This week Monero (XMR crypto) developers moved to calm fears of a potential 51% attack linked to the Qubic mining pool. Whether Qubic ever actually controlled a majority of  XMR ▲0.31% hashrate is still unproven, but the claim alone was enough to jolt the community.

XMR ▲0.31% hashrate is still unproven, but the claim alone was enough to jolt the community.

“Qubic only showed what is possible,” said Joel Valenzuela, a Dash DAO core member. “Much better-funded and more determined actors could cause so much more chaos. It’s an ‘evolve or die’ moment.”

The scare briefly knocked the XMR price down to $233 on August 16 before bouncing back above $250 along with the wider crypto market. Should you be worried?

What Is the Full-Chain Membership Proofs (FCMP) Monero Upgrade?

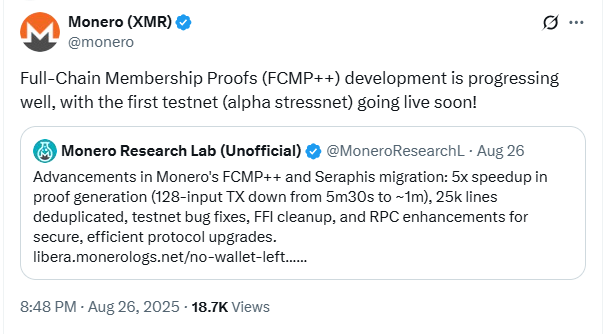

Monero confirmed that its Full-Chain Membership Proofs (FCMP) upgrade is moving fast, with a testnet launch expected soon. FCMP is seen as a direct response to 51% attack fears and a leap forward for Monero’s privacy model.

The upgrade promises two critical advances:

- Zero-knowledge proofs for verifying transactions without revealing amounts or identities.

- Performance gains, cutting cryptographic proof times for multi-input transactions from 5+ minutes to about 1 minute.

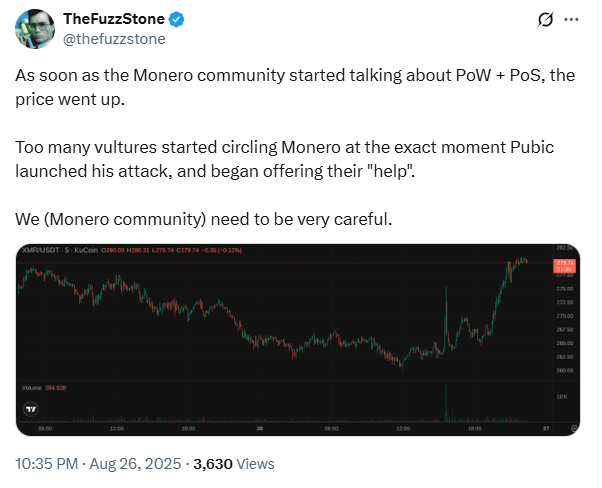

The Qubic scare reignited debate about Monero’s reliance on proof-of-work (PoW).

Successful PoW coins ensure their security by cornering their mining niche. Bitcoin is the SHA-256 coin, and Ethereum is the GPU coin. The insane fees were essentially the requirement to maintain Ethereum as the primary GPU coin with a high security budget.

DISCOVER: 20+ Next Crypto to Explode in 2025

Monero, on the other hand, secured the CPU niche but was not greedy enough to exploit it. The hash rate would have been way higher if it had been greedier with miner rewards. There would be more serious miners, and Qubic would be unable to do what it’s doing to this extent. Instead of shilling Bakecel circular economy, Monero should have gone with a better Swiss bank account narrative.

Some developers and community members are now pushing for a hybrid model, mixing PoW with other mechanisms.

Luke Parker, Monero developer, has suggested exploring hybrid approaches.

However, devs like Valenzuela are conflicted: “The community is probably split 50/50 on this issue.”

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Is a Hybrid Consensus Model the Future of XMR Crypto? Data Breakdown: The Economics of a 51% Attack

Understanding why the Qubic event sparked alarms helps in examining the numbers.

Proof-of-work comes with a built-in risk. Whoever captures 51% of the hashrate gains the power to rewrite the chain and create double-spends at will.

Monero tried to guard against mining centralization by shifting to the CPU-friendly RandomX algorithm, cutting ASICs out of the picture. But the move has its downside: it makes it easier for an attacker to rent massive computing power or hijack botnets, which is far less feasible in Bitcoin’s ASIC-dominated landscape.

The controversy around hybrid consensus reveals a larger struggle. Monero must decide whether to stick with proof-of-work purity or adopt new structures to withstand emerging risks better.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- This week Monero developers moved to calm fears of a potential 51% attack linked to the Qubic mining pool.

- Some developers and community members are now pushing for a hybrid model, mixing PoW with other mechanisms.

The post Look Inside Monero’s FCMP Upgrade Plan to Recover From 51% Attack appeared first on 99Bitcoins.