SharpLink Gaming’s Ethereum portfolio has ballooned in value after the cryptocurrency climbed nearly 4.5% over the past day, pushing the company’s unrealized profits close to the $1Bn mark

In a statement on Tuesday, SharpLink said its gains from Ether purchases have topped $900M since the firm began accumulating the asset on June 2.

SharpLink’s unrealized profit now surpasses $900M since launching the ETH treasury strategy on June 2, 2025.

During that time, ETH concentration doubled, making every share more valuable.

With 839k ETH on our balance sheet and no debt, SharpLink’s in a strong position to keep… pic.twitter.com/4HlQWRZjvw

— SharpLink (SBET) (@SharpLinkGaming) October 6, 2025

Data from the Strategic ETH Reserve shows SharpLink holds 838,730 ETH, valued at roughly $3.93Bn at current prices. That stake represents about 0.69% of Ethereum’s total circulating supply, placing the company among the largest corporate holders of the token.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in October2025

How Did SharpLink’s Ethereum Holdings Reach Nearly $4 Billion?

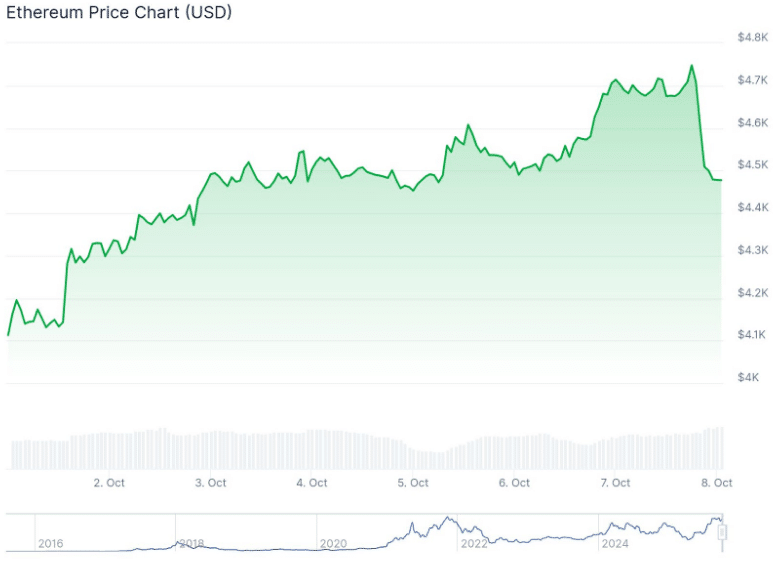

Ether’s jump to $4,700 on Tuesday, up nearly 5% from Monday’s $4,500, added further momentum to SharpLink’s balance sheet.

The firm also reported that its Ether concentration per share has almost doubled since the start of its accumulation program, increasing potential returns for shareholders.

The data also illustrates how SharpLink built its position gradually through the summer. The first round of purchases included 176,300 ETH, followed by several additional buying waves in July and August.

Since early September, SharpLink’s total Ether holdings have stayed close to 839,000 coins. The steady price climb has sharply boosted the value of its reserves.

Other firms with Ethereum-focused treasuries have taken a similar approach. Together, their combined holdings now exceed 5.6M ETH, worth about $26.5Bn at current market prices.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

BitMine Immersion Technologies leads the group with roughly 2.83M ETH, valued at $13.25Bn. That represents about 2.34% of the total Ethereum supply.

SharpLink follows in second place, while The Ether Machine ranks third with almost 500,000 ETH worth around $2.32Bn.

Data from the Strategic ETH Reserve shows that Ethereum held by exchange-traded funds has reached 6.83M ETH, valued at roughly $32Bn. That equals around 5.63% of the total supply.

Altogether, corporate treasuries and ETFs now control nearly 12.49M ETH worth about $58Bn. That accounts for more than 10% of Ethereum’s total circulation.

The cryptocurrency remains the world’s second-largest treasury asset, trailing only Bitcoin’s 4M coins valued near $500Bn. Solana holds third place with around 18M tokens worth about $4Bn.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Sharplink Hits Near $1Bn in Paper Gains: How Liquid Are SBET ETH Profits? appeared first on 99Bitcoins.