The BTC USD price is volatile, looking at the price action of the past few days. After last week’s surge, which pushed Bitcoin to its highest price level in history at over $124,500, bears have taken control. Early gains on August 14 were quickly reversed as sellers pressed on, fully erasing the previous day’s gains. While there were expectations that crypto prices would recover, bears doubled down.

By the start of the week, there has been no reprieve. Not only is BTC USD trading below last week’s lows, but with each lower low on the Bitcoin daily chart, the probability of Bitcoin crashing below $110,000 this week increases.

(Source: TradingView)

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

BTC USD Slips, Longs Liquidated: What’s Next for Bulls?

From the daily chart, the path of least resistance appears northward. However, buyers are fading, and sellers believe they can capitalize, possibly popping the bubble. A double top has formed, with clear resistance at around all-time highs. On the lower end, the primary support is $110,000.

Although BTC ▲0.71% bulls from late June remain in control from a top-down perspective, for the uptrend to continue, there must be a comprehensive close above $124,500 and a reversal of recent losses.

If not, and sellers take over, it could lead to a bloodbath, forcing BTC USD back to $100,000 or lower. When this happens, even some of the top Solana meme coins may fall.

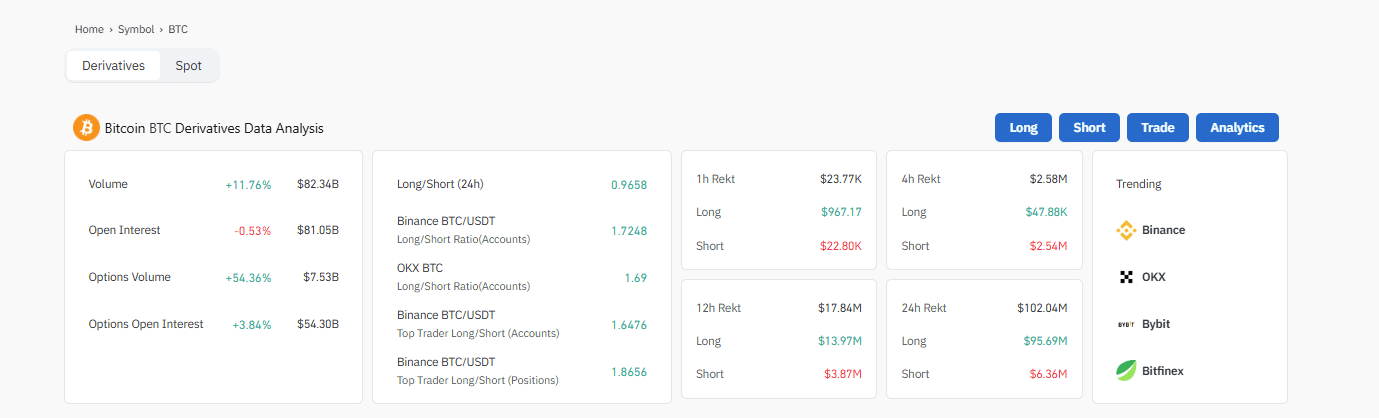

On Coinglass, over $102 million in leveraged Bitcoin longs were liquidated in the past 24 hours. Data shows that most of these liquidations occurred on Bybit and Binance. The largest BTC USDT liquidated position was worth $9.7 million on Binance.

As prices fall, open interest is also down, dropping to $81 billion. This contraction suggests that traders are staying on the sidelines and possibly exiting their long positions.

(Source: Coinglass)

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Bitcoin Whales Accumulating as Speculators Capitulate: Who Will Win?

On X, one analyst notes that short-term holders, mostly speculators who bought less than three months ago, are officially in pain, selling BTC at a loss. The short-term holder realized profit/loss ratio indicates that speculators began feeling pressure once prices fell below $115,000. Historically, investors who buy during this capitulation tend to be handsomely rewarded.

Short-term holders are officially in pain, selling coins at a loss. Investors will see that buying short-term holder blood has an impressive track record. $BTC pic.twitter.com/cGJ4jV09Un

— Frank (@FrankAFetter) August 19, 2025

However, even as speculators cave, Bitcoin whales, particularly those holding between 10 and 10,000 BTC, are aggressively accumulating. According to Santiment data, this cohort has consistently bought over the past five months, adding 225,320 BTC worth over $25.5 billion since March 22. By fading speculators, most of whom are weak hands, their accumulation signals confidence in future price recovery.

Bitcoin's key whales & sharks are continuing to accumulate after the mild dip from last week's all-time high. With prices -6.22% since August 13th, wallets with 10-10K $BTC have accumulated 20,061 more coins.

When we zoom out, this same group of key stakeholders has added… pic.twitter.com/v6YNvyRk50

— Santiment (@santimentfeed) August 18, 2025

DISCOVER: 20+ Next Crypto to Explode in 2025

Federal Reserve as a Possible Bull Catalyst

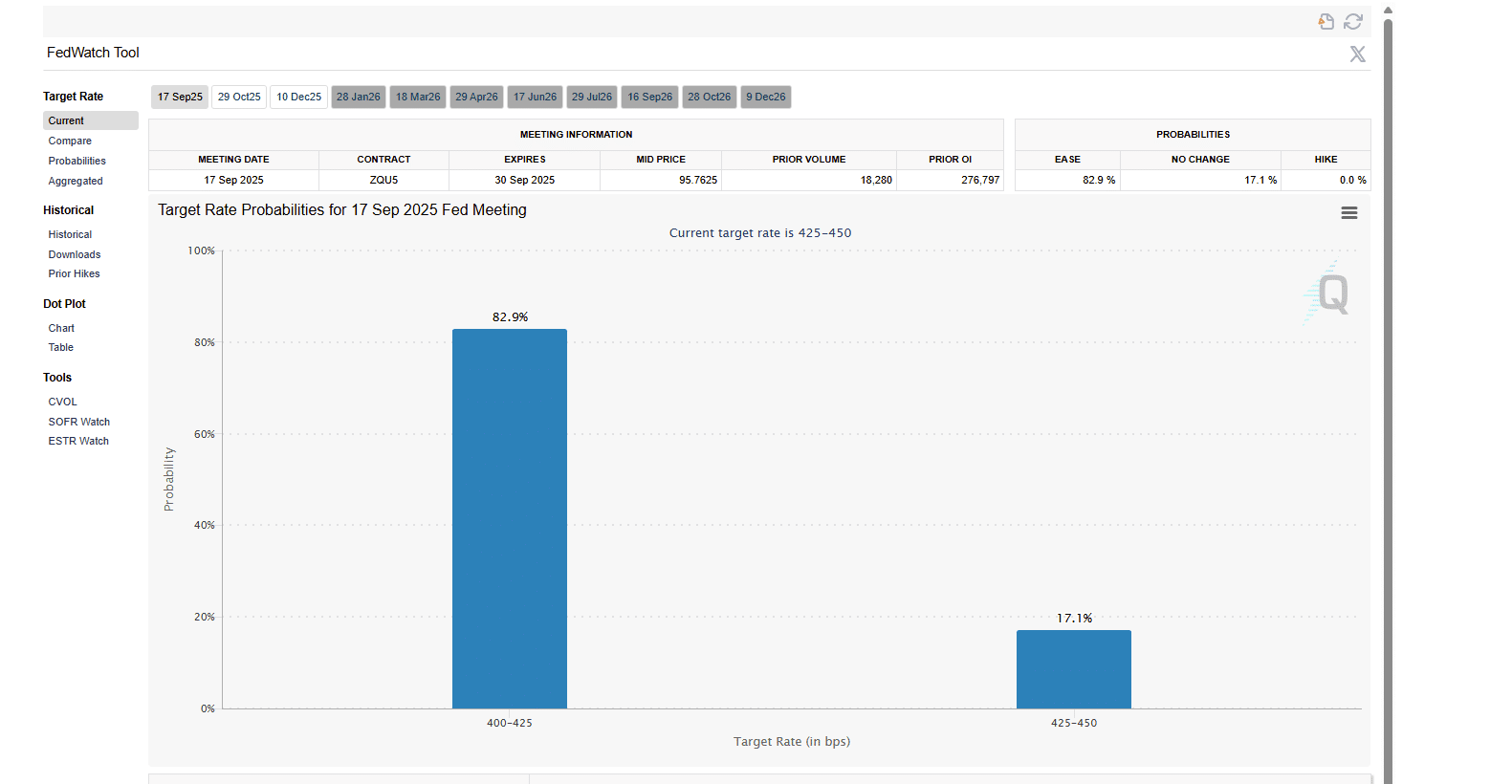

All eyes are now on Jerome Powell’s upcoming speech at the Jackson Hole Economic Symposium on Friday. The Federal Reserve chair will discuss the United States’ economic outlook and possibly address monetary policy plans.

The central bank is expected to slash rates in September. Despite inflation rising faster than economists forecasted, the odds of the Federal Reserve cutting rates remain high. Nearly 83% of economists expect rates to drop to the 4-4.25% range on September 17.

(Source: CME FedWatchTool)

If the Federal Reserve surprises the market by holding rates, it could increase pressure on Bitcoin, accelerating a potential dump below $100,000. Conversely, considering tariff impacts and rising inflation, any rate cut could catalyze demand, encouraging risk-on investors to pile into safe havens like Bitcoin and gold.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

BTC USD Price Sliding, Speculators Capitulate, But Bitcoin Whales Stacking

- BTC USD dropping, slides below $115,000

- Speculators are getting liquidated as fear sets in

- Bitcoin whales are stacking. Accumulates over $25 billion of BTC in five months

- Eyes on Jerome Powell ahead of his speech on Friday

The post BTC USD Speculators at Max Pain, Bitcoin Whales Unfazed: Stack Over $25B in 5 Months appeared first on 99Bitcoins.