Once a struggling hospitality company, Metaplanet (TSE: 3350, OTC: MTPLF) has reinvented itself into what it now calls Asia’s Bitcoin rocketship. With its latest purchase, the Bitcoin For Corporations member has become the 4th largest publicly-traded Bitcoin treasury company in the world, positioning Japan at the center of the corporate Bitcoin movement.

The Treasury Engine: 30,823 BTC and Counting

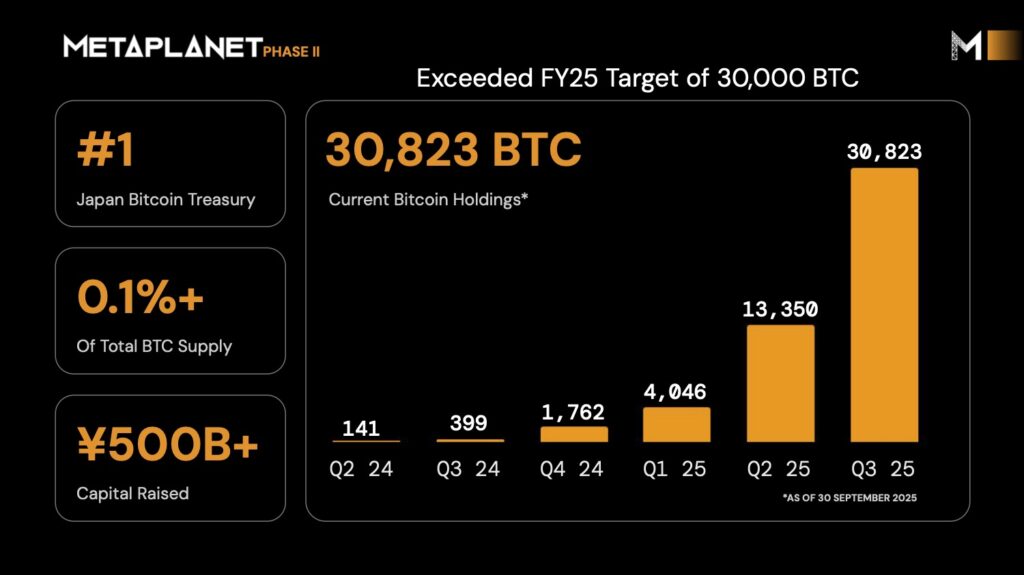

On October 1, Metaplanet acquired 5,268 BTC for approximately $615.67 million at an average price of $116,870 per bitcoin. This brings its total to 30,823 BTC, worth $3.33 billion at cost with an average entry of $107,912 per BTC.

Year-to-date, the company has generated a BTC Yield of 497.1%, far outpacing traditional corporate performance metrics. With over 0.1% of Bitcoin’s fixed supply, Metaplanet has already exceeded its FY2025 goal of 30,000 BTC.

Breakout Quarter: Revenues That Scale With Bitcoin

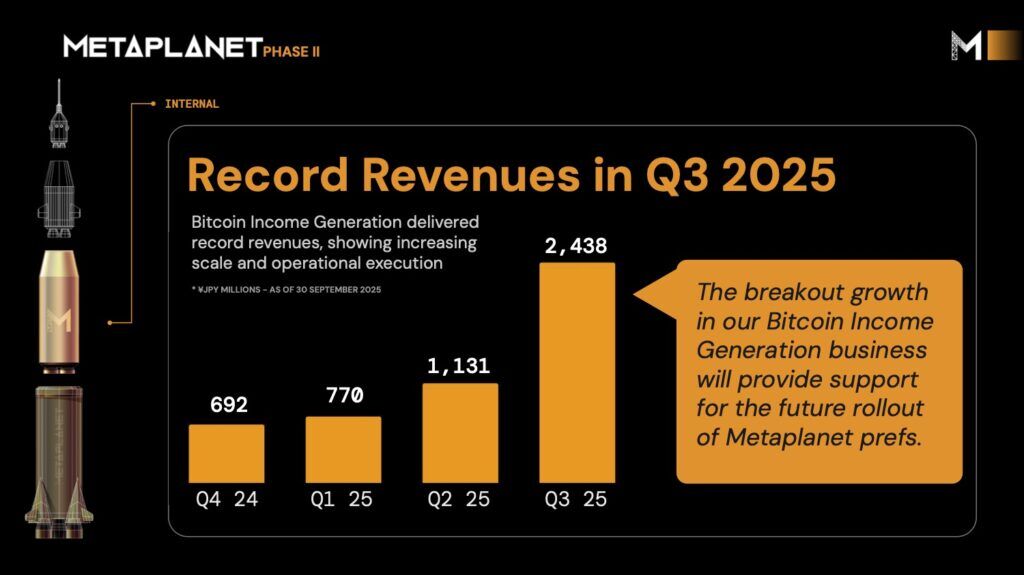

The company’s Bitcoin Income Generation business has turned market volatility into a new kind of revenue engine. Q3 2025 delivered ¥2.438 billion in revenue, a 115.7% jump from Q2.

On the strength of this growth, Metaplanet has doubled FY2025 revenue guidance to ¥6.8 billion and raised operating profit guidance to ¥4.7 billion. For context, FY2024 revenue was only ¥1.06 billion.

In a single year, Metaplanet has gone from modest income streams to a scaled Bitcoin-native operating model, showing corporations that treasury strategy and operating execution can compound together.

Phase II: From Treasury to Platform

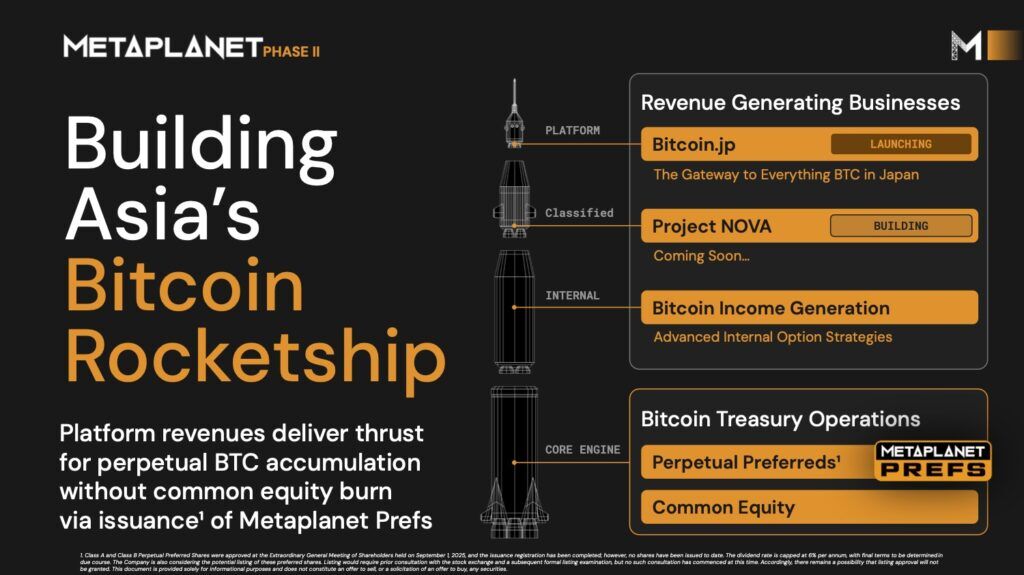

Metaplanet’s ambition extends beyond stacking BTC. The company is building a vertically integrated Bitcoin platform to expand income streams and fuel perpetual accumulation without relying on equity dilution.

- Core Engine — Treasury Operations: Proven ability to raise over ¥500B and execute above NAV.

- Internal — Bitcoin Income Generation (Live): Advanced options monetization and proprietary trading, scaled by a global derivatives team.

- Platform — Bitcoin.jp (Live): Positioned to be Japan’s “home for everything Bitcoin,” spanning media, education, and financial services.

- Classified — Project NOVA (2026): Described as the “gateway to everything BTC in Japan,” NOVA is expected to capture market inefficiencies and create new distribution channels.

Together, these businesses provide the revenue thrust for Metaplanet’s treasury mission: maximize BTC per share.

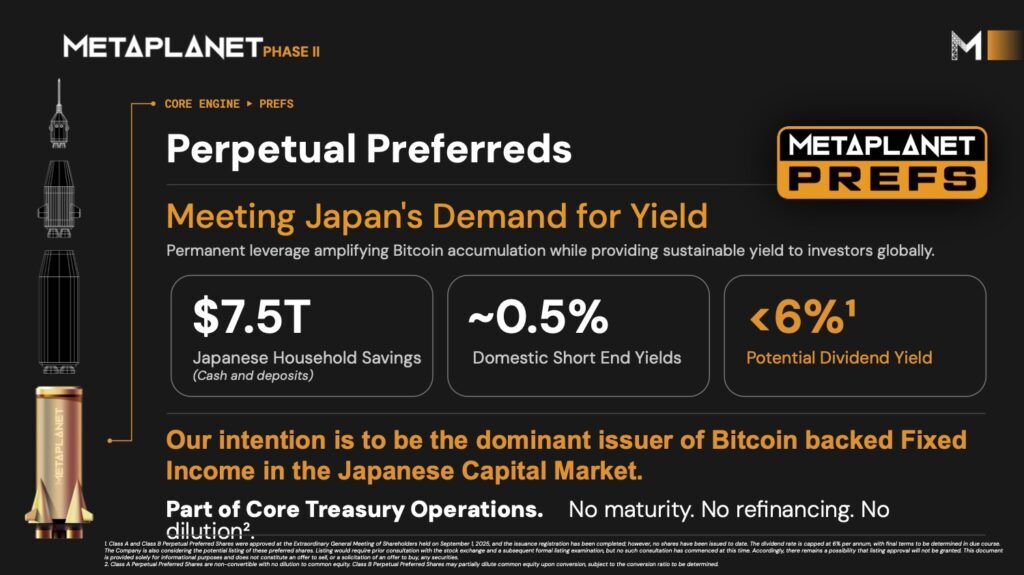

Financing the Future: Perpetual Preferred Shares

A cornerstone of Phase II is the introduction of Class A and Class B Perpetual Preferred Shares, approved by shareholders in September 2025. These instruments offer up to a 6% dividend yield and are designed to:

- Provide permanent leverage with no refinancing risk.

- Tap Japan’s ¥7.5 trillion household savings pool, where domestic yields remain near 0.5%.

- Expand Bitcoin accumulation capacity to 25% of NAV without diluting common equity (Class A).

The vision is clear: become the dominant issuer of Bitcoin-backed fixed income in Japan — effectively securitizing the country’s savings surplus into perpetual Bitcoin exposure.

Japan as the Launchpad

Metaplanet’s rise is not just about corporate execution, but national context. Japan’s unique advantages — high savings rates, regulatory clarity, and a culture of rapid tech adoption — provide fertile ground for Bitcoin-native innovation.

Where the U.S. has Strategy (formerly MicroStrategy) leading as a Bitcoin treasury pioneer, Japan now has Metaplanet positioning itself as the Asian epicenter of corporate Bitcoin accumulation.

Toward 1% of Bitcoin Supply

The company’s long-term goal is audacious: control 1% of all Bitcoin by 2027 — approximately 210,000 BTC. With over 30,000 BTC already secured, ¥500B raised, and new revenue engines coming online, Metaplanet has the momentum to make that target credible.

For BFC members and corporate leaders worldwide, the company’s ascent offers a playbook: how balance sheet strategy, operational scalability, and capital markets innovation can converge to create a new class of Bitcoin-native public company.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase or subscribe for securities.