Crypto traders have nowhere to hide. It has been a tough week for Bitcoin, Ethereum, Solana, and other top 10 holders. While optimism is high, the only question that matters is: Why is crypto down today?

As is clear, the total crypto market cap is down -2% in the last 24 hours, pushing valuation to around $3.1T. While Bitcoin crypto leads the valuation chart, it disappointingly broke below $90,000, dragging other coins, including Ethereum, Solana, and XRP, with it. What began as a localized correction has spiraled into a broader sell-off, leaving investors wondering where the bottom lies.

While the “Moon” talk of 2025 has quieted, the current volatility is being driven by a “perfect storm” of macroeconomic tension, technical breakdowns in Bitcoin, and a high-stakes appearance by President Donald Trump at the World Economic Forum (WEF) in Davos.

Trump: Greenland or Tariffs

The market: pic.twitter.com/Sm8MIuEyMS

— Not Jerome Powell (@alifarhat79) January 20, 2026

DISCOVER: 9+ Best Memecoin to Buy in 2026

The Davos Factor: Trump’s “Greenland” Tariffs at the WEF

Even if you are apolitical, the primary catalyst for today’s jitters is President Donald Trump’s special address at the World Economic Forum (WEF) in Davos. The market is reacting to the fallout of his “America First” trade policies, specifically the escalating “Greenland Crisis.”

A stronger attitude towards Donald Trump is required, says Gavin Newsom as he speaks to Sky News in Davos.

Gavin Newsom says the EU should 'stop doing what they are doing' or they could be 'devoured' by the US president. pic.twitter.com/9mZmAvsmBG

— Sky News (@SkyNews) January 20, 2026

Trump recently proposed sweeping tariffs on European nations, starting at +10% and possibly rising to +25%, as leverage in his bid to acquire Greenland. Historically, tariffs tend to “diffuse” upside momentum, and that was evident last week. Bitcoin and some of the best cryptos to buy slid sharply, only to reverse losses.

With European leaders vowing to retaliate with a €93 billion “trade bazooka,” global investors are fleeing “risky” assets, including the top Solana meme coins, and piling into traditional safe havens. In a telling sign of the current sentiment, Gold has surged to record highs above $4,600, while Bitcoin has failed to act as “digital gold,” dropping alongside the relatively highly volatile tech stocks.

GOLD

Gold has broken out above its 3-month resistance level as the flight to safety intensifies amid deteriorating geopolitical uncertainty. As long as gold holds above this line, we assume it is heading higher.

P.S. If an equities deleveraging event occurs, cash is king. pic.twitter.com/UafUGXYIlM

— The Great Martis (@great_martis) January 20, 2026

DISCOVER: Best New Cryptocurrencies to Invest in 2026

Institutional Exit, Eyes on Bitcoin: Will It Drag Ethereum, XRP, and Solana?

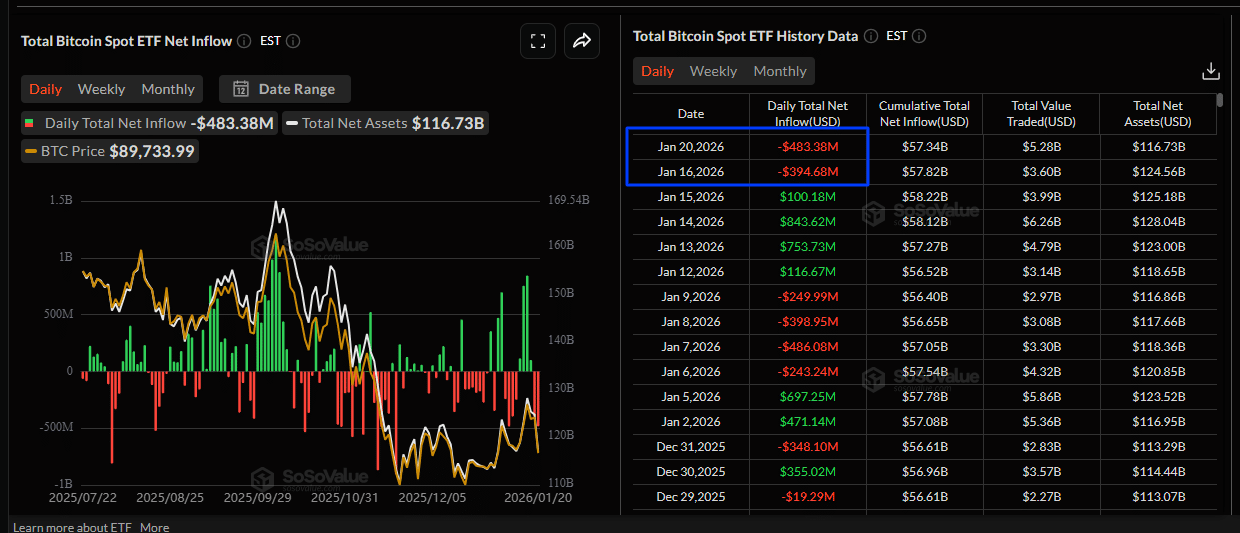

After a record-breaking 2025, institutional appetite for spot ETFs is facing its first real test of 2026. The data suggests that the “smart money” is currently on the sidelines or actively exiting.

Following a period of aggressive accumulation, US-listed spot Bitcoin and Ethereum ETFs have recorded worrying net outflows over the last 48 hours. Trackers show that over $800M worth of spot Bitcoin ETFs have been redeemed this week. There have been no inflows, further weakening bulls.

(Source: SosoValue)

Analysts suggest institutional players are locking in gains after the impressive BTC USDT run toward $126,000 last year. What’s also possibly creating a liquidity crunch, negatively impacting Bitcoin and the next cryptos to explode, is the recent Martin Luther King Jr. holiday in the US, which created a liquidity gap. The net result was the amplification of institutional sell orders.

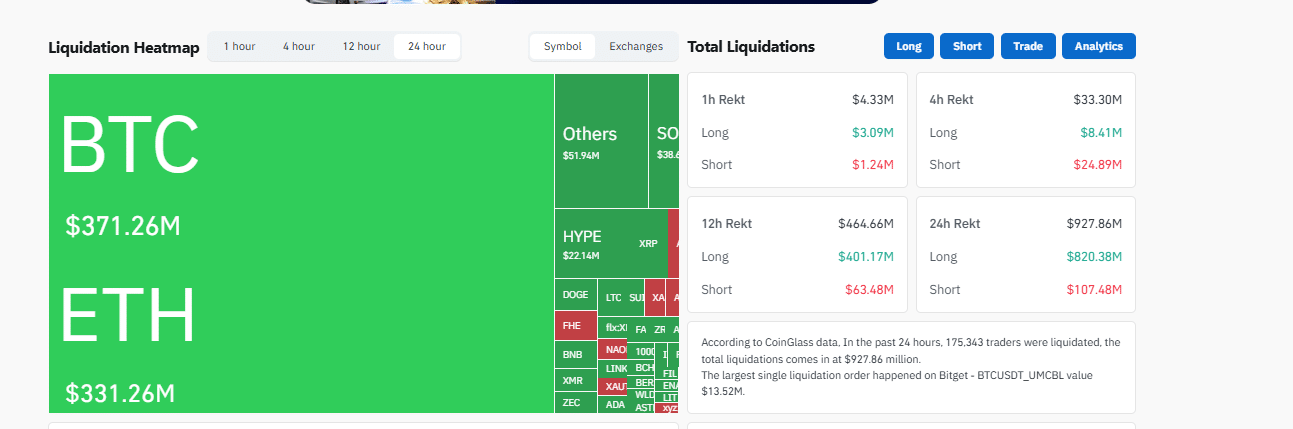

Increased redemption could explain why the king of crypto has struggled to maintain its footing, creating a “gravitational pull” that is dragging down Ethereum, Solana, and XRP. Earlier today, the Bitcoin price slipped below the psychological $90,000 support level. This breach triggered a cascade of over $371M in Bitcoin leveraged long liquidations in the last 24 hours.

(Source: Coinglass)

Since long liquidations force spot selling of collateral, the renewed selling pressure is also dragging other altcoins. Ethereum is struggling to hold the $3,100 mark, down -10% in the past week. Similarly, Solana, which is known for its high beta, is down -11% over the past week as traders rotate out of high-growth, high-volatility ecosystems.

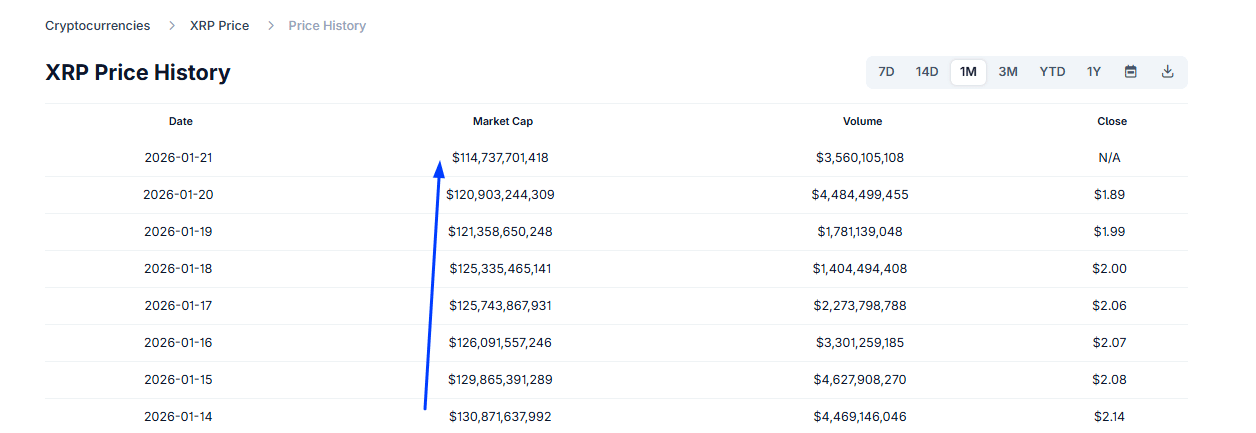

XRP crypto has also not been spared. Despite positive news on Ripple’s real-world asset tokenization, the XRP USD price fell below $2, a round number and a psychological level. XRP has been selling off strongly since January 14.

(Source: Coingecko)

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Why is Crypto Down Today? Solana, Ethereum, and XRP Extend Losses: What’s Going On? appeared first on 99Bitcoins.