In the latest PEPE price prediction, discover how meme coins could receive a boost from the UK and Japan Signaling Softer Rules, as we explore whether PEPE is poised for more upside.

Pepecoin(PEPE) saw a small lift on November 5 as regulators in the UK and Japan struck a more open stance on digital-asset rules – increasing hopes of further meme coin oriented products.

PEPE price itself however continued to suffer, under pressure from the wider market drawback in a session that saw PEPE traded around $0.0000058–$0.0000060, showing a decline of -19% in the last 24 hours.

Could FCA Oversight of Non-Systemic Stablecoins Benefit PEPE Traders?

Reuters reported that in London, Bank of England Deputy Governor Sarah Breeden said it was “really important” for the US and the UK to move together on stablecoin oversight.

She confirmed the central bank will release its consultation on Nov. 10. The plan now focuses on stablecoins deemed “systemic,” while others would fall under the Financial Conduct Authority.

Market participants saw this as a step toward clearer rules for payment tokens and a calmer setting for crypto trading.

Meanwhile, the Japanese officials are considering changes to tax treatment and leverage rules.

With such changes, which some believe can be made, trading will be cheaper and more accessible, which will help meme coins such as PEPE to draw investors.

In Tokyo, the key exchanges are gearing up toward a potential expansion due to the government’s looking at the prospect of tax exemption on crypto profits and the reduction of leverage regulations.

Industry voices say the shift could open the door for more retail traders and increase activity in digital assets.

If approved, the changes may add liquidity to both spot and derivatives markets that list meme coins, including PEPE, making prices clearer and easier to trade.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

How is CZ Handling His PEPE Short Positions Amid Shifting Market Sentiment?

Meanwhile, a large, unnamed trader known as the “anti-CZ whale” took a different path from wider market sentiment after a post by Changpeng Zhao.

Data from Lookonchain shows the trader is sitting on roughly $21M in unrealized profit from a position in ASTER on Hyperliquid, a decentralized perpetuals exchange.

As the price falls, the Anti-CZ Whale who added to his $ASTER shorts after CZ's buy post is now sitting on over $21M in unrealized profit across 2 wallets.

He's also shorting $DOGE, $ETH, $XRP, and $PEPE, all in profit.

His total profit on #Hyperliquid is now close to $100M!… pic.twitter.com/vfmAPf9ke6

— Lookonchain (@lookonchain) November 4, 2025

At the same time, Zhao has been closing short positions on PEPE with success.

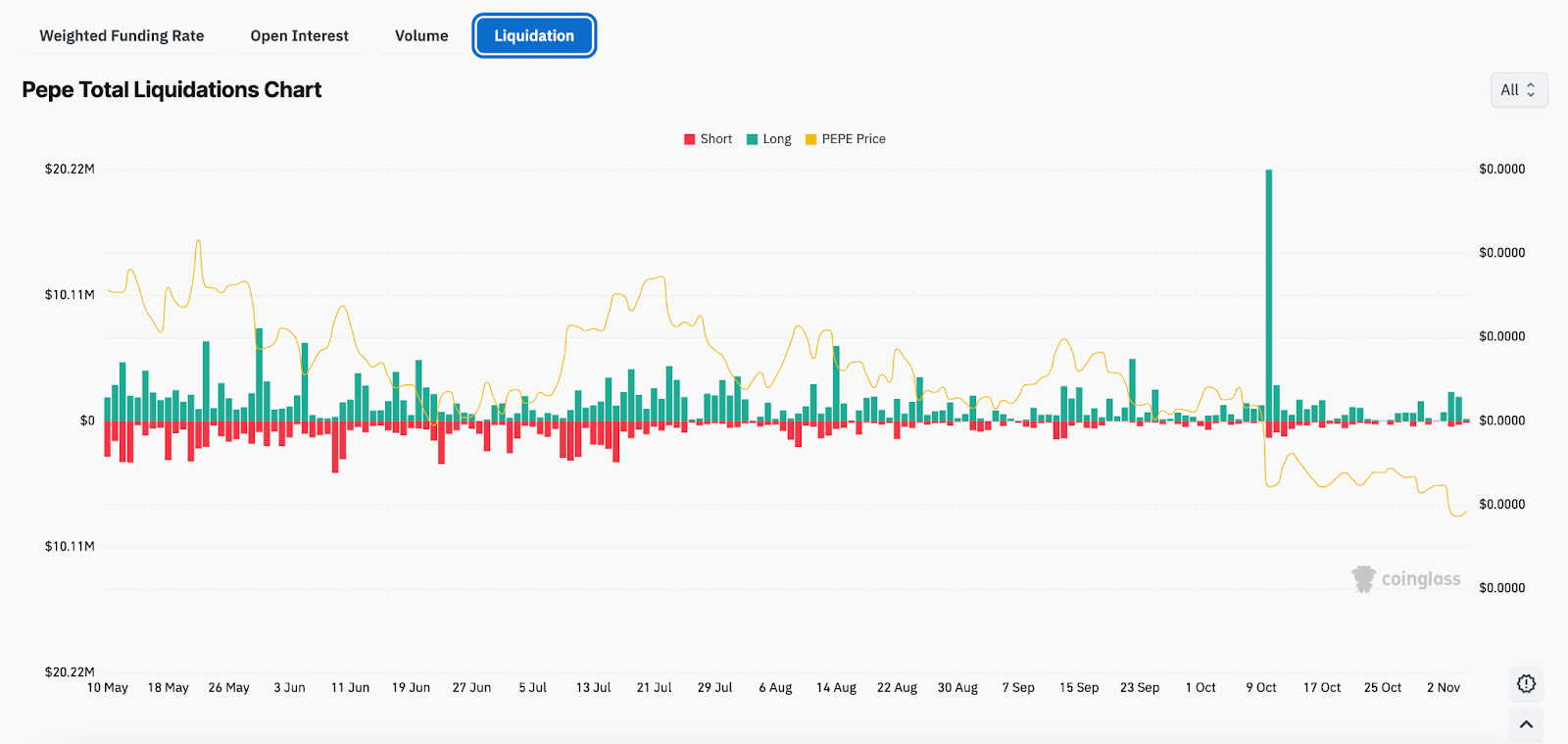

Pepe’s liquidation data shows a steady blend of long and short positions getting wiped out over the past six months, mostly during quick price swings.

The sharpest move came in early October, when long liquidations jumped after a sudden drop in price.

Activity has eased since then. Both long and short liquidations now sit lower, suggesting traders are using less leverage as the token loses strength.

Price has been slipping since mid-May. After the peak, trading turned uneven, then dropped more sharply in October.

The chart still leans bearish. Volatility is low, and there’s little sign of strong bullish positioning. Traders seem cautious.

A new chart from analyst Chandler compares earlier cycle timing with the current market. His view is that this cycle may be tracking old patterns or running longer than many expect.

The weekly market-cap chart for crypto assets excluding Bitcoin suggests past cycle tops did not land where early forecasts expected.

In 2017, the peak came roughly 175 weeks after the previous one. Traders assumed the same timing in 2021, but the actual high arrived closer to week 200, following a late surge.

This cycle is now nearing the 200-week mark. Even so, the chart hints that the peak could stretch toward 225 weeks, leaving room for a later top.

Total market cap is holding near $1.3Tn, showing a steady period rather than clear weakness.

RSI sits in the middle of the range, with no signs of extreme buying pressure. That gives space for another move higher if the market follows its earlier pattern.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post PEPE Price Prediction: With UK and Japan Signaling Softer Rules, Is PEPE Poised for More Upside? appeared first on 99Bitcoins.