For the first time in more than a century, America is about to go dark on its inflation stat. With Bureau of Labor Statistics staff furloughed due to the shutdown, there will be no Consumer Price Index and no official measure of the cost of living, nor a baseline for the markets.

What the hell? So the CPI report under Trump will be just smoke and mirrors? This comes at a time when many are arguing that CPI is rigged in the US, like in Banana republics.

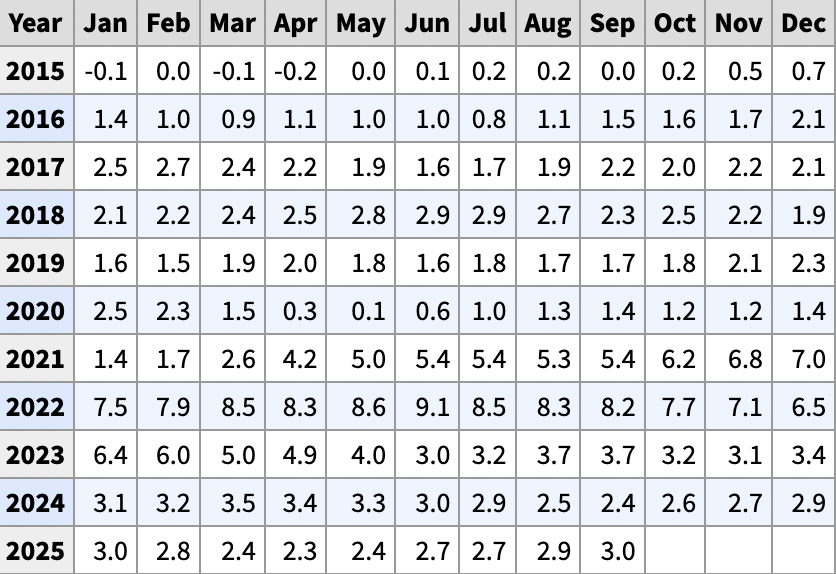

Anyone who pays household bills can see the cost inflation in real time, and it’s much more than 3%. Economists and traders are now navigating blind, improvising where the world’s most-watched inflation gauge used to be.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

CPI Inflation Stat: Is The US F*cked?

“virtually NO INFLATION” says the billionaire politician who hasn’t had to shop at normal stores in decades.

Just like Biden was lying, Trump is lying. pic.twitter.com/innsKZL1K2

— An0maly (@LegendaryEnergy) October 6, 2025

We are currently observing a classic late-cycle policy error in real-time:

- Interest Rates & The Fed: The Fed has begun cutting, bringing the target range to 4.00-4.25% as of September. They are cutting into a slowdown, terrified of the cracks forming in employment.

- Inflation (The Sticky Tail): September CPI ticked up to 3.0% (headline and core). The “last mile” to 2% has failed. The Fed is easing while inflation is re-accelerating, a disaster scenario for bond real yields and equity valuations.

- The Yield Curve Signal: The 10Y-2Y spread is now positive (+0.54%). History shows the recession begins after the curve dis-inverts.

DISCOVER: 20+ Next Crypto to Explode in 2025

Meanwhile, for more than a century, the CPI has tracked every rise and fall in the cost of living without interruption. That record ends this month. With government statisticians furloughed and no new data collected, this is adding more pressure to an already stressful US economic environment.

“Without timely inflation data, households can’t budget, companies can’t plan, and investors are essentially trading on fiction,” said Jon Hill, head of U.S. inflation strategy at Barclays.

Now That CPI Is Gone, What’s Next? The Problem with the “Fallbacks”

With no CPI data to anchor markets, two fallback systems have taken their place and they don’t match. The US Treasury assumes inflation will continue at the past year’s average pace.

The ISDA, which governs swaps, froze inflation at last October’s level: 3.01%.

The result is a warped market. Barclays estimates that the split now implies a 3.05% breakeven rate for TIPS versus just 1.78% for inflation swaps, and this is a gulf wide enough to break models that once moved in sync.

For crypto traders, this is a rupture in one of the world’s core pricing systems.

DISCOVER: Top 20 Crypto to Buy in 2025

How High Will Inflation Get in 2025? Traders Turn to Alternative Indicators

Prediction markets aren’t optimistic. Polymarket contracts give less than a 30% chance that CPI data drops before November.

Without CPI, the Fed walks into its October meeting half-blind. Bond auctions risk distortion, and macro models could start spitting out false signals.

If the shutdown drags on, the divide between TIPS and swaps could widen further, twisting the yield curve and leaving economists guessing what’s really going on.

EXPLORE: Is It All Over For the Bull Run? Rates Cuts Sink Crypto Markets

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- For the first time in more than a century, America is about to go dark on its inflation stat. With Bureau of Labor Statistics furloughed.

- If the shutdown drags on, the divide between TIPS and swaps could widen further, twisting the yield curve.

The post US Inflation Stat Faces Chaos as Government Shutdown Freezes BLS Data appeared first on 99Bitcoins.