The crypto market in Turkey is facing turbulence as President Recep Tayyip Erdogan pushes for stricter regulations targeting digital assets. Reports from Bloomberg reveal that new legislation could empower Turkey’s Financial Crimes Investigation Board (MASAK) to freeze crypto accounts without court orders, sparking fears across the local crypto market.

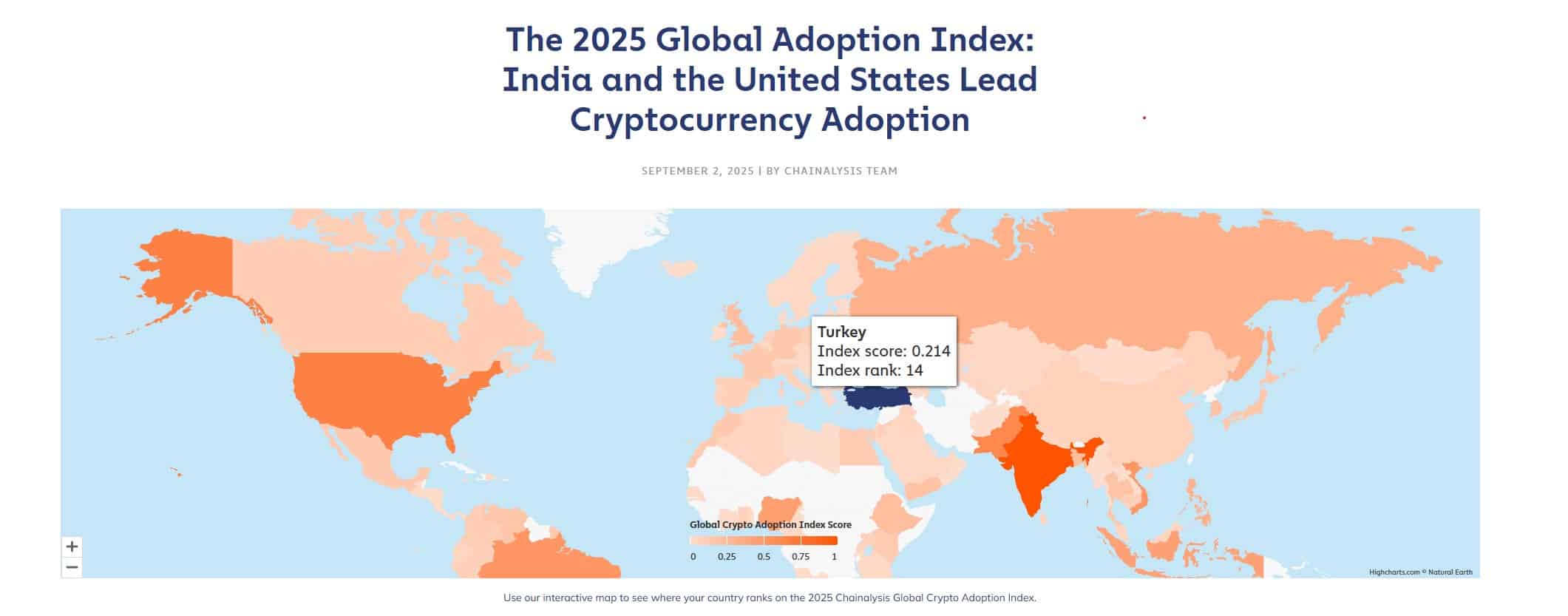

With Turkey ranking among the top 15 crypto-adopting nations, over $ 170 billion in trading volume was recorded in 2023 alone. Now, the government aims to curb illegal betting, fraud, and tax evasion, raising concerns about market freedom and investor confidence.

Will these actions create stability or trigger FUD and a potential sell-off in the overall crypto price landscape?

Why Is Erdogan Targeting Crypto Now?

The proposed crackdown comes amid soaring inflation and ongoing economic instability, driving millions of Turks to use crypto as a hedge against the rapidly devaluing lira. According to Chainalysis, Turkey has one of the highest crypto adoption rates globally, with

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

1.42%

Bitcoin

BTC

Price

$113,719.43

1.42% /24h

Volume in 24h

$51.89B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

and stablecoins like USDT and USDC widely used for savings and remittances.

(Source – Chainalysis)

However, this explosive growth has drawn government scrutiny. Finance Minister Mehmet Simsek confirmed that MASAK would soon gain enhanced powers to fight money laundering, particularly from illegal betting platforms and fraud operations. Under the new framework:

- Transactions above 15.000 lira (~$450) will require strict KYC checks and documented explanations.

- MASAK will have the authority to freeze crypto and bank accounts linked to suspicious activity without prior court approval.

- Stablecoin transfers will face stricter limits to prevent unregulated capital flight

- Exchanges must report and track transactions, with heavy penalties for non-compliance.

The timeline for these measures builds on previous regulatory milestones:

- February 2025: Full AML rules took effect, requiring crypto firms to obtain licenses and comply with ongoing audits.

- July 2025: Authorities blocked 46 unlicensed exchanges, including major DEX platforms like PancakeSwap.

- July 28, 2025: The founder of ICRYPEX, a major Turkish exchange, was detained, with allegations linking crypto funding to government critics.

These steps align with international standards like the EU’s MiCA framework, but critics argue they also serve as a political tool. Opposition figures claim the government is using crypto regulations to target dissent, pointing to a wider crackdown on media and political rivals like Istanbul Mayor Ekrem Imamoglu, who has faced repeated legal action.

NEW: Turkey tightens crypto regulations with rules for exchanges and investors, giving the Capital Markets Board full oversight over crypto platforms and stricter compliance requirements. pic.twitter.com/khTCoGchlE

— Cointelegraph (@Cointelegraph) March 13, 2025

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

What is the Impact on the Turkish Crypto Market and Global Investors?

Turkey has become a global crypto hotspot, with platforms like Binance ranking it among their top markets. Yet, tighter rules risk slowing growth and could reduce liquidity for both local and international traders. The crackdown can impact various sectors in the crypto space, like:

- Crypto prices: Historically, shifts in Turkish policy have caused immediate volatility. For example, the 2021 ban on crypto payments led to a sharp drop in the Bitcoin price across local exchanges.

- Investor sentiment: The fear of frozen accounts may drive users toward censorship-resistant assets or offshore exchanges, thereby reducing activity on regulated platforms.

- Stablecoin markets: With stablecoins like USDT serving as a key hedge against inflation, limits on transfers could disrupt everyday use cases, ranging from remittances to business transactions.

In an X (Twitter) post, Finance Minister Simsek previously stated that whoever doesn’t comply with Turkish crypto law will face serious penalties.

Kripto varlık hizmet sağlayıcıları ile ödeme ve elektronik para kuruluşları mevzuat değişiklikleriyle getirilen yükümlülükleri yerine getirmedikleri takdirde ciddi yaptırımlarla karşılaşacak.

Suç gelirleriyle etkin mücadelemizi sürdürürken finansal sistemin güvenirliğini ve… https://t.co/6DQPFZycNW

— Mehmet Simsek (@memetsimsek) April 16, 2025

Globally, analysts compare Turkey’s move to past events in Nigeria and India, where initial restrictions were later softened to encourage innovation. If Turkey strikes a balance, these regulations could legitimize the sector, attracting institutional players. However, if the crackdown leans too heavily on control, it may stifle local innovation and push users into unregulated, risky markets.

For now, investors are advised to monitor official updates from the Capital Markets Board (CMB) and MASAK closely. Whether this marks a turning point for Turkish crypto adoption or the start of a long-term chilling effect remains uncertain. One thing is clear: Erdogan’s crypto strategy will be a defining factor for Turkey’s financial future, influencing both domestic adoption and global perceptions of emerging-market regulation.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

The post Erdogan Is Planning a Massive Turkey Crypto Crackdown appeared first on 99Bitcoins.