The crypto market cap sits at 3.32 trillion dollars, and for us watching screens a little too long, it is somehow bullish. Bitcoin price keeps pulling focus, driving the direction of the crypto market as a whole. Crypto market cap holds steady, and Bitcoin price refuses to slip; it feels like it’s about to get good.

For us in the market, this is a deliberate phase. Capital is flowing back into the crypto market with intent, and the Bitcoin price keeps pushing the total cap. Since the November lows, close to 390 billion dollars have returned to crypto. Stretch that view back to April, and about 820 billion dollars have been added, good numbers to rebuild confidence.

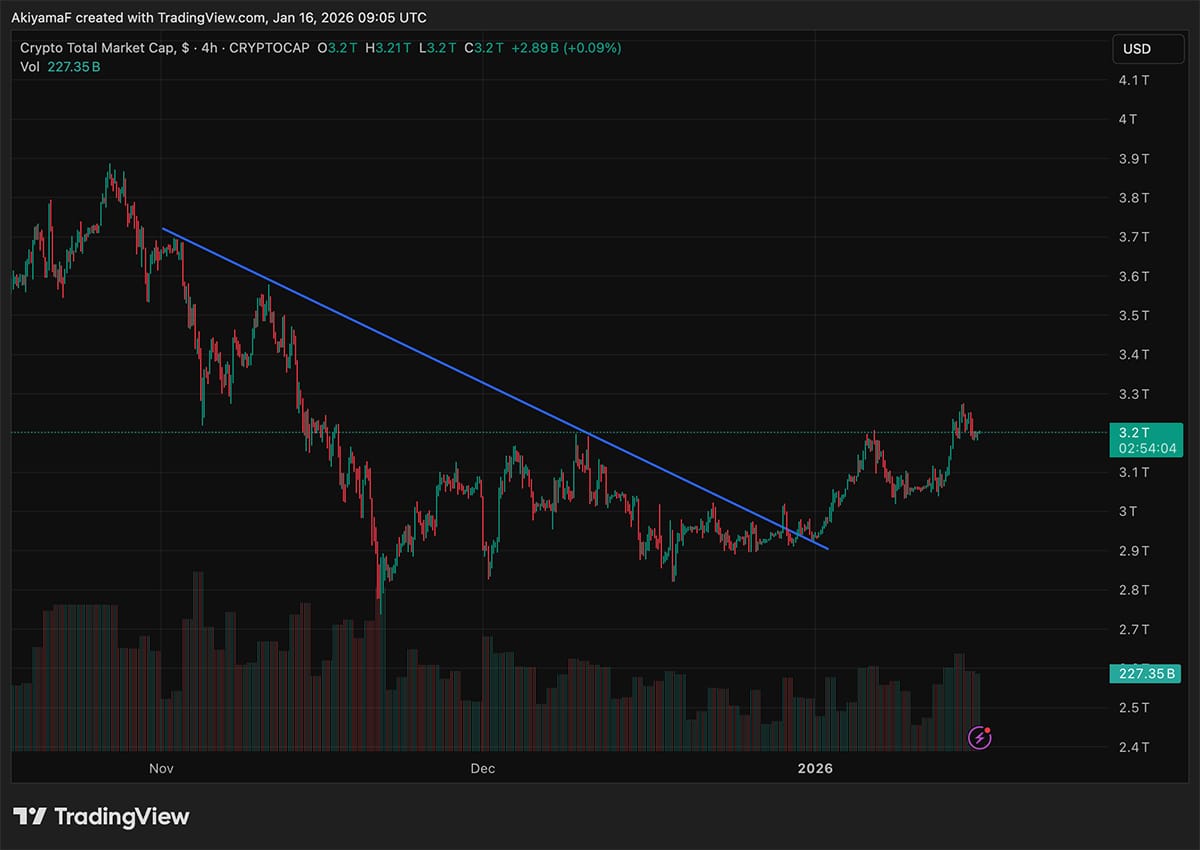

Crypto Market Cap Bullish Divergence Takes Shape

On the charts we follow daily, the crypto market cap shows a bullish divergence that is once again bullish. Volume reached 139 billion dollars in the last session, as engagement skyrocketed. The Bitcoin price continues to lead the way, holding its dominance around 59 percent. But, it is also below 60%, which is good for atlcoins.

(source – TradingView)

Bitcoin price is now at $95,000 level, pushing higher at a controlled pace. RSI is at 56, and MACD leans positive, which keeps our confidence in check. ETF inflows reached $1.8 billion this 4 days, with one of the days recording just south of $650 million, with BlackRock doing most of the heavy lifting. But that’s not all, Saylor’s Strategy is also keeping adding their spot holding.

BULLISH: $1.8 BILLION IN BITCOIN ETF INFLOWS

Bitcoin ETFs just logged four consecutive days of inflows totaling $1.8 BILLION, on track to closing the week in the green. pic.twitter.com/Sm2rgH64fV

— Coin Bureau (@coinbureau) January 16, 2026

Derivatives data also make things interesting. Bitcoin liquidations came in around 82 million dollars, while open interest climbed to 110 billion dollars. This is a good signal as positions stay open, conviction stays intact, and Bitcoin price remains within reach of the six-figure milestone.

DISCOVER: 10+ Next Crypto to 100X In 2026

Bitcoin Price Keeps the Market Moving

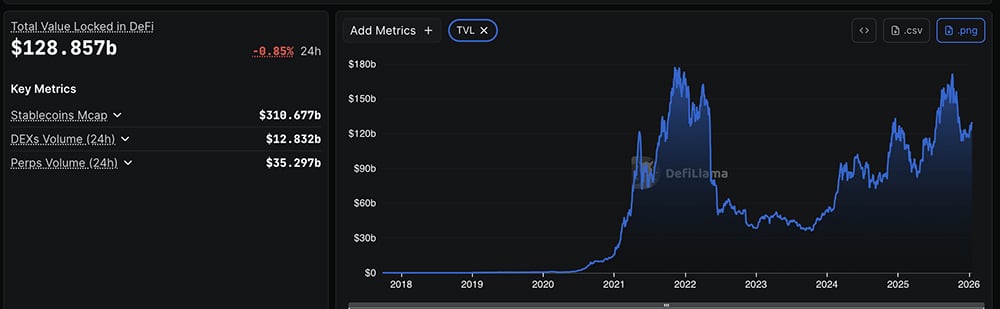

A stable Bitcoin price tends to lift the rest of the market, and we can see it now. With dominance still under 60 percent, room exists for rotation. DeFi total value locked climbed to 129 billion dollars, driven mainly by lending platforms that continue to attract capital and stablecoins.

(source – Defillama)

Stablecoins keep liquidity flowing, with it averaging $3.5 trillion in daily volume, supporting the crypto market cap. Tokenized real-world assets reached 24 billion dollars, while Ethereum holds around 71 billion dollars in TVL. Even privacy-focused coins are also joining the move, proving the market still likes a diverse playlist. Yep, Monero is blasting all-time high after all-time high.

Beyond charts, adoption stories keep stacking up. Regulation discussions, bank interest in stablecoins, and tokenization efforts continue to build. Maybe it’s time to listen to the full album instead of a hit single. And yes, at least once a cycle, we all catch ourselves smiling at the screen, thinking, this might be where the Bitcoin price goes full euphoria.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Coinbase and Robinhood Stocks Slide as Senate Crypto Bill Hits Pause

Shares of Coinbase and Robinhood slid after US senators delayed work on a long-awaited crypto market structure bill. Coinbase (COIN) closed yesterday’s (January 15) trading session down -6.48%, while Robinhood (HOOD) finished the session down -7.79%.

Price action across both stocks highlights further regulatory uncertainty, with Robinhood also dealing with concerns about trading volume. The move fits a familiar pattern in which crypto-related stocks wobble when regulators show hesitation.

CONGRESS DELAYS CRYPTO BILL: STOCKS PLUNGE

Crypto equities are tanking as regulatory hurdles stall market progress.

Stock Impact:

$HOOD: -7.8%

$COIN: -6.5%

Spot Market Reaction:$BTC: $95,300 (-2.3%)$ETH: $3,290 (-2.6%)$SOL: $141 (-3.9%)…

— Christian (@Cryptowcesar) January 15, 2026

This move was not in response to earnings or platform hacks. It was about rules. And when rules stay fuzzy, markets flinch. We have seen this movie before. Past delays in US crypto law have triggered broad pullbacks as traders cut risk and wait for clarity.

The crypto market itself is looking a little hesitant heading into the weekend, with BTC USD down -1.2% on the day but still trading safely above $95,000. After a strong start to the year, minor pullbacks are normal and healthy, and can act as a period of consolidation before the next leg begins.

Read the full story here.

Argentina Gets Its First Bitcoin Credit Card

Lemon, one of Argentina’s leading crypto platforms and the country’s second-largest crypto exchange, announced on January 14-15, 2026, the launch of the nation’s first Bitcoin-backed Visa credit card. This innovative product allows users to access credit in Argentine pesos (ARS) for everyday spending while keeping their Bitcoin (BTC) holdings intact as collateral. No need to sell or convert their BTC.

Lemon has introduced Argentina’s first Bitcoin-backed Visa credit card.

The product lets users unlock peso credit by pledging $BTC as collateral, avoiding the need to liquidate digital assets for everyday spending. #Bitcoin #LemonCash pic.twitter.com/aBHYznpGTn

— CryptoMoses (@realcryptomoses) January 15, 2026

The rollout addresses a critical need in Argentina’s challenging economic environment, where persistent inflation, currency devaluation, and limited access to traditional banking have driven millions toward crypto as a practical survival tool.

Read our full coverage here.

Ethereum USD Climbs as Institutions Step In and Retail Traders Step Back

Ethereum has continued its strong start to 2026, holding steady above $3,300 USD as a different kind of buyer steps in to take control of the chart. Price strength held even as leveraged retail traders exited, a rare combination in crypto rallies.

Zooming out, this move aligns with a broader 2025 trend in which long‑term holders and institutions replace short‑term speculation, as ETH has climbed by more than +10% since the beginning of the year.

ETFs and publicly traded Ethereum Treasury firms have been the main drivers of ETH’s strength in recent weeks, as institutions and DATs race to secure their share of the Ethereum staking yield, creating organic demand for the number two digital asset.

Read the full story here.

US Mortgage Lender Lets Buyers Qualify With Bitcoin: Will BTC USD Explode?

Bitcoin is money and a store of value. While the USD serves this very role in times of turbulence, it is quicker to more BTC around without fearing censorship. Given its intrinsic properties, Bitcoin is now finding adoption. Besides institutions that have been pouring their billions buying BTC-backed spot Bitcoin ETFs, Bitcoin is finding support from banks.

This week, Newrez, a major US mortgage lender, crossed a line many thought was years away. The lender announced it will allow borrowers to qualify for mortgages using Bitcoin and other top crypto to buy. This matters because home buying is the final boss of personal finance. When crypto counts toward that goal, it signals a shift from speculation to real-world utility. And for long-term holders, it changes how and when you might sell.

JUST IN: $864 BILLION NEWREZ JUST ANNOUNCED IT WILL ACCEPT #BITCOIN AND CRYPTO FOR MORTGAGE QUALIFICATION

"NO SELLING REQUIRED." THIS IS HUGE

pic.twitter.com/2uMjNLChZ0

— The Bitcoin Historian (@pete_rizzo_) January 15, 2026

In response, the Bitcoin price held firm, finding support above $95,000, building on from gains of early this week. And Bitcoin, including the next cryptos to explode, could edge higher since Newrez news fits a wider push by institutions to treat crypto like real money, not a hobby.

Read our full coverage here.

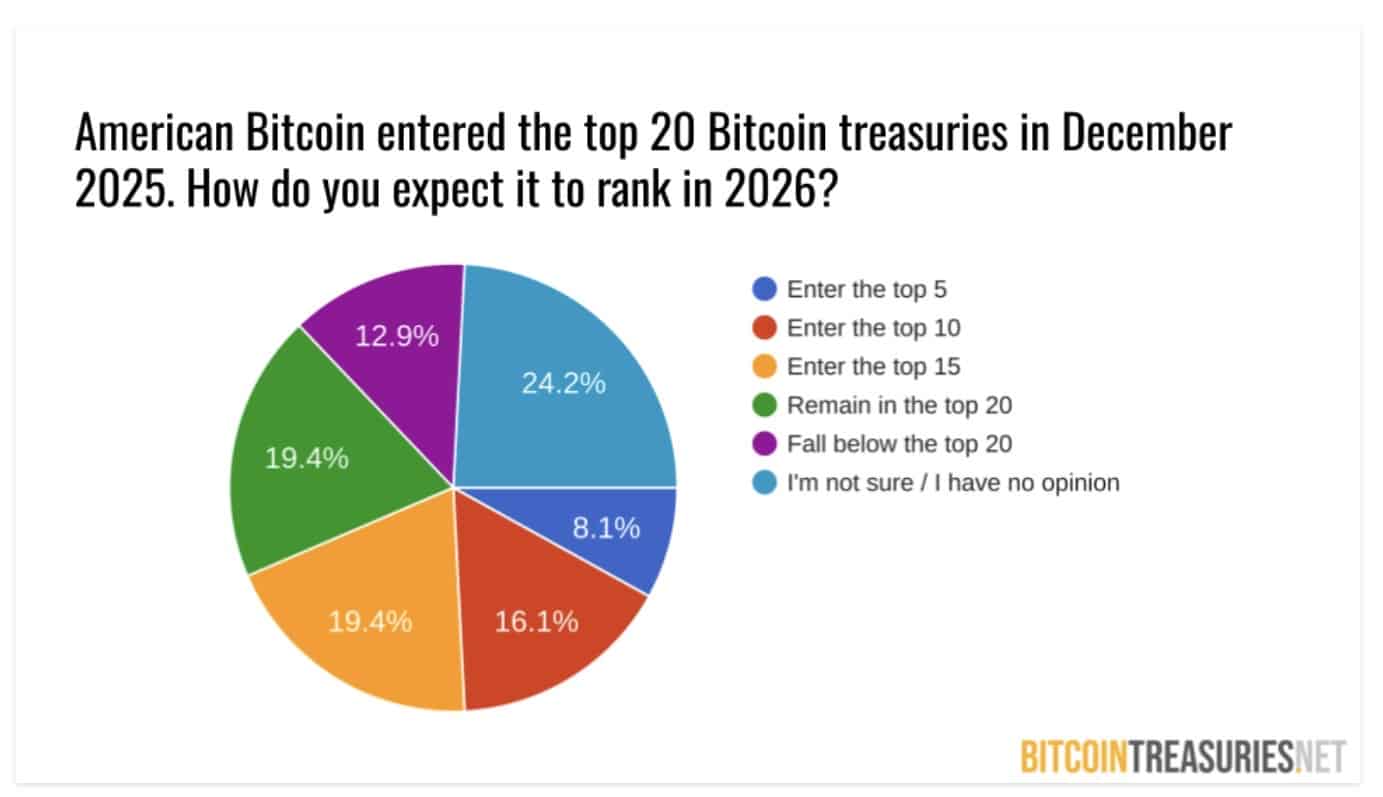

Companies Plan Bigger Bitcoin Treasury in 2026

Companies holding Bitcoin on their balance sheets are gearing up for significant growth in 2026. The poll of investors, analysts, and corporate decision-makers shows strong optimism that public companies will increase their Bitcoin treasury next year, building on the momentum from 2025. A Bitcoin treasury means a company keeps part of its cash in Bitcoin, the same way it might hold dollars, bonds, or gold. Firms do this to protect purchasing power when inflation or currency risk eats into cash.

The survey shows investors expect these corporate Bitcoin balances to rise in 2026. Companies buy in size and hold for years, not weeks. More long-term holders mean fewer coins sloshing around on exchanges.

(Source: Bitcoin Treasuries)

Read the full story here.

Another US State Backs Bitcoin as West Virginia Pushes Crypto Treasury Bill

West Virginia lawmakers introduced a bill that would let the state treasury invest in Bitcoin and approve stablecoins. Although Bitcoin is down 1% overnight, it is holding strong above $95,000, currently trading at $95,600. A hold of $94,000 over the weekend could provide fuel for a push toward $100,000 next week.

While the broader crypto market remains strong following a strong start to 2026, the combined market cap is down -0.9% over the past 24 hours, currently at $3.32 trillion. This pullback is mostly due to Elon Musk’s X killing the InfoFi sector by removing API access for hundreds of projects, including Kaiti AI, Cookie DAO, and others, in an attempt to combat the growing AI slop on the platform.

Back to the West Virginia news, the move fits a broader trend: US states are seeking inflation hedges and alternatives to cash. State-level Bitcoin adoption continues to creep from idea to policy. And that matters more than most price charts. When governments discuss holding Bitcoin, they view it less as a gamble and more as a long-term reserve.

Currently, three US states, Arizona, New Hampshire, and Texas, have had their respective Bitcoin reserve bills enacted, allowing them to hold Bitcoin and other digital assets. As of late 2025, Texas is the only state to have purchased BTC, investing $5M in BlackRock’s IBIT Bitcoin ETF and an additional $5M in self-custody.

Read the full story here.

Over 7.7M Bitcoin Ordinals Minted Despite BTC USDT Crashing In Q4 2025

The Bitcoin price started the week strongly before flatlining from Wednesday. All in all, the BTC USDT price is trading at over $95,000, holding firm despite the sideways move. For now, the ideal target stays at $100,000. If this level is breached, it is likely that Bitcoin and crypto will, once again, trend, attracting “extra” activities.

Good or bad, network activity is gauged by the number of transactions. A healthy BTC USDT uptrend, lifting some of the top Solana meme coins, for instance, should be marked by swelling on-chain activity. If the number of transactions spikes, it means more users are actually posting transactions, not just HODLing, hoping to strike gold.

Read the full story here.

The post Crypto Market News Today, January 16: Total Crypto Market Cap Bullish Divergence, But Can Bitcoin Break Price High? appeared first on 99Bitcoins.