Binance Research highlighted several major developments that suggest that crypto is breaking into mainstream finance.

Crypto is no longer on the fringes of the financial world. On Friday, June 6, Binance Research released its weekly report, emphasizing that crypto is becoming increasingly integrated with traditional finance. Still, it noted that crypto was among the hardest-hit market segments last week, largely due to political turmoil.

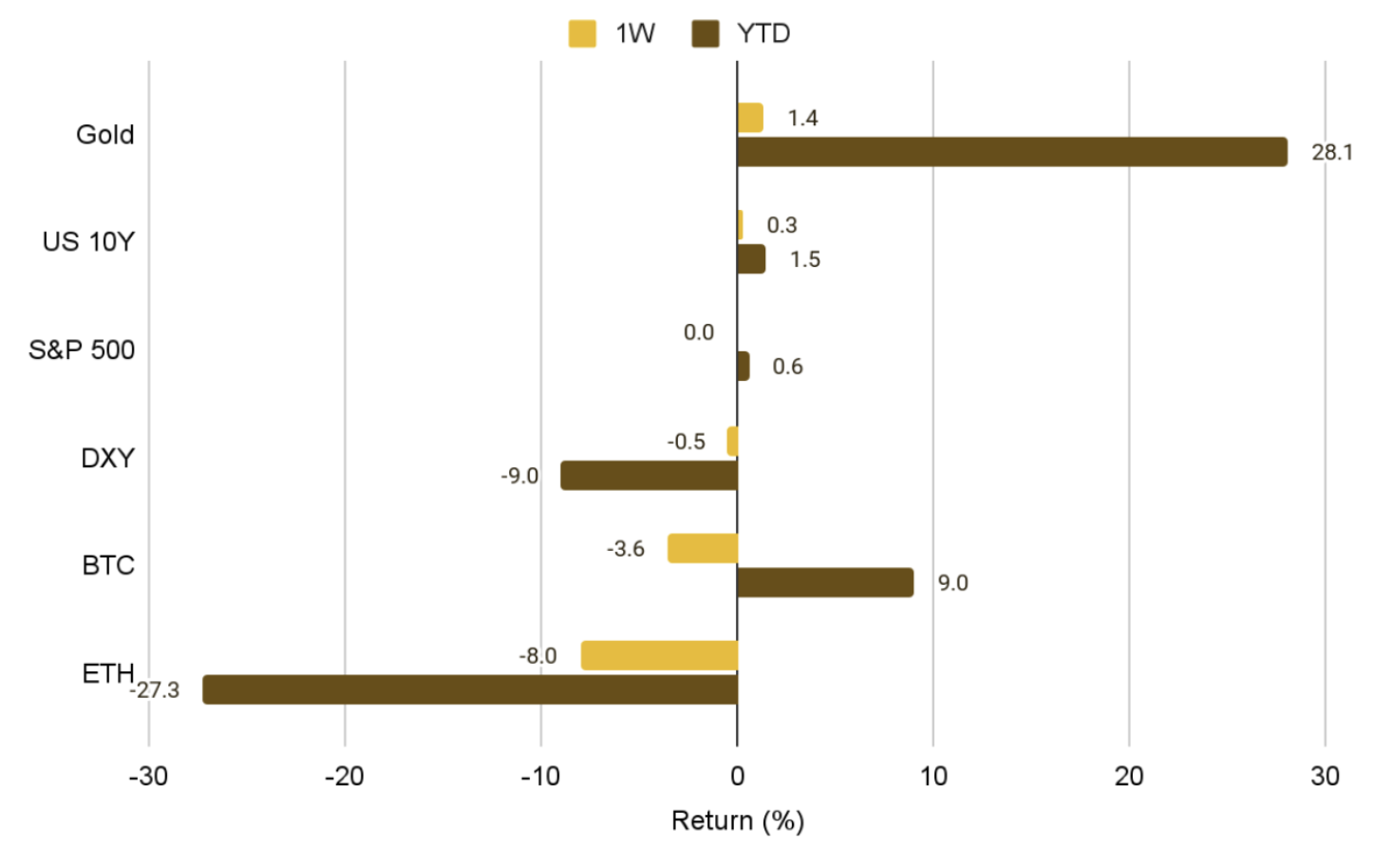

Both Bitcoin (BTC) and Ethereum (ETH) entered negative territory this week, weighed down by the public split between Donald Trump and Elon Musk. Their public arguments have significant implications for crypto, as Musk has been a major advocate for the industry.

As a result, Bitcoin fell to a weekly low of $101,500, while Ethereum dropped to $2,388. Still, despite the temporary price shock, the long-term outlook for both assets remains positive. Notably, over the week ending June 2, there was a significant decrease in BTC and ETH held on exchanges.

Exchange outflows potentially indicate that traders are taking long-term positions and moving their assets into cold storage.

Institutional adoption boosts BTC and ETH long-term

Last week also saw several key developments in crypto’s integration with mainstream finance. JP Morgan announced that it would accept crypto ETF holdings as collateral for loans. The bank will also factor these funds into assessments of clients’ net worth.

On the regulatory front, the Securities and Exchange Commission issued new guidance on proof-of-stake networks. According to the SEC under the Trump administration, staking is no longer considered a securities activity. This is significant for companies looking to launch Solana (SOL) and Ethereum staking ETFs.

Finally, Circle went public on June 5 in a strong showing, with its stock gaining 120% on its first day of trading. The hot IPO signals continued strong interest in crypto firms within traditional markets.