Ondo Finance has acquired Oasis Pro as the RWA tokenization platform secures its place in the industry. ONDO prices are steady but firm.

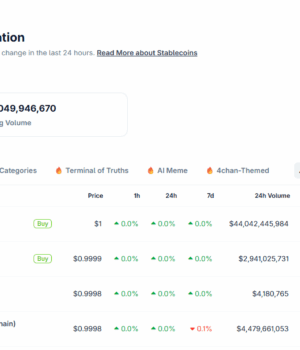

While the focus is on Bitcoin, meme coins, and even DeFi, the future of crypto is clearly emerging as tokenization. Since the first stablecoin hit the market in 2014, the industry has grown to a market cap of over $264 billion.

USDT by Tether has a market cap of over $158 billion, while USDC by Circle is in second place with a market cap of nearly $62 billion. Other stablecoins track JPY, GBP, and even gold, all with decent market caps cumulatively exceeding $500 million.

(Source)

RWA Tokenization Exploding

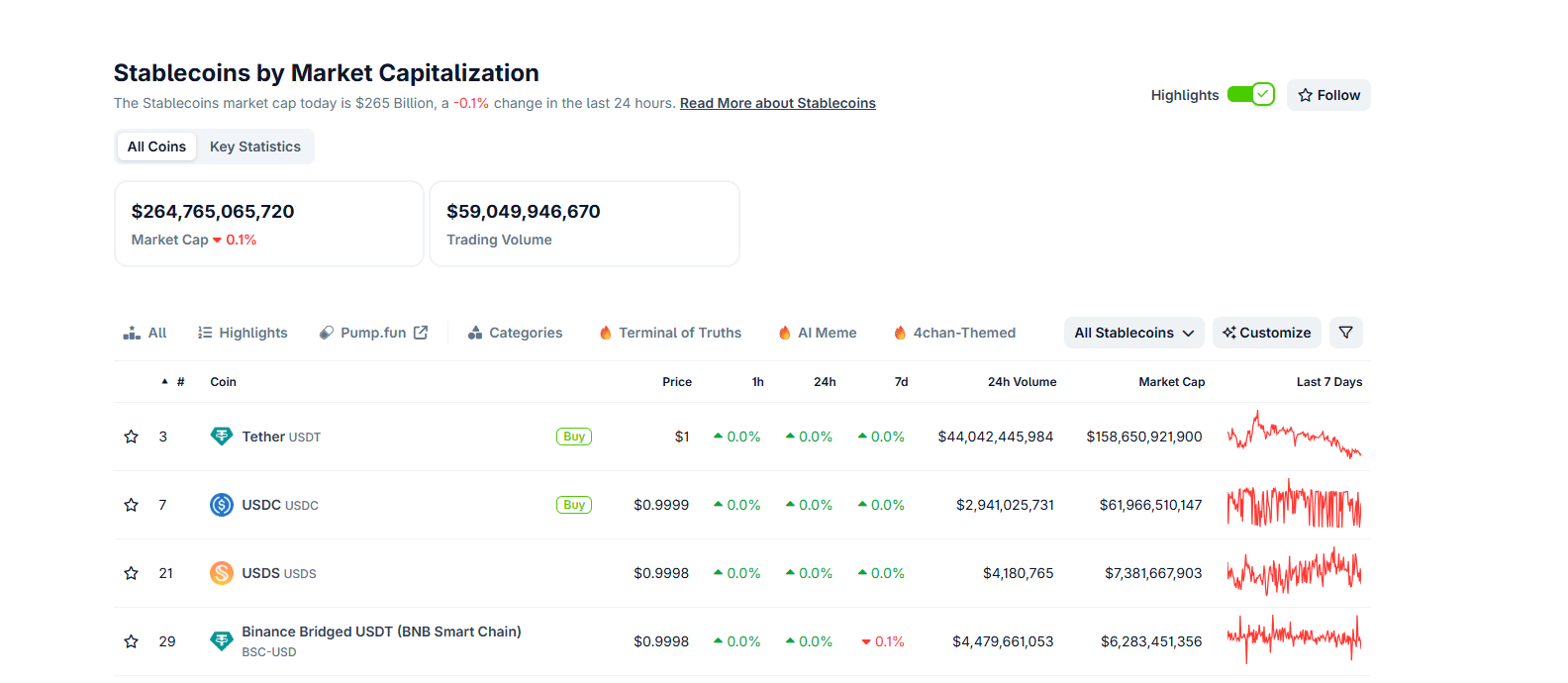

A look at rwa.xyz data reveals that over $24.8 billion of real-world assets (RWAs) have been tokenized. Over the months, there are more than 282,000 holders of these assets, nearly doubling in the past month alone. In total, there are 249 issuers as of July 8. Most of these tokens are on Ethereum, but others are circulating on Aptos, Stellar, Solana, and Algorand.

Among the big issuers is Ondo Finance, a RWA tokenization platform that has been gaining traction in the past two years. Currently, Ondo Finance’s USDG and USDY, two products tokenizing United States bonds, are among the most valuable, with a market cap of over $710 million and $652 million, respectively.

In the past week, these products have seen their total value locked (TVL) increase by 3% and 9%, respectively.

(Source)

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Ondo Finance Acquires Oasis Pro

Yesterday, Ondo Finance took another monumental step in its efforts to become a big player in the tokenization market.

The Boston Consulting Group (BCG) projects tokenization to crack $16 trillion by 2030. Tokenization is a big industry, and Ondo Finance cemented its position after acquiring Oasis Pro.

The deal, announced on July 4, will see the RWA platform take over the regulated brokerage platform, absorbing the broker’s licenses and infrastructure.

Oasis Pro is regulated in the United States as one of the first operators of Alternative Trading Systems (ATS) for digital securities. Through this deal, Ondo Finance now has the foundation to build on Oasis Pro’s comprehensive regulatory framework further, effectively bridging DeFi with CeFi via tokenization.

Ondo Finance now has the right to issue, trade, and even settle tokenized securities in a way that’s compliant with the United States SEC’s laws. Before this deal, Oasis Pro was among the first platforms to settle digital securities using USD and stablecoins like USDC and DAI.

Pat LaVecchia, the CEO of Oasis Pro, said the deal now sets the foundation for a “regulated tokenized securities ecosystem.” Meanwhile, Nathan Allman, the CEO of Ondo Finance, added that this acquisition empowers them to “realize their vision of building a robust and accessible tokenized financial system, backed by the strongest regulatory foundations.”

DISCOVER: 20+ Next Crypto to Explode in 2025

24/7 Trading Of U.S. Securities

Ondo is already preparing to launch its Global Markets platform, offering tokenized stocks to non-U.S. investors. These stocks will be tokenized and wrapped, backed by real shares via regulated custodians.

In this way, these stocks will be tradable every day of the week, just like some of the best cryptos to buy. Additionally, investors will be able to own a fraction of these shares and even program transaction flows.

Eventually, they plan to scale to thousands of securities, including ETFs, by the end of the year.

At press time, is flat, capped at around $0.82, trailing some of the top Solana meme coins.

Technically, the uptrend remains, but for buyers to find strength, prices must float above the local support at $0.72.

DISCOVER: Next 1000x Crypto – 11 Coins That Could 1000x in 2025

Ondo Finance Acquires Oasis Pro, Eyes $16T Tokenization Market

- Tokenization could hit $16 trillion by 2030

- Ondo Finance acquires Oasis Pro

- RWA tokenization platform plans to tokenize U.S. securities

- ONDO crypto prices flat below $0.82

The post Ondo Finance Positions to Dominate the $16 Trillion Tokenization Market After Strategic Acquisition appeared first on 99Bitcoins.