Bitcoin broke through the $115,000 level today, continuing its September rally as U.S. inflation data shaped expectations for Federal Reserve policy. The Consumer Price Index (CPI) came in line with forecasts, while jobless claims rose higher than expected, fueling bets that the Fed could cut interest rates at its upcoming September 17 meeting.

This combination of steady inflation and labor market weakness has markets pricing in as much as 75 basis points in rate cuts by year-end. Traders reacted quickly, with Bitcoin climbing to $115,500 and marking its strongest performance since late August.

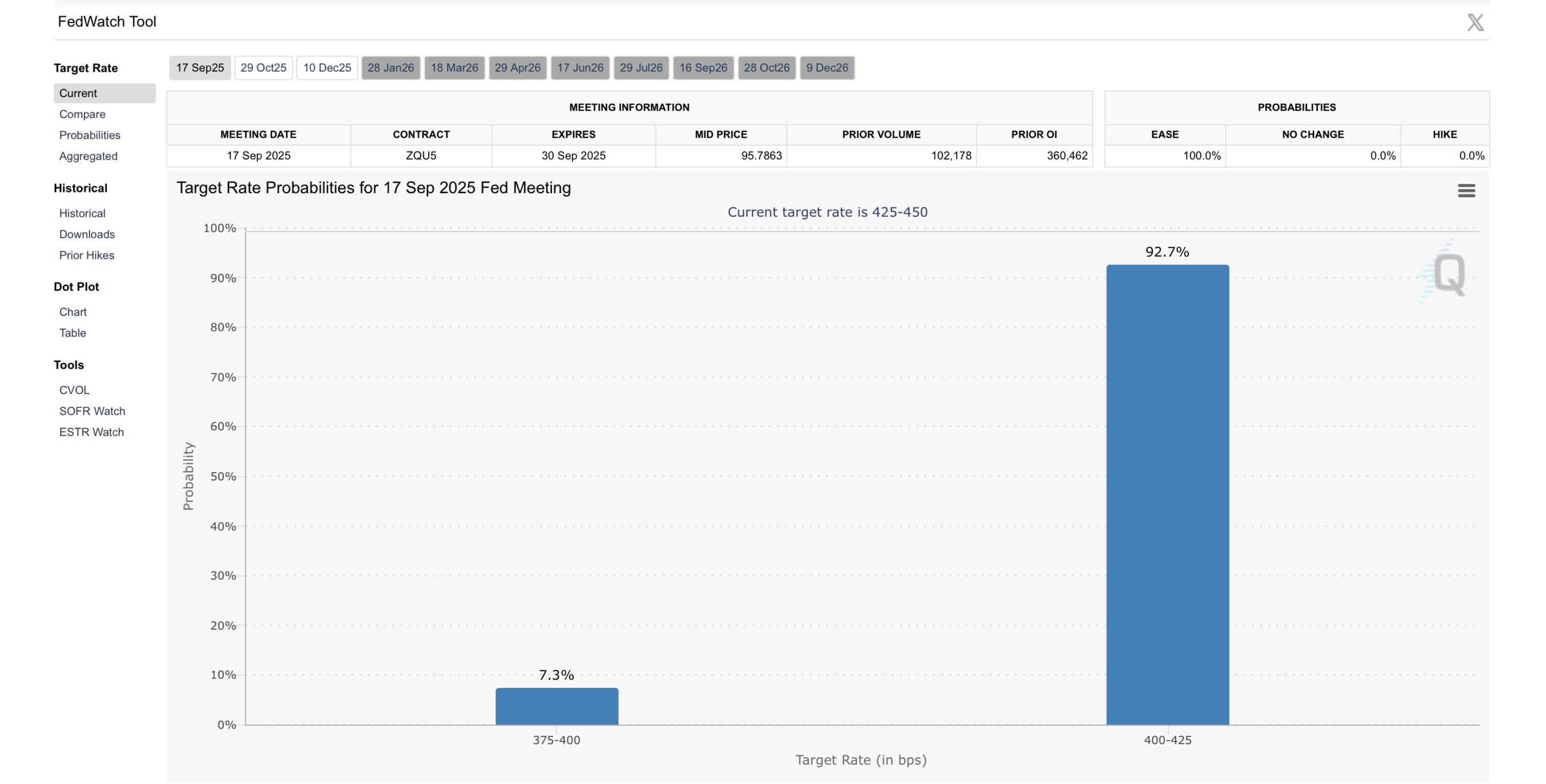

The latest FedWatch data shows markets now pricing in a 92.7% probability of the target rate being lowered to 400–425 basis points, while only 7.3% expect a deeper cut to 375–400 bps. Importantly, the current rate of 425–450 bps has a 0% chance of being maintained, underscoring the market’s conviction that rate cuts are coming. Just a month ago, there was still a 6% chance of no change — showing how quickly sentiment has shifted.

Solana also moved higher, trading at $238, while Binance Coin (BNB) reached $909: a new all-time high. Another standout was Hyperliquid (HYPE), which surged to $57 and joined the list of tokens hitting record levels. Meme coins showed signs of revival as well, with PENGU up 10%, DOGE gaining 4%, and Fartcoin nearing a $1 billion market cap after a 20% rise over the past week.

EXPLORE: Top 20 Crypto to Buy in 2025

Best Crypto To Buy Now: BNB, HYPE, Mantle And Breakout Altcoins

With Bitcoin holding above $115K and fresh rate cut speculation on the table, traders are looking at which tokens could outperform in the next leg of the market. BNB and HYPE are two clear front-runners after setting new all-time highs, highlighting strong momentum and investor demand. Mantle (MNT) is another name to watch, as it recently climbed to new highs, showing resilience as the broader market focused on Layer-2 and Exchange tokens.

$HYPE just hit a new all-time high.

Hyperliquid pic.twitter.com/XnLrke5JAX

— Param (@Param_eth) September 12, 2025

As CPI-driven volatility settles, the market’s focus will shift back to growth narratives and adoption trends. While short-term pullbacks remain possible, the combination of Bitcoin strength, altcoin breakouts, and growing ETF speculation is making September one of the most dynamic months for crypto this year.

Tether Launches USA₮, a U.S.-Regulated Dollar-Backed Stablecoin

Tether, the world’s largest stablecoin issuer, has announced USA₮, a planned U.S.-regulated dollar-backed stablecoin, alongside the appointment of Bo Hines as CEO of Tether USA₮. The move signals Tether’s intent to strengthen U.S. dollar dominance in the digital economy through transparency, compliance, and innovation.

Tether’s flagship token, USD₮, already holds a market cap above $169 billion and supports nearly 500 million users globally, often serving underbanked communities. With USA₮, the company aims to build on this success by offering a U.S.-regulated stablecoin compliant with the recently enacted GENIUS Act, designed to ensure transparency and strong governance.

USA₮ will be issued by Anchorage Digital, the only federally regulated crypto bank, with Cantor Fitzgerald as custodian.

According to Tether, the token will set a new benchmark for compliance and accessibility, reinforcing the U.S. dollar’s role in global finance while expanding adoption in the regulated digital asset market.

Will ONDO Finance Hit $2.5? ONDO Price Blasts 8% Amid Tokenized Stocks Launch

The price of the Ondo Finance token increased by 12% in the last 24 hours, reaching $1.13 on September 12, 2025. The rally follows massive hype around tokenized U.S. stocks and ETFs launched through Ondo Global Markets.

The surge positions ONDO as a leader in the booming real-world assets (RWA) sector, with growing institutional partnerships and retail momentum pushing it into the spotlight as traders eye higher year-end price targets.

THORChain Co-Founder Scammed by North Korean Hackers in $1.3M Exploit

JP, co-founder of THORChain and Vultisig, has reportedly lost around $1.3 million in a sophisticated conference call scam carried out by North Korean hackers. The exploit, revealed by blockchain investigator @zachxbt, highlights a striking irony: JP’s projects have previously been linked to facilitating money laundering for DPRK-linked groups.

Adding to the controversy, JP recently defended North Korea’s right to hack and exploit teams during a documentary on the Bybit hack.

Fed Set to Cut Rates in September, More Easing Likely Ahead

Reuters poll of 107 economists shows near-unanimous agreement that the U.S. Federal Reserve will cut interest rates by 25 basis points at its September 17 meeting, lowering the federal funds rate to 4.00%-4.25%. Weaker labor market data, including stalling job growth in August and a major downward revision to prior employment figures, has shifted expectations firmly toward monetary easing despite inflation risks.

Markets have fully priced in a September cut and now expect at least three reductions this year, compared to just two forecast weeks ago. While most economists anticipate another 25-basis-point cut in the fourth quarter, some see the possibility of a larger 50-basis-point move.

By year-end, forecasts split between a total of 50 bps and 75 bps of cuts. Looking ahead, analysts expect further easing in 2026, with rates potentially falling to 3.00%-3.25% as the Fed prioritizes labor market stability.

The post [LIVE] Crypto News Today, September 12 – Bitcoin Crosses $115K, SOL Price Surges To $238 And BNB Hits A New ATH: Best Crypto To Buy Now? appeared first on 99Bitcoins.