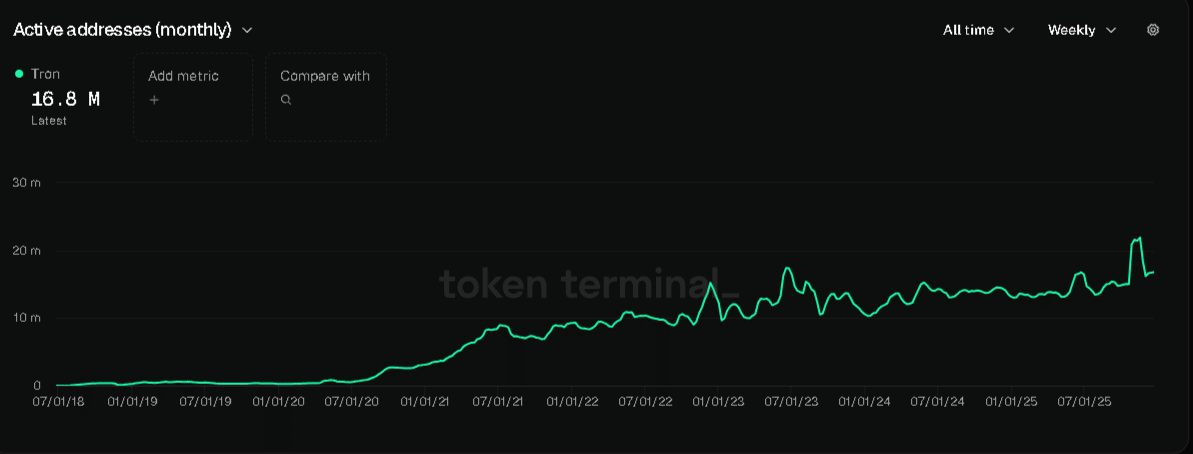

TRON crypto just closed one of its strongest growth periods ever on-chain while TRX token holders sat through the token’s worst fourth quarter since 2017. The network added users at a record speed, even as TRX price dropped by more than -16% in Q4, lagging behind many large-cap altcoins. This gap between usage and price shows a core crypto lesson for beginners: strong fundamentals do not always mean short-term profits.

The upshot? Tron passed 355 million total accounts in December 2025 and regularly processed 8.8–10.2 million transactions per day in Q3. Yet TRX still booked its weakest Q4 performance in eight years, even as the broader market focused on Bitcoin ETFs and high-flying names like Solana and Ethereum. For regular investors, this serves as a clear reminder to distinguish between network adoption data and short-term token speculation.

Why Is TRON Booming On-Chain While TRX Price Drops?

Think of TRON as a busy highway and TRX as the highway’s toll ticket. The highway has never been busier, but the ticket price still fell. That seems odd at first, so let’s break down what actually drives this activity.

TRON slashed average network fees by about 60% in August 2025. Lower fees made it cheaper for people and businesses to move money, which pushed TRON past BNB Chain and Solana in daily active users. At the same time, TRON cemented itself as the main home for USDT, the largest stablecoin (a token that tracks the price of a real-world currency like the US dollar).

(Source –TokenTerminal, Tron Active Addresses)

While the 60% fee cut in August 2025 ignited adoption, it came with a cost: Super Representative (SR) daily revenue dropped by 64% within days. This trade-off, slashing validator income to build a ‘highway’ for global USDT payments, is the real bet Justin Sun is making on TRON’s long-term utility, in my opinion.

USDT on TRON now represents more than half of all USDT in circulation and helps settle over $22 billion in value per day, according to an analysis from Elevennews. In plain English, people use TRON as a cheap, fast rail for moving digital dollars around the world. That does not automatically translate to TRX mooning, especially when traders rotate into flashier narratives.

We have seen this before on other networks. Polygon’s on-chain activity kept climbing even while price struggled, as we covered in our piece on network usage vs. price drops. TRON now offers another case study of the same pattern.

DISCOVER: 20+ Next Crypto to Explode in 2025

What Does This TRON Divergence Mean for Everyday Crypto Investors?

For beginners, the TRON story addresses a significant question: should you focus solely on coins that are currently rising, or consider where real users are actually transacting? TRON’s growth in stablecoin transfers, daily users, and retail payments shows heavy real-world usage even during a weak quarter for TRX itself. That creates a more “boring but useful” narrative compared to hype-driven meme coins.

TRON also stepped quietly into an institutional spotlight. The U.S. Commerce Department chose TRON to publish official GDP data hashes on-chain. A “hash” is like a unique digital fingerprint for a file; placing it on a blockchain allows anyone to verify that the data has not been altered. That kind of government-level use suggests some decision-makers trust TRON’s reliability and uptime.

Still, price pressure across major altcoins remains a concern. Ethereum’s sharp slides, as we discussed in our report on ETH volatility, show how quickly sentiment turns against anything not named Bitcoin. Fund flows also move in and out of altcoins rapidly, as we explained in our coverage of crypto fund outflows and inflows. TRX sits inside that same risk-on bucket for many traders.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Is TRX a Hidden Opportunity or Just Another Risky Altcoin?

On one side, you have a network with strong user growth, stable and dominant flows of stablecoins, and even a government data use case. That looks attractive to long-term thinkers who care about real activity, not just price charts. On the other side, TRX still trades like a high-risk altcoin in a crowded market of Layer-1 competitors like Solana, BNB Chain, and Ethereum.

If you decide to explore TRX, treat it as a speculative bet, not a savings account. TRX can drop significantly during risk-off periods, even if on-chain metrics appear strong. Never put rent money, emergency savings, or short-term cash into TRX or any altcoin.

A simple approach for beginners: learn how stablecoins and low-fee networks work first, then size any TRX exposure small inside a diversified portfolio. The TRON story will continue to evolve as the cryptocurrency market grapples with whether real-world usage or short-term hype matters more in 2026.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post TRON Users Hit Record High While TRX Suffers Worst Q4 Since 2017 appeared first on 99Bitcoins.