Despite big investments and clear demand for yield, most Bitcoin holders have never tried BTCFi because the platforms feel complex and unfamiliar. Without simpler products and better communication, BTCFi could stay a niche space for insiders rather than reach mainstream adoption.

Summary

- Most Bitcoin holders still haven’t touched BTCFi, even though investors are pouring money into the space and there’s clear demand for yield and liquidity.

- The problem is that current platforms are built for crypto insiders, leaving everyday BTC users confused, cautious, or unaware these products even exist.

- Unless BTCFi becomes simpler and better communicated, it risks staying niche instead of reaching the broader Bitcoin audience, GoMining warns.

While venture funding and media hype might suggest that Bitcoin DeFi — or simply known as BTCFi — is on the rise, Bitcoin users tell a different story. A new survey by GoMining shared with crypto.news found that nearly 80% of BTC holders have never used BTCFi, highlighting a gap between the industry’s ambitions and its actual adoption.

Similar to decentralized finance (DeFi) on Ethereum, BTCFi was meant to offer a set of tools and platforms that let people use BTC in financial ways beyond just buying and holding. For example, people could use BTC for lending, getting access to synthetic Bitcoin assets, or bridging them via cross-chain bridges to get access to different networks.

Institutional pouring also seems to be growing. Data from Maestro, an enterprise-grade Bitcoin-focused infrastructure provider, shows that BTCFi venture funding surged to $175 million across 32 rounds in the first half of 2025, with 20 out of 32 deals focused on DeFi, custody, or consumer apps in the BTCFi space.

For crypto natives only

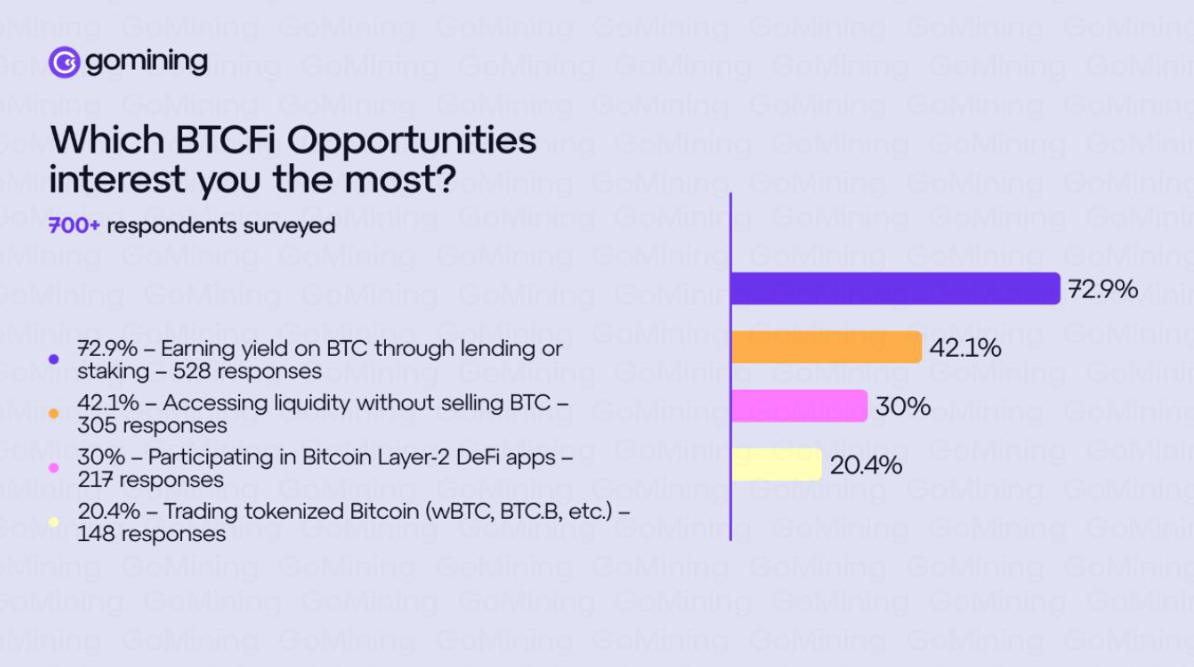

Yet, according to GoMining’s survey, which questioned more than 700 people across North America and Europe, around 77% of Bitcoin holders have never tried BTCFi. As the firm explains, the problem isn’t a lack of demand, as the survey showed that 73% of Bitcoin holders want to earn yield on their assets, while 42% are interested in accessing liquidity without selling.

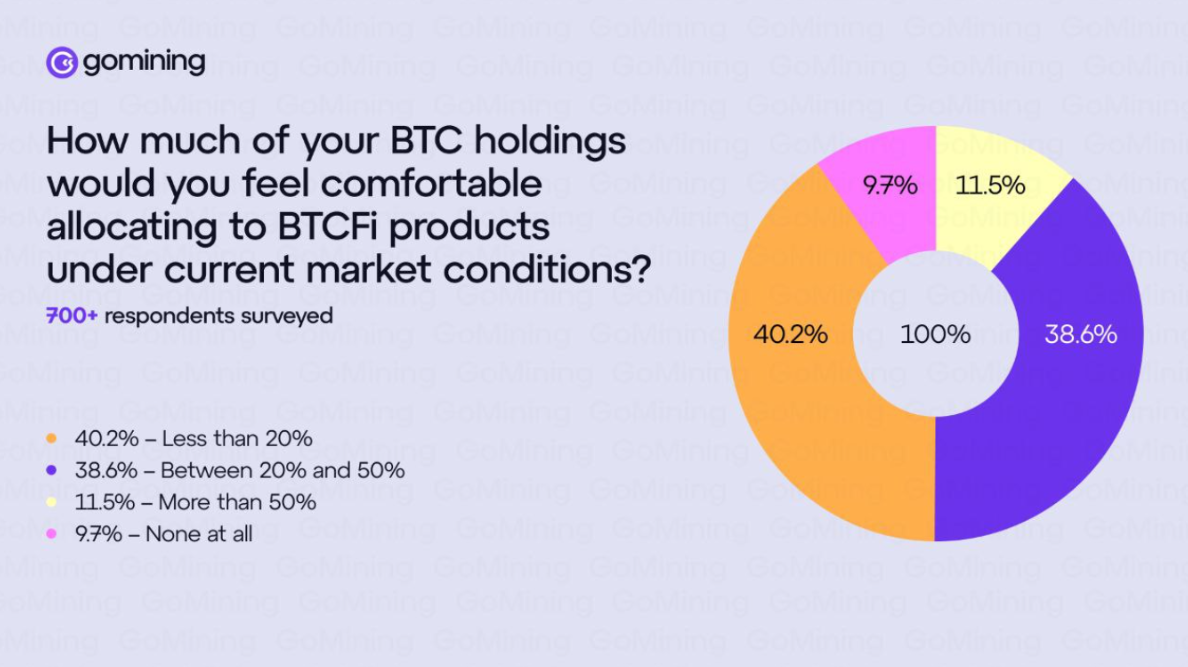

Adoption appears to be slowed by trust and complexity. More than 40% of respondents said they would commit less than 20% of their Bitcoin to BTCFi products, a conservatism GoMining linked to confusion and security worries.

Mark Zalan, CEO of GoMining, said the results matched what the company has seen in its own work, adding that there’s an “enormous appetite for these opportunities, but the industry has built products for crypto natives, not for everyday Bitcoin holders.”

Lack of awareness

Perhaps the clearest challenge for BTCFi is awareness. Nearly two-thirds of those surveyed — or about 65% — couldn’t name a single BTCFi project. For Zalan, this points to a failure in communication

“This isn’t a failure of Bitcoin holders to keep up. The BTCFi industry must communicate more effectively with its target market. When two-thirds of potential users can’t name a single project in your space, you’re facing an adoption challenge that education can solve.”

Mark Zalan

GoMining’s findings suggest that so far, BTCFi has been talking mostly to insiders rather than the broader base of Bitcoin owners.

Not like DeFi

One reason for the disconnect may be that BTCFi has borrowed heavily from Ethereum’s DeFi model. But Bitcoin users tend to have different preferences. They often favor custodial wallets and regulated exchange-traded funds over self-custody and complex protocols.

As Zalan explained, Bitcoin holders “aren’t Ethereum users,” adding that Coinbase and Bitcoin ETFs succeeded “because they prioritized accessibility.” In other words, while the appetite exists, platforms still need to be simpler, safer, and easier to use.

The survey paints a picture of a sector with both potential and barriers. Bitcoin holders clearly want yield and liquidity options, but they aren’t rushing to BTCFi platforms because of trust issues, complexity, and low brand recognition.

And that contradiction creates both challenges and possibilities. If BTCFi platforms invest more in clear communication and straightforward onboarding, they might be able to win over the wider Bitcoin audience. But if not, BTCFi risks remaining a niche space for crypto insiders rather than the millions of Bitcoin holders it aims to serve.