Bitcoin is almost ending the year with chaotic and frustrating price actions. It now hovers at $20,000 below where it stood when Donald Trump officially became president, a gap that is sending BTC lower on a year-to-year basis for the 3rd time.

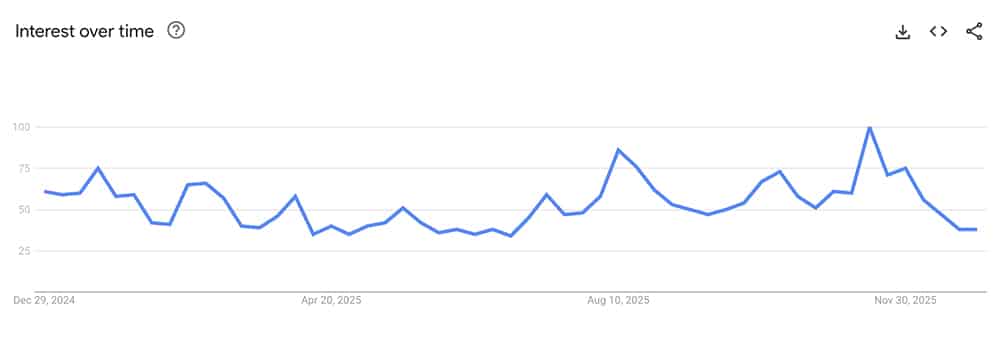

Right now, retail interest has cooled, with Google Trends showing searches for Bitcoin at their lowest point in a year. For many of us, this Bitcoin price is just unexpected.

(source – Google Trends)

However, not all assets are down or have a frustrating price chart like Bitcoin. Silver, following gold, has just recorded a breakout that hasn’t been seen in more than forty years. As we know, strength in precious metals has often signaled shifting liquidity conditions. When capital begins flowing into hard assets, the Bitcoin price has frequently followed, although not immediately.

Silver’s chart shows a familiar pattern with a long, boring base, slow upward movement, and plenty of giving up before the real move began. The current Bitcoin structure looks similar. This “painful” phase is uncomfortable, but it’s where momentum usually builds.

(source – BTC USD, Silver, TradingView)

DISCOVER: 10+ Next Crypto to 100X In 2025

Bitcoin Price and Liquidity Clues From Metals

Liquidity doesn’t always announce itself all at once; it shows up in places, and this time it’s at metals, long before it reaches crypto. The metals run is a sign that financial conditions are easing.

This lag is normal. Bitcoin price movements tend to frustrate us, as usual, right before the real run begins. Sharp pullbacks and sideways action are designed to wear down conviction, and the odds increase that Bitcoin price will eventually respond to the same macro forces.

The popular 4-year Bitcoin price cycle is widely accepted, but it’s based on only three historical examples. When longer economic cycles are considered, such as the 18-year real estate pattern or the Benner cycle, the timeline points toward 2026 as a major peak.

18-year real estate cycle says 2026=CYCLE PEAK

200 year old farmer chart says 2026=CYCLE PEAK

pic.twitter.com/WPkC11hMZe

— Quinten | 048.eth (@QuintenFrancois) November 2, 2025

Bitcoin and crypto behavior have consistently aligned with real-world business cycles. Extended US debt refinancing and post-pandemic monetary policy stretched the current cycle, delaying the explosive phase we expected after the last halving. That delay really explains why Bitcoin price has felt muted.

Encouragingly, leading indicators are beginning to stabilize. Past data suggests that as metrics turn up, Bitcoin price rallies usually begin. This December might be the beginning, not the end.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

A Quietly Bullish Setup

Recent derivatives data show cooling leverage, neutral funding rates, and reduced speculation. On-chain metrics also show steady accumulations by whales, even as sentiment hit fear.

–>

Crypto Fear and Greed Index

Fear

<!–

<!–

–>

Extreme

Fear

Fear

Neutral

Greed

Extreme

Greed

<!—->

From the technical point of view, Bitcoin continues to consolidate above key support as panic selling stopped, and we saw this as the price starting to stabilize. Once liquidity continues to improve, Bitcoin will likely follow metals higher, with 2026 shaping up as the cycle peak. We just need to remember, Bitcoin is here to stay to revolutionize the banking system.

The banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.” — Thomas Jefferson

DISCOVER: 10+ Next Coin to 100X In 2025

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

There are no live updates available yet. Please check back soon!

The post Crypto Market News Today, December 30: Bitcoin Price Struggles To Bounce as Year Ends | Expecting 2026, What’s Next? appeared first on 99Bitcoins.