Ethereum price is testing our patience again. We are watching the second-largest cryptocurrency flirt dangerously with the $2,000 mark, a massive psychological barrier that sends shivers down the spine of any new investor.

After sliding nearly 7% in January, a month that historically delivers 30%+ gains, ETH is at a crossroads. Is this a golden ticket to buy the dip, or are we catching a falling knife?

DISCOVER: Top 20 Crypto to Buy in 2026

Why ETH Price Is Testing $2,000 Again

So, how did we get back here? It feels like just yesterday we were talking about new highs, yet here we are defending the $2,000 fortress. Broadly speaking, crypto is struggling under the weight of market uncertainty, with sentiment hitting rock bottom despite the “supercycle” chatter we heard all of 2025.

Supercycle TL:

– @cz_binance calling for supercycle up to 2 weeks ago, in both posts & numerous interviews

– 30th January, on @Binance Square says supercycle is cancelled as community is “fudding” him over 10/10

You can see the problem now. pic.twitter.com/4YQJc7KVFL

— $trong (@StrongHedge) February 1, 2026

Historically, buyers step in here to bounce the price back up. As noted in recent analysis, intraday support suggests bulls are trying to hold the line between $2,000 and $2,075.

However, when fear takes over, even strong trampolines can break. Panic selling often accelerates when investors see red, pushing the Fear & Greed Index to extreme lows.

What Analysts Are Saying About Ethereum Price at $2,000

On one side, you have big banks like Standard Chartered and Citi projecting that Ethereum could hit $5,400 to $7,500 by the end of 2026. They are looking at catalysts such as the U.S. Clarity Act and the recent accumulation of 2.3 million ETH by treasury firms. That is deep-pocketed “smart money” buying while retail investors panic.

Seeing these massive inflows reminds us that institutional interest remains real, regardless of daily price swings. However, technical charts tell a scarier story. If the $1,900 support band breaks, bearish analysts warn we could slide toward $1,760 or even $1,000.

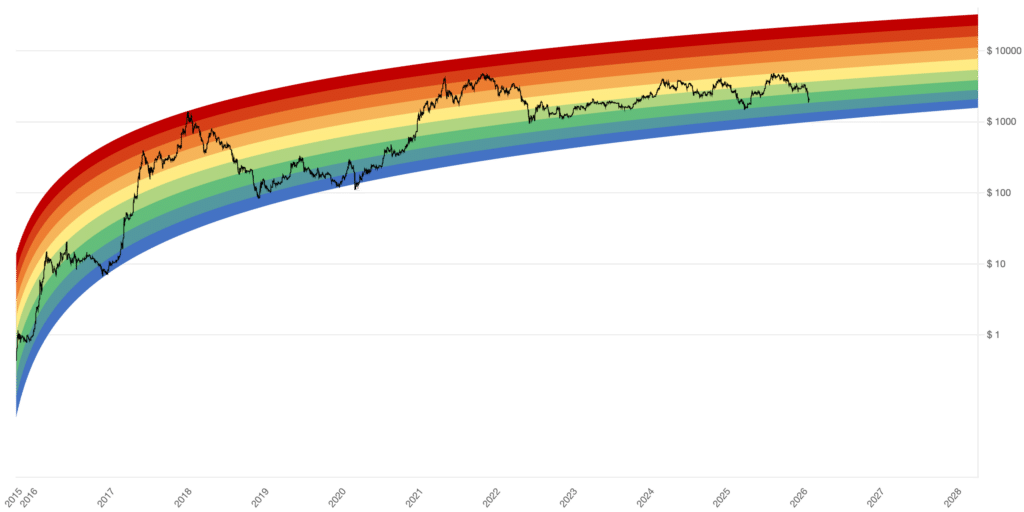

(Source: Ethereum Rainbow Chart / blockchaincenter)

Conversely, the famous Rainbow Chart, a colorful long-term valuation tool, currently assigns $2,000 to the “Accumulate” zone. This suggests that for patient investors, this price might be a bargain, leading some to ask: Is Ethereum dying, or is this the biggest buy signal of the decade?

DISCOVER: Best New Cryptocurrencies to Invest in 2026

Is $2,000 ETH a Buy or a Warning Sign?

If you are new to crypto, this volatility is your tuition fee. When headlines scream “crash” while banks whisper “opportunity,” it’s easy to freeze up. Here is the reality: no one knows exactly where the bottom is.

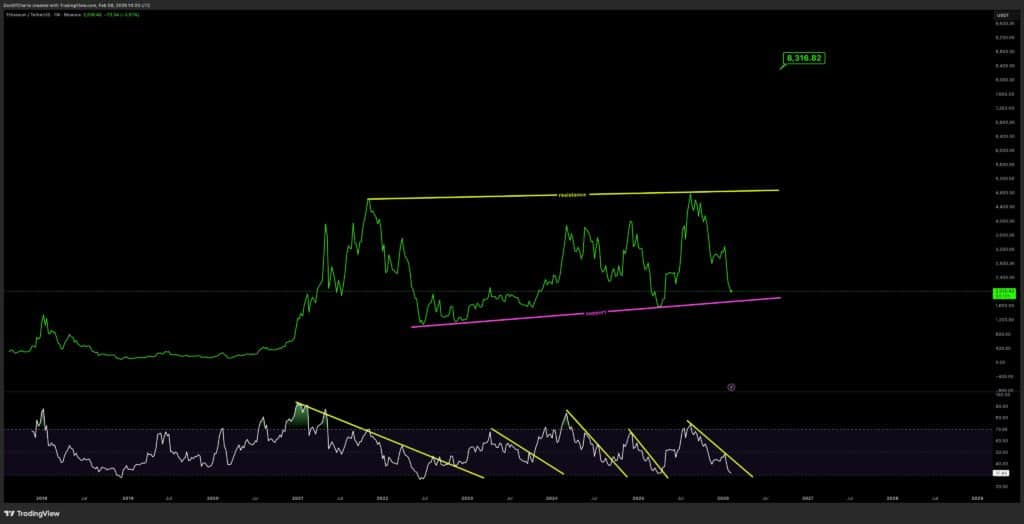

(Source: ETHUSD / Tradingview)

If you believe in Ethereum’s long-term vision, smart contracts, decentralized finance, and the upcoming upgrades, viewing $2,000 as an entry point for Dollar Cost Averaging (DCA) makes sense.

This means buying small amounts over time rather than going all-in at once. However, never invest money you can’t afford to lose. The road to $7,500 might be paved with dips to $1,500, and you need the stomach to handle the ride.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Ethereum Price Drops to $2,000: Is This a Breakdown or a Long-Term Opportunity? appeared first on 99Bitcoins.