Is Trump getting rid of the income tax? President Donald Trump says tariffs could eliminate income taxes for most Americans. Economists disagree, but Trump is adamant that his tariff policy could wipe out income taxes for most households.

“When tariffs cut in, many people’s income taxes will be substantially reduced, maybe even completely eliminated,” Trump said Wednesday.

JUST IN:

President Trump says tariffs could replace federal income tax. pic.twitter.com/yrwvuzbJoz

— Watcher.Guru (@WatcherGuru) September 3, 2025

Trump says his policy would focus on Americans and investors making less than $200,000. Census Bureau data shows only 14.4% of U.S. households earned above $200,000 in 2023. If Trump’s proposal were true, most Americans would no longer pay federal income taxes.

Is Trump Getting Rid of the Income Tax? Why Economists Say Tariffs Can’t Replace Income Taxes

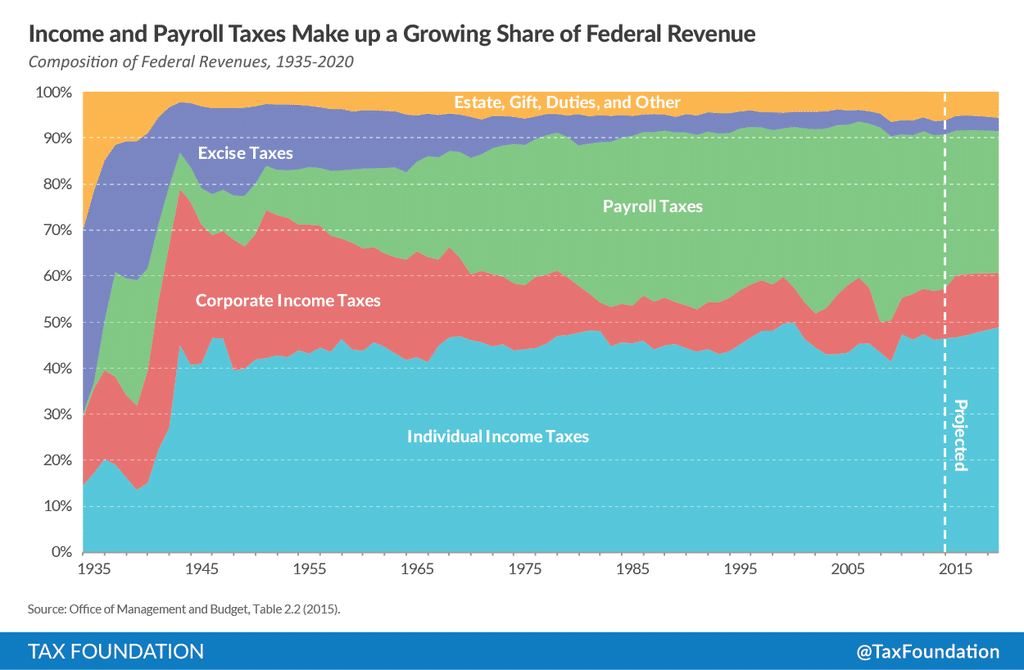

While getting rid of the income tax sounds nice, the numbers don’t align. According to Tax Foundation economists Erica York and Huaqun Li:

“The individual income tax raises more than 27 times as much revenue as tariffs currently do,” said Li. “Even eliminating income taxes for a subset of taxpayers would require significantly higher replacement revenues than tariffs could generate.”

As for crypto investors, many of us can avoid income tax by moving to areas with low taxes, but there are still capital gains to worry about. You’re going to pay the tax man one way or the other.

Meanwhile, Trump’s scheduled tariffs in 2025 are estimated to raise $167Bn in revenue, covering less than 25% of the cost of eliminating income taxes for households earning below $200,000.

Recent data from the IRS also shows the federal income tax brought in $2.2Tn in 2023, while all tariffs combined generated under $100Bn. The gap underscores why experts doubt tariffs can fully replace the system.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

Project 2025 and the Push Toward a Consumption Tax

Trump’s income tax elimination comes from the Republican-backed Project 2025 proposal. One of the plan’s sponsors, and recently ousted IRS Chief Billy Long, previously sponsored legislation to abolish the IRS and implement a national sales tax.

The White House also plans to cut IRS staff by 18%, reducing compliance oversight and enforcement.

While Trump’s plan faces skepticism, investors have legal strategies to reduce taxes. Scott Galloway of NYU, and other top crypto investors, suggest borrowing against stock portfolios instead of selling: “You own $100 in Amazon stock… instead of selling, borrow against it and let the stock continue to grow.”

This strategy avoids triggering capital gains, while investments continue compounding.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What Trump’s Tax Plan Could Mean for Markets

Talk of tariffs replacing income taxes would radically shift how Washington funds itself.

Federal revenue could shrink or deficits balloon, and in that scenario, crypto is likely to draw fresh attention as a hedge against policy chaos.

EXPLORE: Gemini IPO Targets $317M as Trump Media Bets $1B on Crypto.com Treasury Strategy

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Is Trump getting rid of the income tax? Trump says tariffs could eliminate income taxes for most Americans. Economists disagree.

- Talk of tariffs replacing income taxes would mark a drastic shift in how Washington funds itself.

The post Is Trump Getting Rid of the Income Tax? New Tariff Plan Could Replace Taxes — But Does the Math Work? appeared first on 99Bitcoins.