The Silver futures price has torn through every major resistance level this year, delivering one of its strongest annual performances in more than a decade. And it sucks, because the only time silver got a headline that I saw is when they called it the “Devil’s metal”. Meanwhile, every ATH for

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

0.65%

Bitcoin

BTC

Price

$89,688.74

0.65% /24h

Volume in 24h

$28.32B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

was blasted across every outlet.

It’s why we have permanent anti-silver shills on Twitter. But that stops now! (and who knows, maybe we’ll get more popular silver-backed cryptos)

Silver has now surged more than 120% year to date, outpacing gold, copper, and virtually every cryptocurrency besides Zcash and other privacy coins. However, despite the vertical rally, 99Bitcoins strategists say the move isn’t over yet.

Ajay Bagga, a veteran market analyst, put it bluntly: “Silver is gold on steroids.”

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Will Silver Futures Price Pump Into 2026? Industrial Demand Turns Silver Into a Macro Engine

Unlike gold, which lives and dies by monetary policy and risk sentiment, silver is chained to global industry. And 2025 has handed it a perfect storm of catalysts.

Solar demand alone has tripled over the last decade, even as per-panel silver efficiency improved. Electric vehicles use up to 80% more silver than traditional engines. Meanwhile, data center capacity has exploded, from roughly 1 gigawatt in 2000 to more than 50 gigawatts today. That trend is feeding directly into the metal’s price.

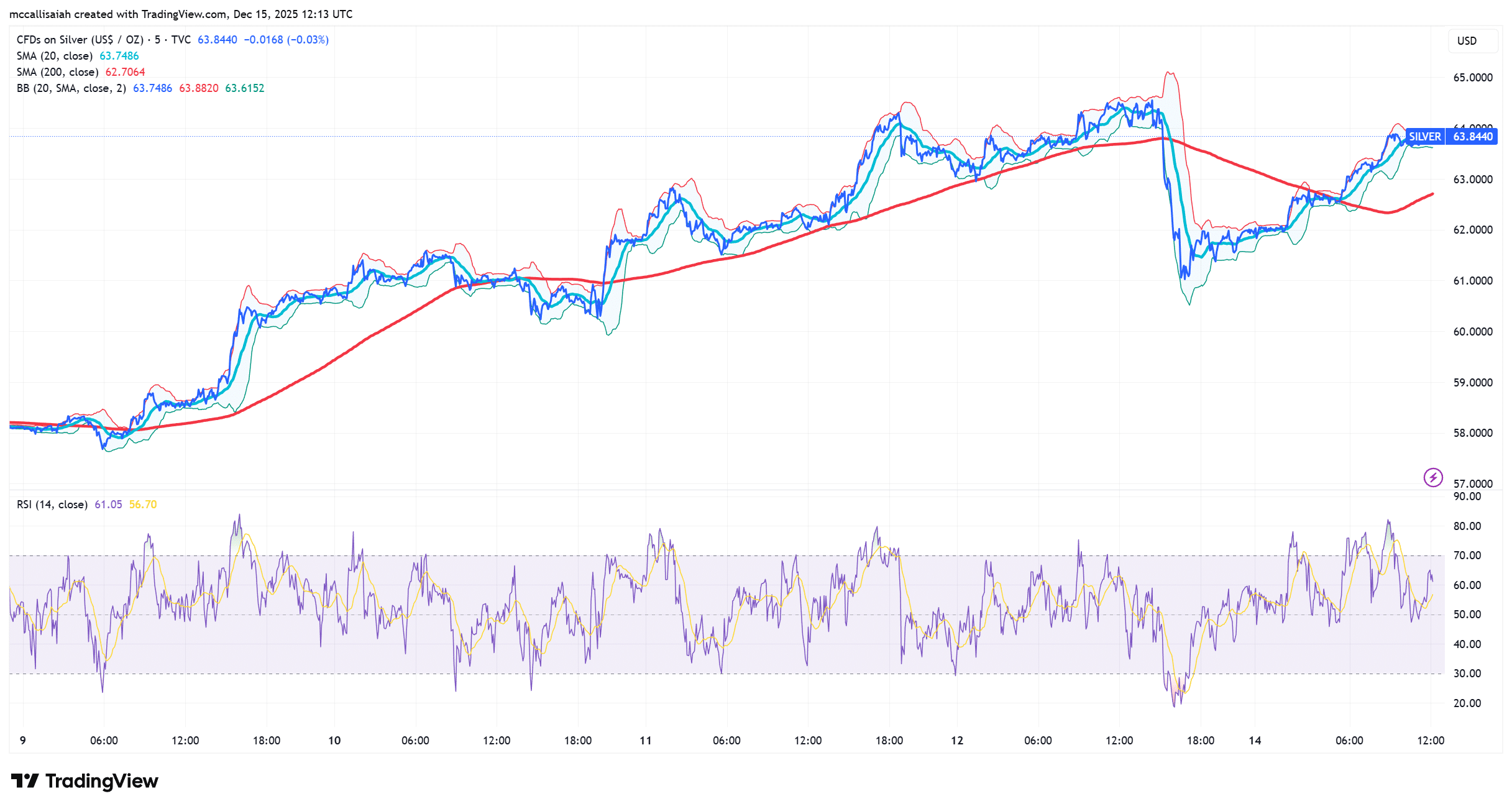

Spot silver is back above $63 after declining 6% in a single day last Friday. I bet it shook out a good number of late and unconvinced buyers. Looks like the dump is over… pic.twitter.com/I2e6J2KBDE

— Rashad Hajiyev (@hajiyev_rashad) December 15, 2025

TradingView data shows spot silver outperformed gold by more than 70 percent on a relative basis this quarter. And according to the Silver Institute, industrial demand hit all-time highs while mine supply stayed flat for the third straight year.

Translation: the deficit is real.

DISCOVER: 20+ Next Crypto to Explode in 2025

Should You Buy Silver Price? Supply Deficits Put a Floor Under Prices

Roughly 80 percent of silver is mined as a byproduct of copper, zinc, lead, and gold. You can’t throttle up output without moving an entirely different market.

Renisha Chainani of Augmont confirmed the pressure: “Tightening stocks, strong industrial demand, and persistent delivery issues are supporting the rally.”

With silver is already up significantly on the year, 99Bitcoins analysts would not recommend allocating more than 10 percent to gold and silver combined.

Macro Winds Still Favor Silver Heading Into 2026

FRED data shows real yields rolling over again. ETF inflows into silver have flipped positive for the first time since 2021. Treasury yields continue to soften as the Fed positions for additional cuts next year.

Silver hasn’t peaked, but the rally might slow. Silver still has room to run, but the rally now demands discipline, not adrenaline.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The Silver futures price has torn through every major resistance level this year, delivering one of its strongest annual performances.

- Silver still has room to run, but the rally now demands discipline, not adrenaline.

The post Silver Futures Price Rally Is “Gold on Steroids,” But Have We Topped? appeared first on 99Bitcoins.