If you’re a TRX holder, it’s time to start worrying. Get ready to wrap your head around major changes unfolding in the multi-billion-dollar stablecoin space, a court Tron has dominated for years.

Yesterday, the Plasma mainnet launched, and contributors, even those who supplied just $1, received over 9,300 XPL tokens for free. It was a classic airdrop, the kind designed to spark FOMO, of which Plasma delivered in spades.

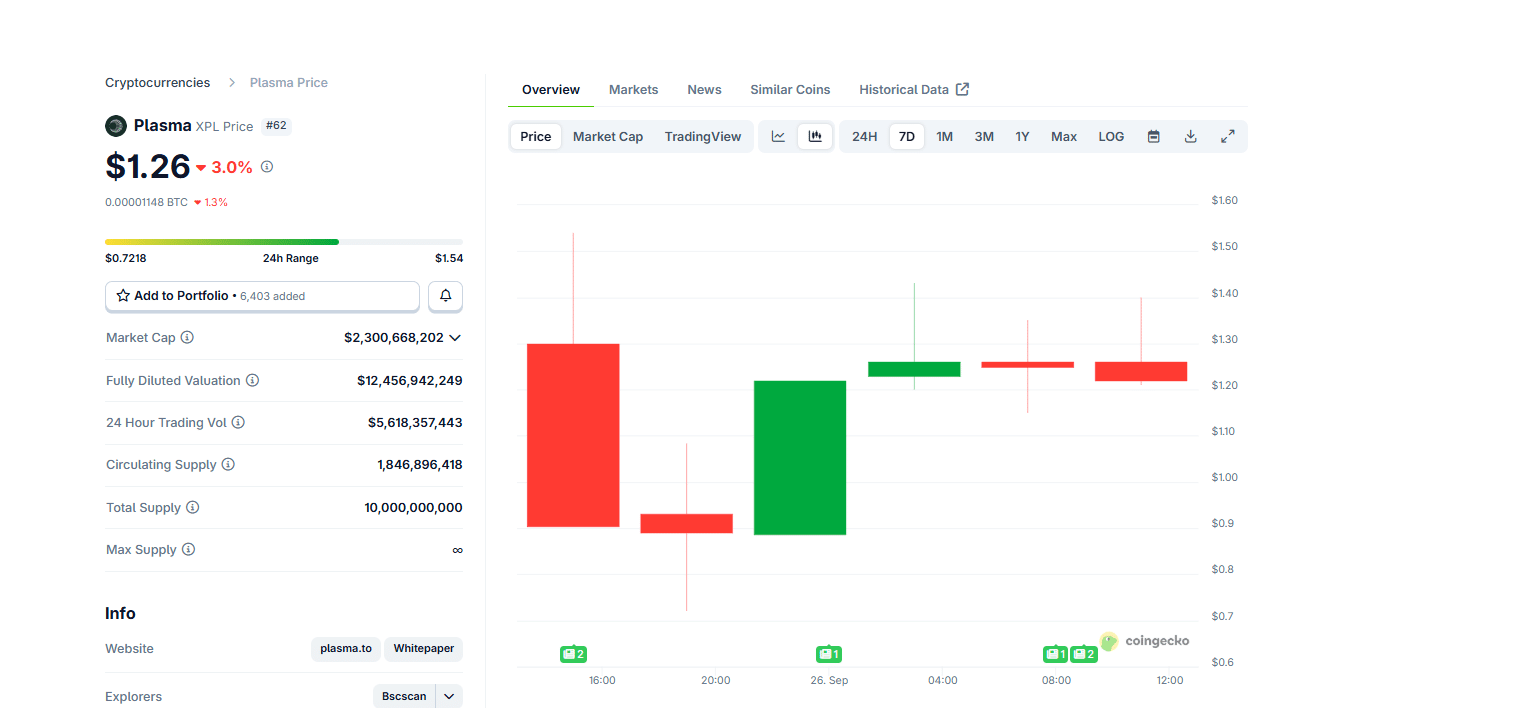

At press time, those 9,300 XPL tokens are worth more than $10,000, with the XPL USD price defying gravity and climbing higher. Patient HODLers could emerge as big winners in the weeks ahead. For the less patient, selling might be the path of least resistance, especially now that XPL boasts ample liquidity across multiple exchanges, including Binance.

On Coingecko, XPL USD is holding firm above $1.20. Thanks to its explosive growth on September 25, its market cap has surged past $2.3 Bn, catapulting Plasma higher and cementing its position as one of the best cryptos to buy. More than 18 hours after launch, Plasma remains a trending topic, with trading volumes climbing steadily across major exchanges. This surge signals strong investor interest, even as the broader market grapples with a sell-off.

(Source: Coingecko)

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

What Is Plasma, and Why Is XPL USD So Hot?

Plasma isn’t just another layer-1 blockchain; it’s a powerhouse with serious backing. Like Bitcoin, it’s a public chain, but unlike general-purpose platforms such as Ethereum or Solana, Plasma is laser-focused on powering stablecoins, especially USDT from Tether.

This focus makes perfect sense. While there’s no direct tie to Tether Holdings, Plasma is supported by Bitfinex, whose owners also control the USDT issuer. Beyond Tether, which issues USDT, the world’s largest stablecoin by market cap, Plasma draws heavyweight investors like Peter Thiel, the renowned backer of successful crypto ventures, including Riot Mining.

Technically, what sets Plasma apart is its ground-up design for efficiency. Scalability is baked in, but the real magic lies in enabling near-zero-fee USDT transfers through a specialized paymaster system. It hit the ground running, attracting over $2Bn in commitments moments after launch. More than 50 DeFi partners, including crypto heavyweights like Aave, Ethena, and Curve, are already live on Plasma.

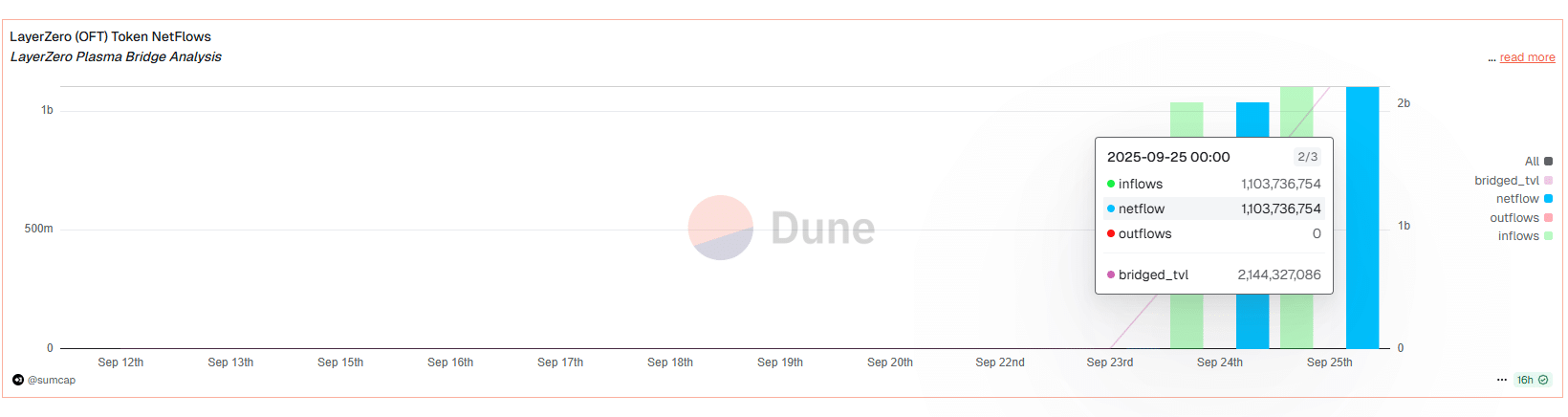

Furthermore, less than a day in, over $1.1Bn in stablecoins have been bridged from Ethereum and Arbitrum via LayerZero.

(Source: Dune)

If XPL USD ticks higher, the expected XPL FOMO will only fuel further adoption.

Plasma Blockchain just launched with zero-fee USDT transfers and already sits on $2B in TVL

But here’s the part nobody’s talking about …

If you can move billions in USDT for free, who really wins and who loses?

Banks? Dead weight. They can’t compete with instant,… pic.twitter.com/xwU7MdSmvN

— Simba (Egide) (@egidesimba) September 25, 2025

Each XPL sold for $0.05 during its public sale, which saw $373M in commitments. Participants, even those staking as little as $10 in USDT via Binance Earn’s locked product, scored at least 9,300 XPL, regardless of stake size. At current levels, XPL’s fully diluted valuation exceeds $12.4Bn, with the token up over +100% in the past 24 hours.

BREAKING: @PlasmaFDN just airdropped 9,304 $XPL (~$10K) to everyone who deposited anything, even $1. pic.twitter.com/sQuQY4fTZC

— HodlFM Team (@Hodl_fm) September 25, 2025

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Is This a Direct Assault on Tron, the USDT King? Will TRX USD Tumble?

As Plasma surges, branding itself as “Money 2.0” and centering exclusively on USDT transfers, storm clouds gather over Tron, its fiercest rival.

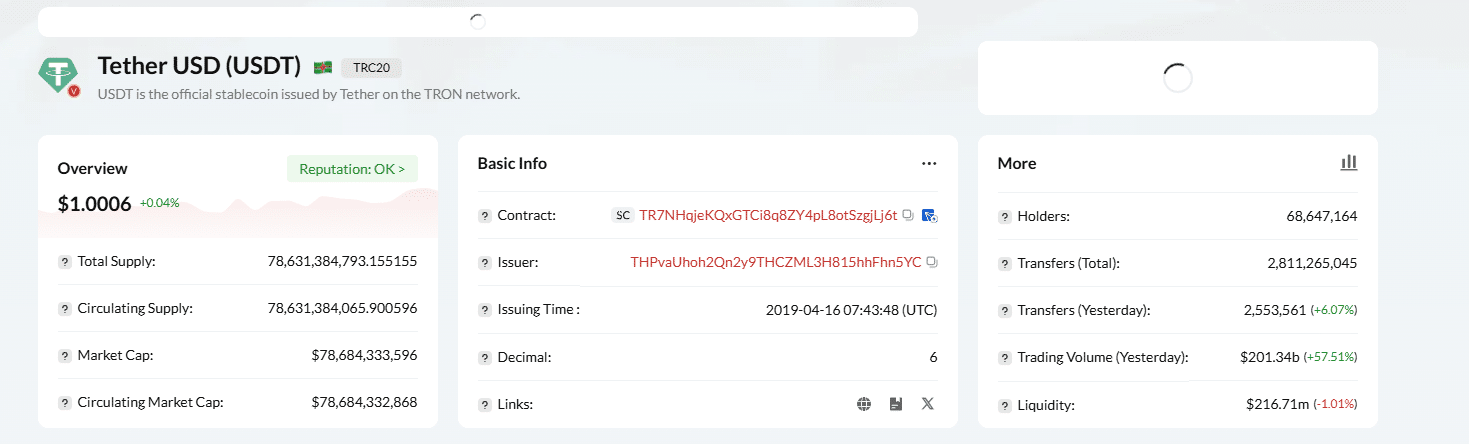

For years, Tron has dominated as the premier platform for USDT transfers, handling over +50% of global USDT volume at any given time. Its edge came from cheaper, more scalable rails than Ethereum, plus sticky network effects in emerging markets.

(Source: TronScan)

But that’s about to change. Indirectly powered by Tether, Plasma has the financial muscle to challenge Tron head-on, potentially consolidating USDT operations on its chain. USDT sends on Plasma? Zero fees. Bridging to Plasma? Also free. The result: a siphon of billions in volume, likely straight from Tron’s coffers.

7/ Plasma takes a different stance from competing stablecoin L1s.

By anchoring around USDT, Plasma can capture Tether flows from cross-border and retail payments, consolidating them alongside trading and settlement activity.

Combined with its distribution edge, Plasma's… pic.twitter.com/P7HCfqXdSW

— Delphi Digital (@Delphi_Digital) September 24, 2025

Whether this becomes Tron’s undoing is anyone’s guess. Justin Sun and the Tron team will almost certainly fight back. As Plasma encroaches, the pressure mounts on Sun to safeguard his network, especially since most of Tron’s fees stem from USDT transfers. Any exodus could leave the chain exposed.

So far, Sun hasn’t uttered a word about Plasma or XPL on X.

That said, cracks are appearing in TRX, much like in BTC USD. TRX USD has dropped nearly -10% from its August highs but remains steady above $0.30, a critical support level. If TRX ▲0.16% trends lower today, holders may panic-sell, accelerating a potential slide toward $0.25 in a bearish continuation pattern.

DISCOVER: 10+ Next Crypto to 100X In 2025

Plasma XPL Explodes, Tron TRX USD In Trouble?

- Plasma mainnet is now live

- XPL airdrop triggers crypto FOMO

- XPL USD surges after listing

- Is Tron and TRX USD in trouble?

The post Plasma XPL Explodes: Is This the Beginning of the End for Tron TRX USD and Justin Sun’s Empire? appeared first on 99Bitcoins.