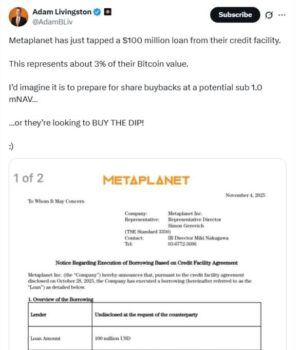

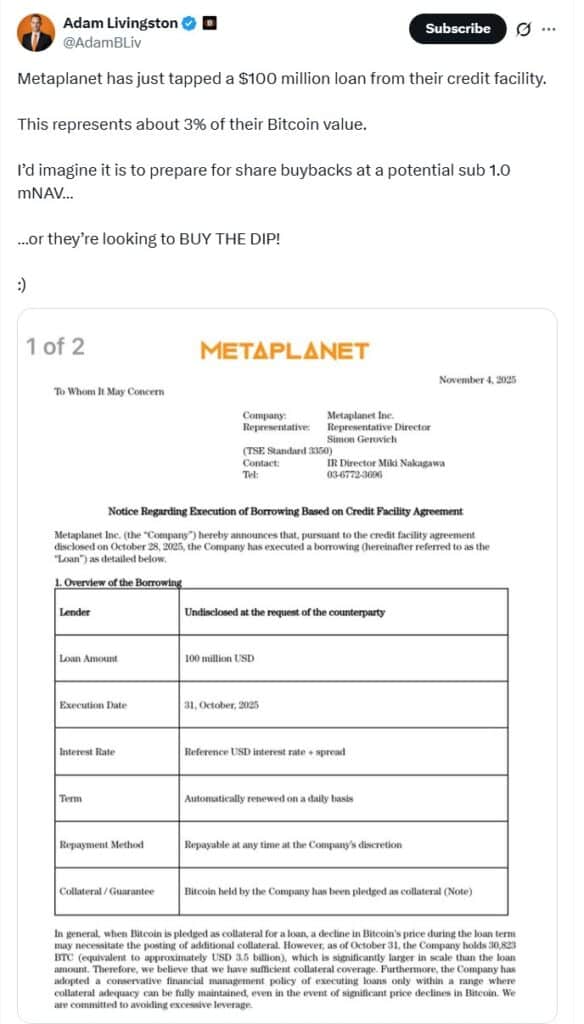

Metaplanet is at it again! The Japanese company has restarted securing Bitcoin after obtaining a $100 million loan collateralized by nothing other than its current BTC treasury. currently, the company holds 30,823 BTC, which is worth approximately $3.5 billion. Metaplanet said that it was “sufficient relative to the loan amount.” Just a few days ago, the company had secured a $500 million credit line backed by its BTC treasury.

On 5 November 2025, the Tokyo-listed company confirmed that it has obtained a $100 million loan, with the proceeds earmarked for three main purposes – expanding its BTC reserve, funding income-generating initiatives, and share buybacks.

“We plan to use the funds for further Bitcoin purchases, our Bitcoin Income business, and, depending on market conditions, for share buybacks,” the company said in a press release. “The funds earmarked for the Bitcoin Income business will be used as margin and invested to generate option premiums.”

https://twitter.com/AdamBLiv/status/1985864449849237510

Currently, Bitcoin is trading at $102,524, after dipping to $99,000 just a few hours ago. So, will Metaplanet buy the dip?

DISCOVER: 20+ Next Crypto to Explode in 2025

Strategy’s Michael Saylor Buys Dip

Meanwhile, on 3 November 2025, Strategy announced that it had added BTC worth around $45.6 million through last week amid continued sell pressure in the crypto market.

According to Strategy’s 8-K filing with the SEC, Strategy acquired 397 BTC at an average price of $114,771 per coin. This raises the firm’s average buy price for Bitcoin to $74,057.

Strategy co-founder and Executive Chairman Michael Saylor once again teased Monday’s purchase announcement, posting the firm’s acquisition tracker on Sunday with the caption, “Orange is the color of November.”

Explore: Bitcoin Prediction for November 2025: Saylor Keeps Buying the Dip

Metaplanet Bought 5,268 Bitcoin In October, 5,419 Bitcoin In September

Last month, Metaplanet CEO Simon Gerovich took to X to celebrate and said, “Metaplanet is now the 4th largest publicly-traded Bitcoin treasury company in the world.”

“Metaplanet has acquired 5268 BTC for ~$615.67 million at ~$116,870 per bitcoin and has achieved BTC Yield of 497.1% YTD 2025. As of 10/1/2025, we hold 30,823 $BTC acquired for ~$3.33 billion at ~$107,912 per bitcoin,” he added.

The Tokyo-listed company’s aggressive latest purchase of Bitcoin for ¥91.6 billion was at an average price of $116,870. The October purchase was followed by a September buy of 5,419 BTC for $632.53.

Notably, the company declared a goal of scaling to 210,000 BTC by the end of 2027.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Key Takeaways

-

Metaplanet management reiterated a goal to scale its corporate Bitcoin treasury to 210,000 BTC by the end of 2027.

-

Metaplanet is the fourth globally among public corporate BTC holders and the largest in Asia,

The post Metaplanet Secures $100 Million In New Funding: Is It Going To Buy The Dip? appeared first on 99Bitcoins.