Jerome Powell crypto endorsement may trigger a parabolic run. Bitcoin is firm above $105,000, with a possibility of gains above $112,000. The Federal Reserve is focused on inflation and monetary policy.

In a volatile week, crypto prices are back in the green. Notably, BTC ▲1.53% broke above $105,000, recovering from sharp losses posted on Sunday, with growing odds of a bull run past $112,000.

Explore: Top Solana Meme Coins to Buy in June 2025

Bitcoin Breaks $105,000

With Bitcoin rising, some of the best cryptos to buy are also firm.

XRP has shaken off last week’s losses, adding 2%, while has pushed weekly gains to over 4.2%. However, most top 20 tokens remain in the red over the past seven days, still recovering from Sunday’s sharp decline.

Confidence is rising, and sentiment is improving. The Fear and Greed Index shows traders and investors moving toward neutral, a shift from the “extreme fear” zone when prices dipped below $100,000.

Explore: 20+ Next Crypto to Explode in 2025

Jerome Powell Crypto Endorsement to Pump Prices?

This shift follows Federal Reserve Chair Jerome Powell’s June 24 testimony before Congress.

Powell effectively “greenlighted” crypto, clarifying that U.S. banks under Federal Reserve oversight can provide services to crypto players, provided the financial system remains safe.

These statements, delivered under oath, mark a departure from the central bank’s previous ambiguity and hostility toward crypto, including some of the best cryptos to invest in 2025.

It was the first time a Federal Reserve Chair publicly supported regulated bank participation in the multi-trillion-dollar crypto industry.

This could trigger a wave of institutional capital inflow, easing access to top digital assets.

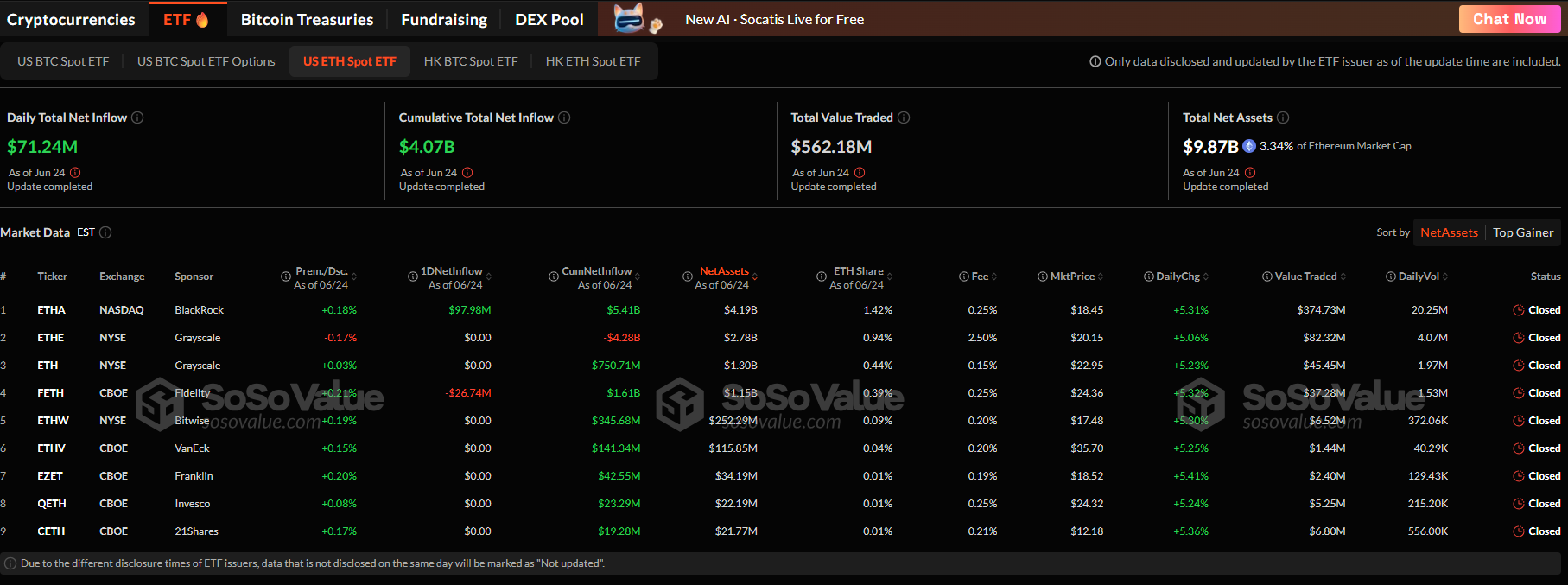

On June 24, institutions bought over $588 million in spot Bitcoin ETFs and $71 million in spot Ethereum ETFs.

(Source)

Powell also confirmed progress on stablecoin legislation via the GENIUS Act, signaling momentum for a clear regulatory framework. Thus far, multiple new players are rushing to offer USD stablecoins backed by U.S. Treasuries.

Federal Reserve Data-Driven: Focus on Inflation and Monetary Policy

Despite the bullish crypto comments, Powell remained focused on macro factors, particularly the Federal Reserve’s mandate to manage inflation.

He noted that the economy is solid, but inflation, though declining, remains sticky. Its trajectory depends on the proposed tariffs by Donald Trump.

The Federal Reserve is data-driven, closely monitoring economic indicators to determine potential rate cuts. Powell indicated no rush to slash rates, lowering the likelihood of a July cut.

The CME FedWatch tool shows a 23% chance of a July rate cut but an 82% probability in September, contingent on inflation nearing the 2% target.

DISCOVER: 9 Best Crypto Presales to Invest in June 2025 – Top Token Presales

Jerome Powell Crypto Greenlight Pumps Bitcoin Above $105,000

- Bitcoin price breaks $105,000 as bulls target $112,000

- Jerome Powell crypto endorsement is massive for the industry

- Institutions pouring into crypto assets via spot ETFs

- Positive legislation may funnel even more capital into crypto

The post Did Jerome Powell Crypto Greenlight Just Set The Stage For Parabolic Run? appeared first on 99Bitcoins.