Lemon, one of Argentina’s leading crypto platforms and the country’s second-largest crypto exchange, announced on January 14-15, 2026, the launch of the nation’s first Bitcoin-backed Visa credit card. This innovative product allows users to access credit in Argentine pesos (ARS) for everyday spending while keeping their Bitcoin (BTC) holdings intact as collateral. No need to sell or convert their BTC.

Lemon has introduced Argentina’s first Bitcoin-backed Visa credit card.

The product lets users unlock peso credit by pledging $BTC as collateral, avoiding the need to liquidate digital assets for everyday spending. #Bitcoin #LemonCash pic.twitter.com/aBHYznpGTn

— CryptoMoses (@realcryptomoses) January 15, 2026

The rollout addresses a critical need in Argentina’s challenging economic environment, where persistent inflation, currency devaluation, and limited access to traditional banking have driven millions toward crypto as a practical survival tool.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2026

How Does a Bitcoin-Backed Credit Card Actually Work?

In simple terms, you lock up Bitcoin as collateral, and Lemon lends you pesos to spend through a Visa card.

In this first phase, users can deposit 0.01 BTC and access up to 1 million Argentine pesos, roughly $700. You keep your Bitcoin. Lemon holds it as security until you repay the balance.

Lemon’s founder and CEO, Marcelo Cavazzoli, emphasized:

We created a simple way to access credit in pesos using Bitcoin as collateral, without needing a credit history.”

He described Bitcoin as:

the best store of value created in the history of humanity and the fundamental piece for the new digital economy.”

EXPLORE: JPMorgan Bullish on 2026: Why the Bank Sees Bitcoin and Crypto ETF Inflows Accelerating This Year

Why is Argentina Exploring This Solution Right Now? Fighting Inflation

Argentina has long struggled with severe economic instability. Hyperinflation peaked at over 200% annually in 2023-2024. While aggressive austerity measures under President Javier Milei and over $20 billion in US bailouts have significantly reduced annual inflation to around 31.5% year-over-year by December 2025 (the lowest in over seven years), monthly price increases remain high, with a 2.8% month-on-month increase in December 2025. This ongoing pressure erodes the purchasing power of the peso and fuels widespread distrust in traditional banks.

The Trump admin is bailing out Argentina's failed libertarian President Milei.

The US gov't is buying Argentine pesos, to stabilize the exchange rate and reduce inflation.

The US will give a $20 billion swap.

Argentina has elections in 2 weeks. The US is meddling to help Milei https://t.co/OkO733SUjD pic.twitter.com/X8kvwg0bBi

— Ben Norton (@BenjaminNorton) October 9, 2025

Historical events, such as the 2001 “corralito” banking freeze that restricted access to deposits and wiped out savings, have fueled a culture of cash hoarding (an estimated $271 billion in undeclared U.S. dollars held outside the formal system) and a shift to hard assets like Bitcoin.

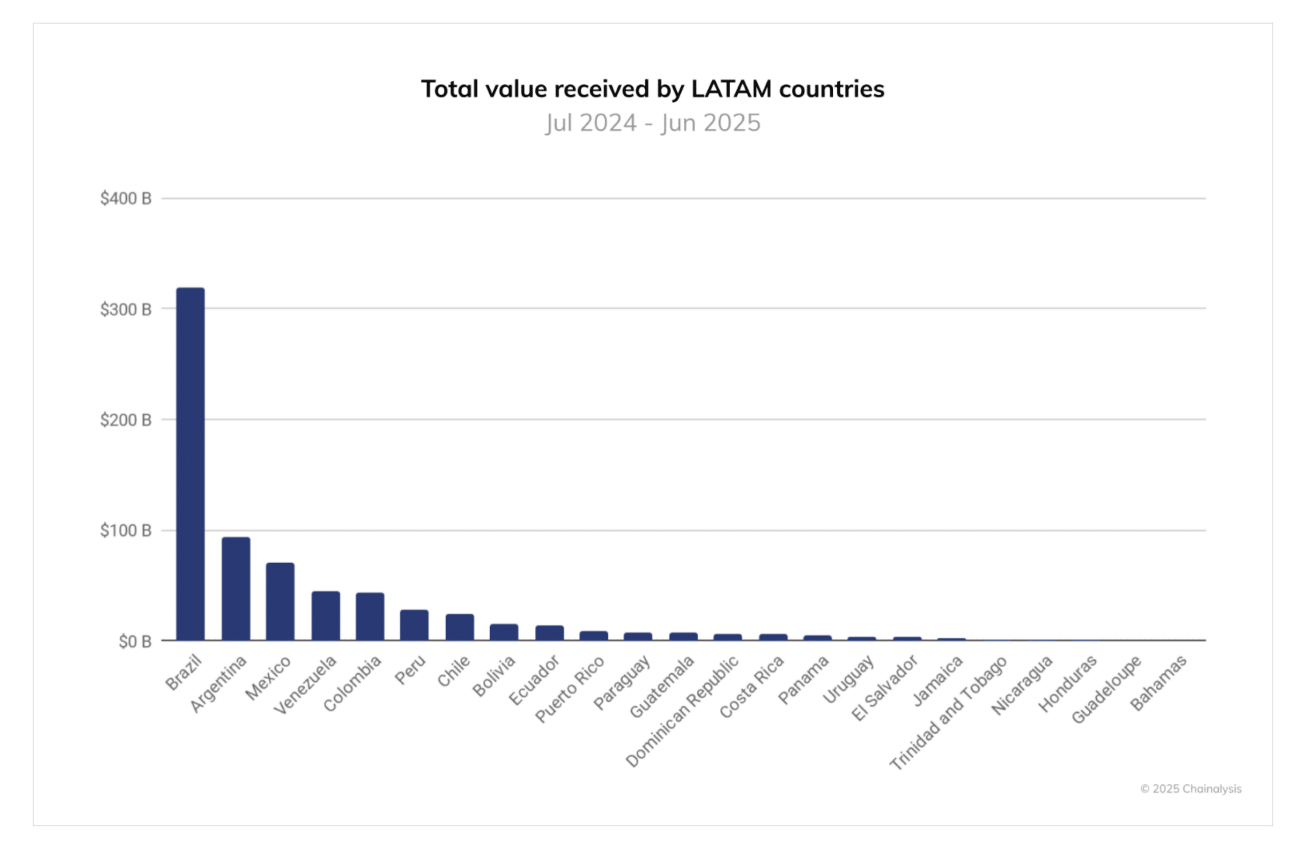

Crypto adoption has surged, with Latin America seeing roughly $1.5 trillion in crypto activity from 2022-2025, and Argentina is second, after Brazil, in per-capita usage.

(Source: Chainalysis)

In this context, Bitcoin has evolved from a niche asset to a preferred store of value. On Lemon’s platform (which serves over 5.5 million users), Bitcoin now constitutes the largest share of user reserves, surpassing even stablecoins (like USDT/USDC) and the peso itself.

As of late 2025 data, BTC accounted for about 34.54% of portfolio allocations among Lemon users, reflecting a behavioral shift toward viewing Bitcoin as a long-term hedge against peso volatility.

That is a big shift. Stablecoins are digital dollars. Bitcoin is volatile. Yet Argentines still choose BTC because they do not trust the peso.

This card also fits a wider move toward crypto payment adoption. Bitcoin is no longer just something you hold. It is something you use.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Argentina Gets Its First Bitcoin Credit Card appeared first on 99Bitcoins.