Ethereum’s next major upgrade, called Fusaka, is scheduled for December 3, 2025, and it could play a central role in lowering scaling costs and supporting ETH’s bullish momentum.

Developers confirmed the timeline after successful testnet deployments on Holesky, Sepolia, and Hoodi earlier this fall.

What’s Inside the Ethereum Fusaka Upgrade?

The upgrade brings about PeerDAS (EIP-7594), which enables the nodes to verify only portions of blob data rather than downloading the entire content. The network is more efficient with this change, and the ground is laid out to do full danksharding in the future. Together with PeerDAS, developers will release two Blob Parameter Only (BPO) forks. These modifications add progressively more capacity to blobs without necessitating new client software. BPO-1 will increase the target of the blob, which was 6/9 to 10/15, one week after Fusaka activates. BPO-2 will increase it to 14/21 a week later, which is over twice the capacity.

Blobs, brought with the Dencun upgrade, reduce the expense of submitting data to the layer-2 (L2) networks. The usage of blobs has since been intense, with a robust demand being evident among rollups such as Arbitrum and Unichain.

In the case of Ethereum, reduced L2 prices would imply greater on-chain utilization. This is a standard feedback into ETH demand, as gas charges and staking rewards are usage-dependent.

In the medium term, the increased data capacity should enhance the role played by Ethereum as the settlement layer of decentralized finance.

The upgrade arrives at a time when ETH is trading in a bullish setup, with analysts pointing toward the $6,000 range by October if momentum holds.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in September2025

How Could the Fusaka Upgrade Impact Ethereum’s Role in DeFi?

Ethereum developers have confirmed the public testnet timeline and the schedule for upcoming Blob Parameter Only (BPO) forks, according to researcher Christine D. Kim, who shared the update on X after the latest All Core Devs Consensus (ACDC) call.

Important decisions were made on today's Ethereum developer call, ACDC #165. Developers confirmed the public testnet schedule and BPO hard fork schedule for Fusaka.

Let's get into it. pic.twitter.com/mNrYMYyDj2

— Christine D. Kim (@christine_dkim) September 18, 2025

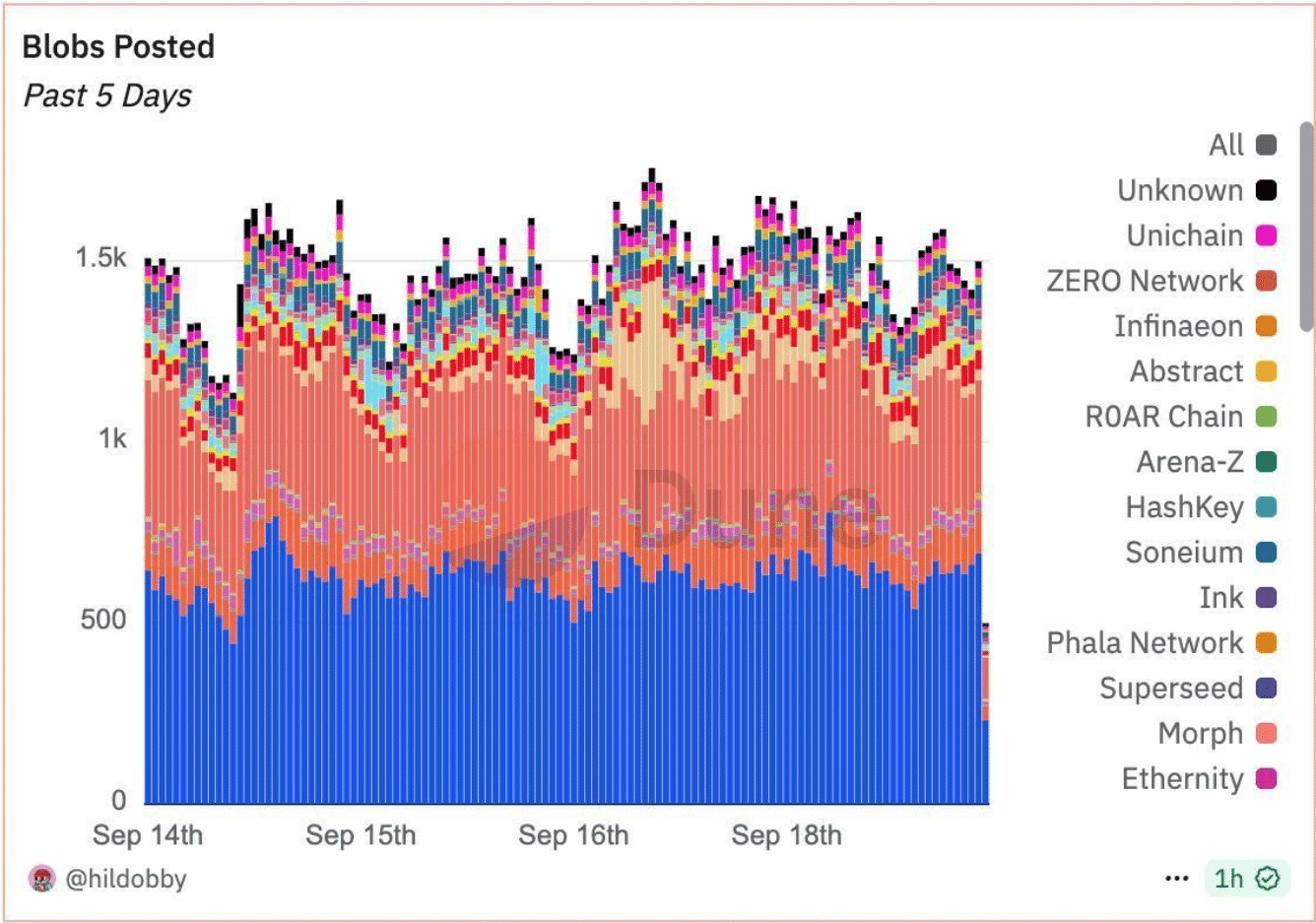

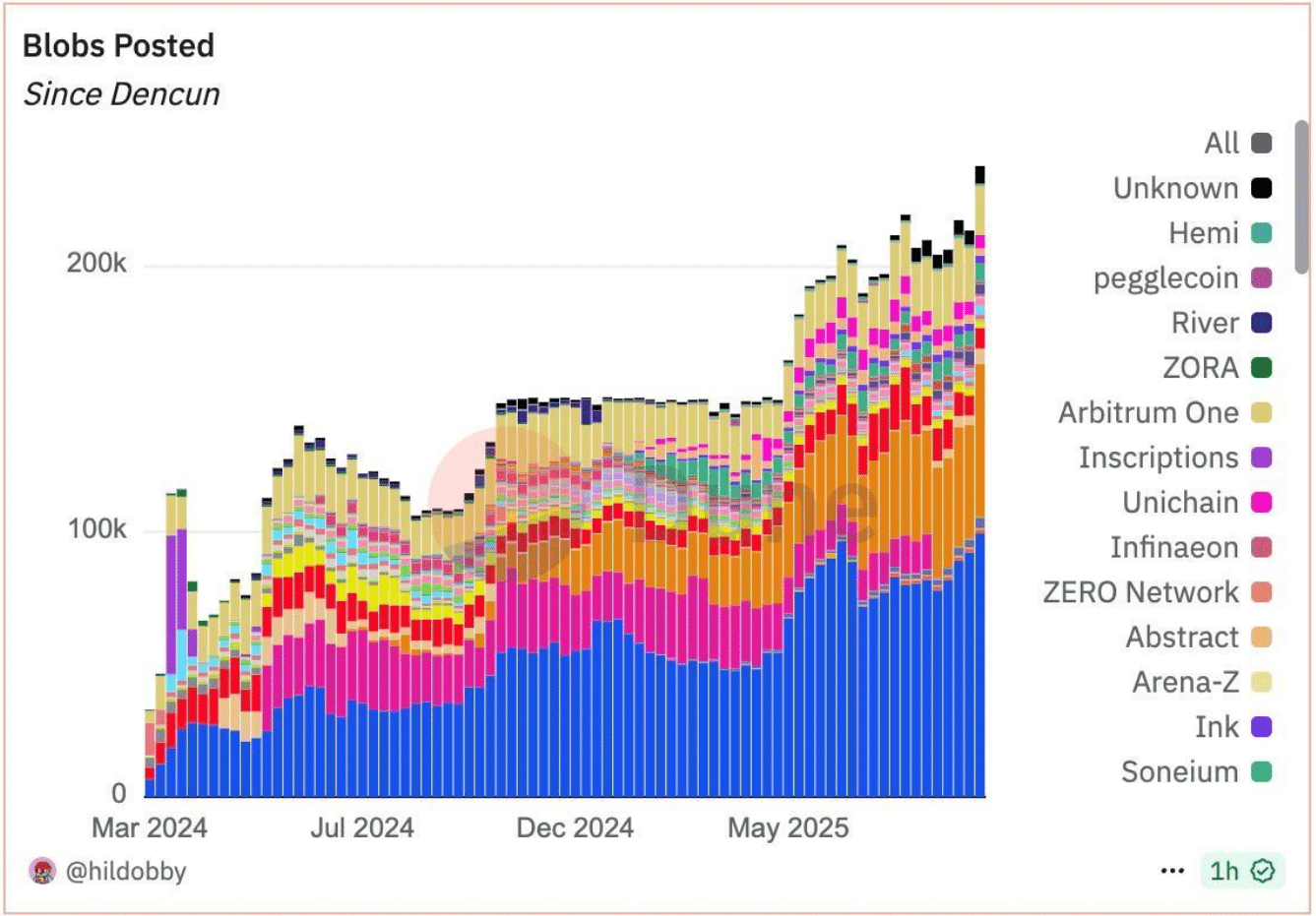

Two new charts offer insight into how the network is being used ahead of the Fusaka upgrade, set for December 3.

Ethereum’s Fusaka upgrade goes live Dec 3.

It’s not just another hard fork—it’s about scalability, security & keeping $ETH as the beating heart of DeFi.

$132B in deposits already sit on Ethereum, 9x Solana. Fusaka expands capacity without breaking decentralization. That’s… pic.twitter.com/osQhWjUAFF

— CryptosRus (@CryptosR_Us) September 19, 2025

The first chart, covering March 2024 to September 2025, shows a steady rise in blob posting across chains and protocols. Daily activity surged past 200,000 in mid-2025, with Arbitrum One, Unichain, Inscriptions, and Abstract leading the way.

This growth highlights the increasing reliance on Ethereum’s data availability layer as scaling solutions and L2s push for cheaper transactions.

The second chart, focused on September 14-18, 2025, shows daily blob counts averaging between 1,000 and 1,500. ZERO Network and Unichain dominate here, while Infinaeon, Abstract, Arena-Z, and Soneium maintain smaller but consistent contributions.

The trend suggests stable network demand rather than short-lived spikes.

Together, the data shows Ethereum’s expanding role as a settlement layer. With $132 billion already locked on the network and blob usage accelerating, the Fusaka upgrade is designed to raise capacity without undermining decentralization.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Ethereum Price Prediction: Is ETH Preparing for a 30% Breakout Toward $6,000?

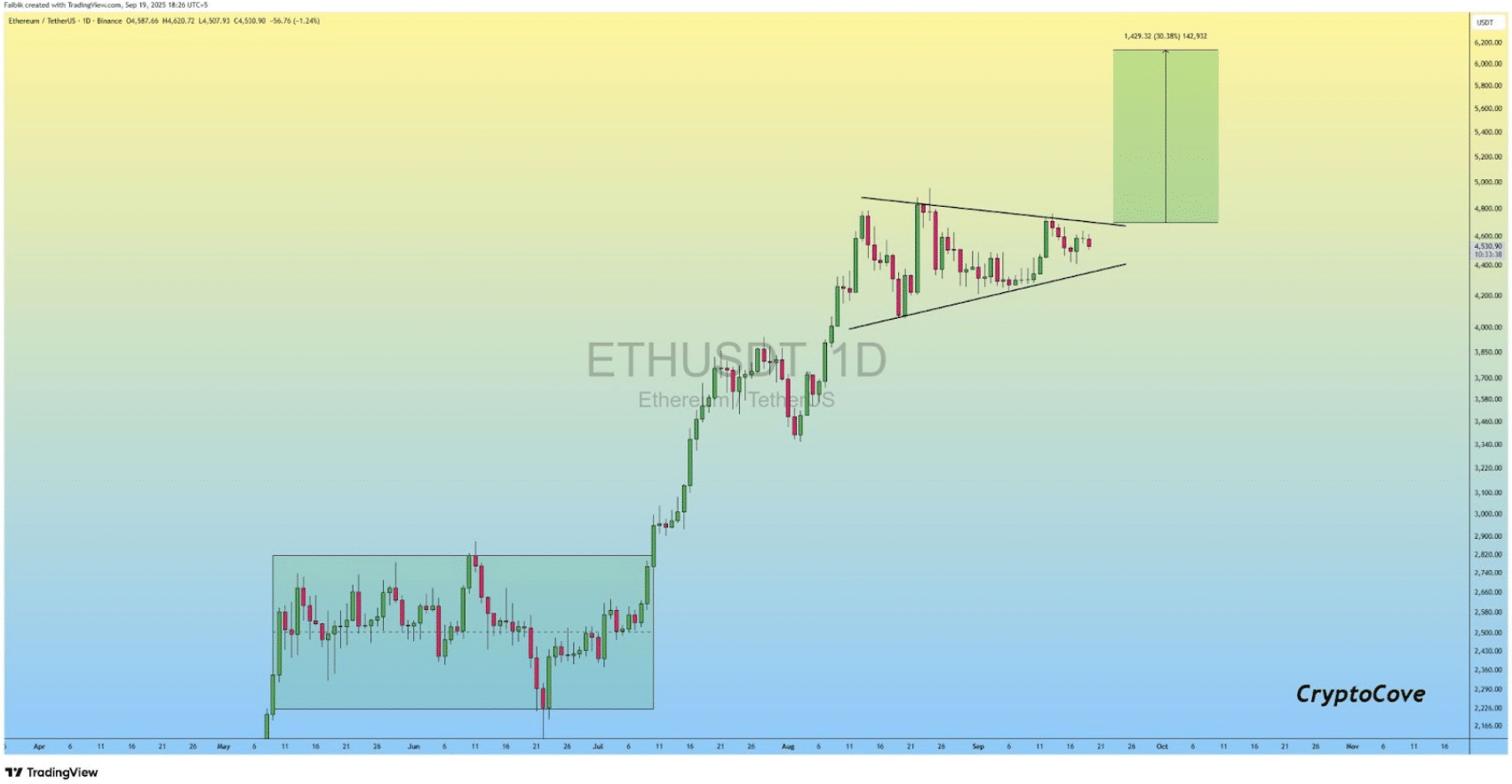

Captain Fabric shared the chart, which points to a bullish continuation pattern in Ethereum (ETH/USDT) after its sharp rally earlier this year.

In the daily chart, ETH has been forming a symmetrical triangle after breaking out of a long accumulation period.

The establishment implies the possibility of another raise.

Following the trend, ETH may experience an increase of approximately 30%, which will take the price levels to approximately $6,000 by October, as the forecast of the analyst suggests.

The green box of the chart illustrates the estimated range of ETH, indicating the potential of the cryptocurrency to reach heights of over $6,000.

This trend of the increases in the number of lows lends credence to this perception where buyer interest persists consistently even throughout the consolidation periods.

To conclude, Ethereum seems to be setting the stage to take off again.

At the time of writing, Ethereum is trading at $4460, showing a decline of -2.79% in the past 24 hours.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Ethereum Fusaka Upgrade: What It Means for ETH Price appeared first on 99Bitcoins.