1.8 million. The corporate’s board had beforehand greenlit a daring treasury technique permitting as much as 90% of its liquid belongings to be held in Bitcoin. This expanded registration provides Thumzup the flexibleness to boost capital by a number of avenues, together with frequent inventory, most well-liked inventory, warrants, debt securities, and models, over the subsequent three years.

Based on the corporate’s submitting, “We view bitcoin as a dependable retailer of worth and a compelling funding. We consider it has distinctive traits as a scarce and finite asset that may function an affordable inflation hedge and secure haven amid international instability”.

No securities are being bought presently. Nevertheless, any future providing underneath the registration might be detailed in a prospectus complement filed with the SEC.

The amended submitting reaffirms Thumzup’s conviction in Bitcoin’s long-term potential, drawing comparisons to gold. “Given our perception that bitcoin is a comparable and probably higher retailer of worth than gold… bitcoin has the potential to strategy or exceed the worth of gold over time,” the corporate acknowledged.

This growth follows a broader shift in Thumzup’s operational technique. Since its Nasdaq listing in October 2024, the corporate has adopted Bitcoin as its major treasury reserve asset and introduced plans to supply funds in Bitcoin by its Account Specialist Program. As Thumzup positions itself on the crossroads of digital advertising and marketing and digital forex, this expanded registration marks a robust sign of its future intentions. For traders and analysts monitoring company Bitcoin adoption, Thumzup’s newest submitting is one other instance of a publicly traded firm doubling down on BTC as a core monetary technique.