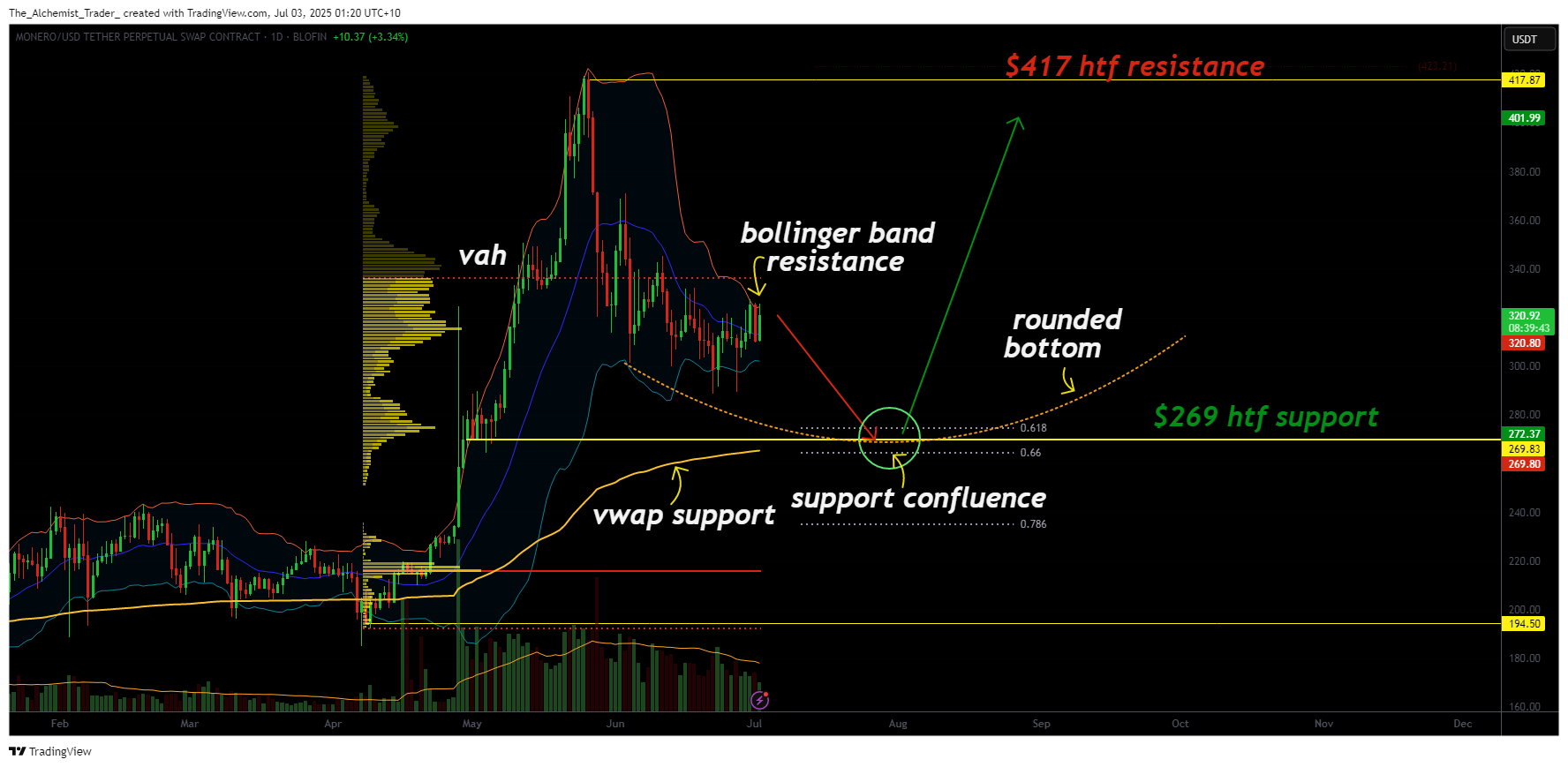

Monero price is shaping a bullish rounded bottom pattern as it approaches key resistance levels. A successful retest of support could spark a rotation toward the $417 high time frame target.

Monero’s (XMR) price action is beginning to take shape as a potential rounded bottom, a classic reversal structure that hints at accumulation at current levels. The altcoin recently tested resistance near the value area high, which also aligns with dynamic compression from the Bollinger Bands. If bulls can reclaim higher ground after a retest, the probability of a larger rally toward $417 becomes more likely.

Key technical points

- Value Area High Resistance: Currently rejecting from the upper boundary of the volume profile, aligned with Bollinger Band resistance.

- $269 High-Diagram Support Zone: Critical region with confluence from the 0.618 Fibonacci level and VWAP SR.

- Rounded Bottom Formation: Potential reversal structure forming over a multi-week base.

The initial barrier for Monero lies at the value area high, a level currently reinforced by Bollinger Band compression. This combination suggests strong resistance, and the reaction at this level will likely dictate the next leg of price action. A rejection here would likely lead to a pullback into the $269 region, which holds significance as a structural support zone.

This $269 area is underpinned by strong technical confluence. It marks the 0.618 Fibonacci retracement from the previous swing move, coupled with anchored VWAP support from the recent impulse. Additionally, this zone aligns with the base of the developing rounded bottom, reinforcing its importance as a foundation for reversal.

Should this level hold in the coming weeks, Monero’s structure will begin to resemble a confirmed rounded bottom. This formation often precedes a sustained bullish phase and, if validated, could open the door for a move toward the $417 resistance, a high time frame ceiling established in prior cycles.

One important factor to monitor is the volume profile throughout this structure. Rounded bottom patterns often develop during periods of low volume, followed by a gradual increase as price approaches the neckline. If Monero begins to show a steady rise in volume near the $269 support during any corrective move, it would signal renewed buyer interest and strengthen the case for a breakout.

Traders should remain patient, as this type of formation typically unfolds over an extended timeframe but often results in explosive continuation once confirmed.

What to expect in the coming price action

If Monero holds above the $269 support zone following a pullback, bulls may regain control and drive a slow but steady rally toward the $417 resistance. However, failure to defend this key level could invalidate the rounded bottom setup and delay bullish continuation.