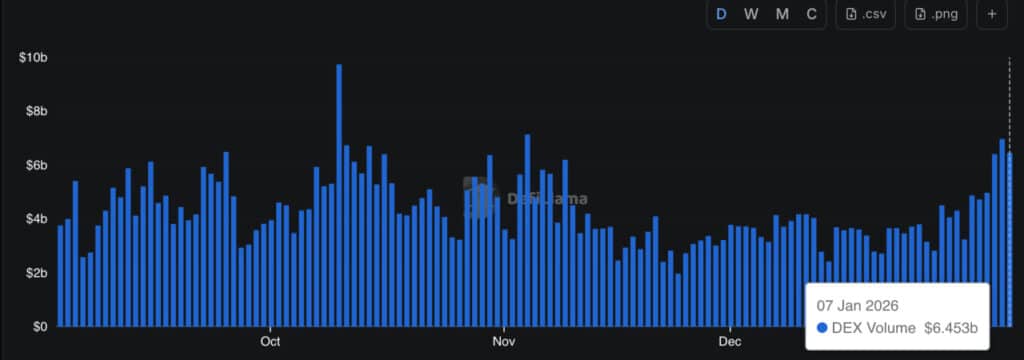

Solana lit up again this week as trading activity on its decentralized exchanges jumped 39%, driven by a fresh wave of meme coin speculation. SOL climbed 8% over seven days and bounced cleanly from the $120 zone before stalling near $140.

This move fits a familiar 2025 pattern where meme coin bursts drive real on‑chain action on Solana.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

What Does a Surge in Solana DEX Volume Mean For SOL Price?

A DEX, short for decentralized exchange, works like a crypto flea market. You trade directly with other users instead of going through a company like Coinbase. On Solana, those markets suddenly got busy.

According to DeFi Llama, Solana DEXs handled about $30 billion last week, up 25% from the week before. Meme coins did most of the heavy lifting. BONK jumped 50% in seven days, while smaller tokens posted even sharper moves.

This matters because every trade uses SOL for fees. More trades mean more demand for the network. That link between usage and value explains why Solana often rallies during meme coin frenzies.

Why Are Meme Coins Powering Solana Again?

Platforms like Pump.fun and Meteora act as meme coin launchpads. Think of them as vending machines for new tokens. When hype returns, these apps print activity fast.

Pump.fun alone hit $2 billion in daily volume at its peak. Solana DEXs have led all chains in monthly trading volume for most of 2025. Low fees make rapid trading cheap. That attracts short‑term traders.

It seems we still have a problem.

This week we saw the highest volume day ever on Pump fun (> $1.2B in swaps), yet all but one of the top runners have now retraced ~90%, with none reaching eight figures.

In 2023 an equivalent volume day would have retired half the trenches. pic.twitter.com/4YbT17LQH3

— boot (@lowercaseboot) January 7, 2026

We have seen this movie before. Solana also led during earlier meme waves, even outperforming Ethereum in raw DEX volume for months.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Solana Price Prediction: Can This Activity Push SOL to $160?

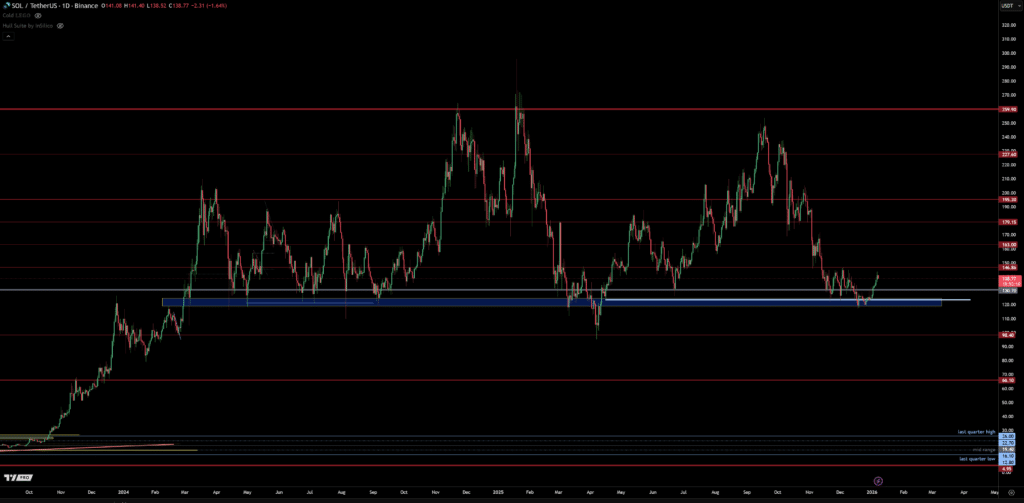

Technically, traders watch the $160 area because it lines up with the 200‑day moving average. That level often acts like a ceiling in shaky markets.

The catch sits under the hood. Weekly Solana transactions stand near 487 million, far below the 816 million peak seen before SOL ran to $240. According to Artemis, network use needs to rise much more to support a lasting breakout.

(Source: SOLUSD / TradingView)

This creates a gap beginners should understand. Price can jump on hype. Long runs need steady usage.

What Are the Risks for Regular Investors?

Meme coin rallies burn bright and fade fast. When trading slows, fees drop. That pressure flows back to SOL. We saw this after Solana crossed $180 earlier in the cycle. Activity cooled. Price followed. This looks more like a fast rebound than a confirmed bull run.

If you are curious about Solana, start small. Learn how the network works. Our guide on Solana network usage breaks down why activity matters more than headlines. Solana thrives when traders show up. Watch transaction counts, not just price candles. That signal decides whether $160 breaks—or rejects.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Solana Price Prediction: DEX Volume Jumps & Meme Coins Return appeared first on 99Bitcoins.