It seems that Aster crypto is back on traders’ screens after a move higher tied to aggressive token buybacks and public support from Binance founder Changpeng Zhao. ASTER traded near $0.653, up 5.8% in 24 hours and 8.6% over the week, after weeks of choppy action.

This rally lands as Layer-2 projects fight for attention in a crowded Ethereum scaling race. CZ tip? Hold.

I've seen many different trading strategies over the years, very few can beat the simple "buy and hold", which is what I do.

Not financial advice.

— CZ

BNB (@cz_binance) January 25, 2026

Despite the surge, token concentration has been a persistent worry. About 97% of ASTER supply sits in the top 100 wallets, raising fears of potential large dumps.

EXPLORE: Top Solana Meme Coins to Buy in 2026

Aggressive On-Chain Crypto Buybacks Fuel ASTER Demand and Reduce Supply Pressure

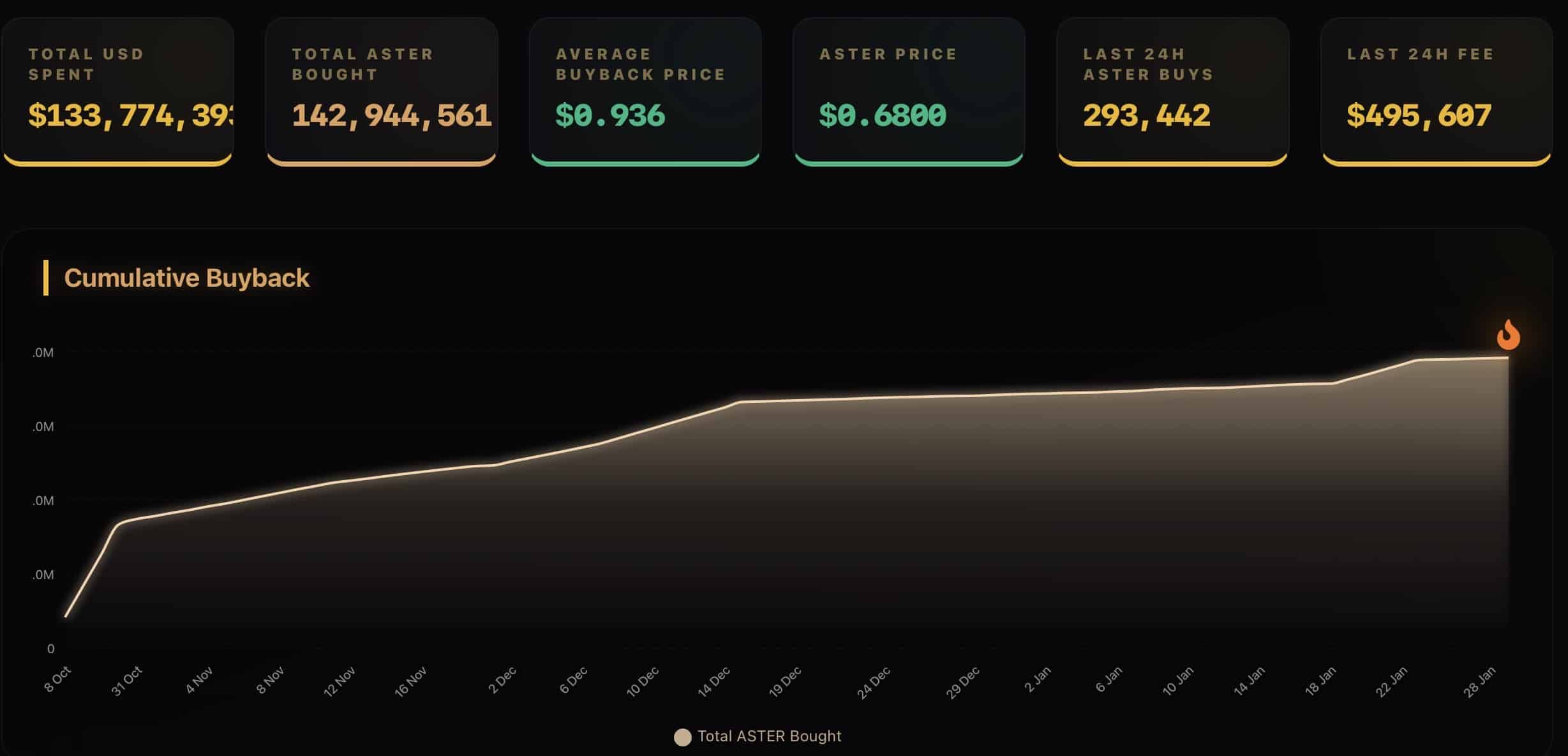

Aster kicked off a fresh phase of its buyback program on January 19, 2026, directing 20-40% of daily platform fees, rising to as much as 80% when combined with prior initiatives, straight into open-market purchases of ASTER tokens. Those tokens get permanently burned, creating steady buy pressure and shrinking circulating supply.

The team has already executed over $140 million in buybacks, destroying 209 million tokens so far, with all transactions transparent on-chain.

(Source: Asterlify)

This deflationary mechanic stands out in a sector where many projects rely on emissions or incentives alone. Recent volume surges, often exceeding $140 million daily, support the program’s effectiveness, as higher trading activity feeds directly into more repurchases.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

ASTER Price Action: Key Levels, Momentum, and Short-Term Outlook

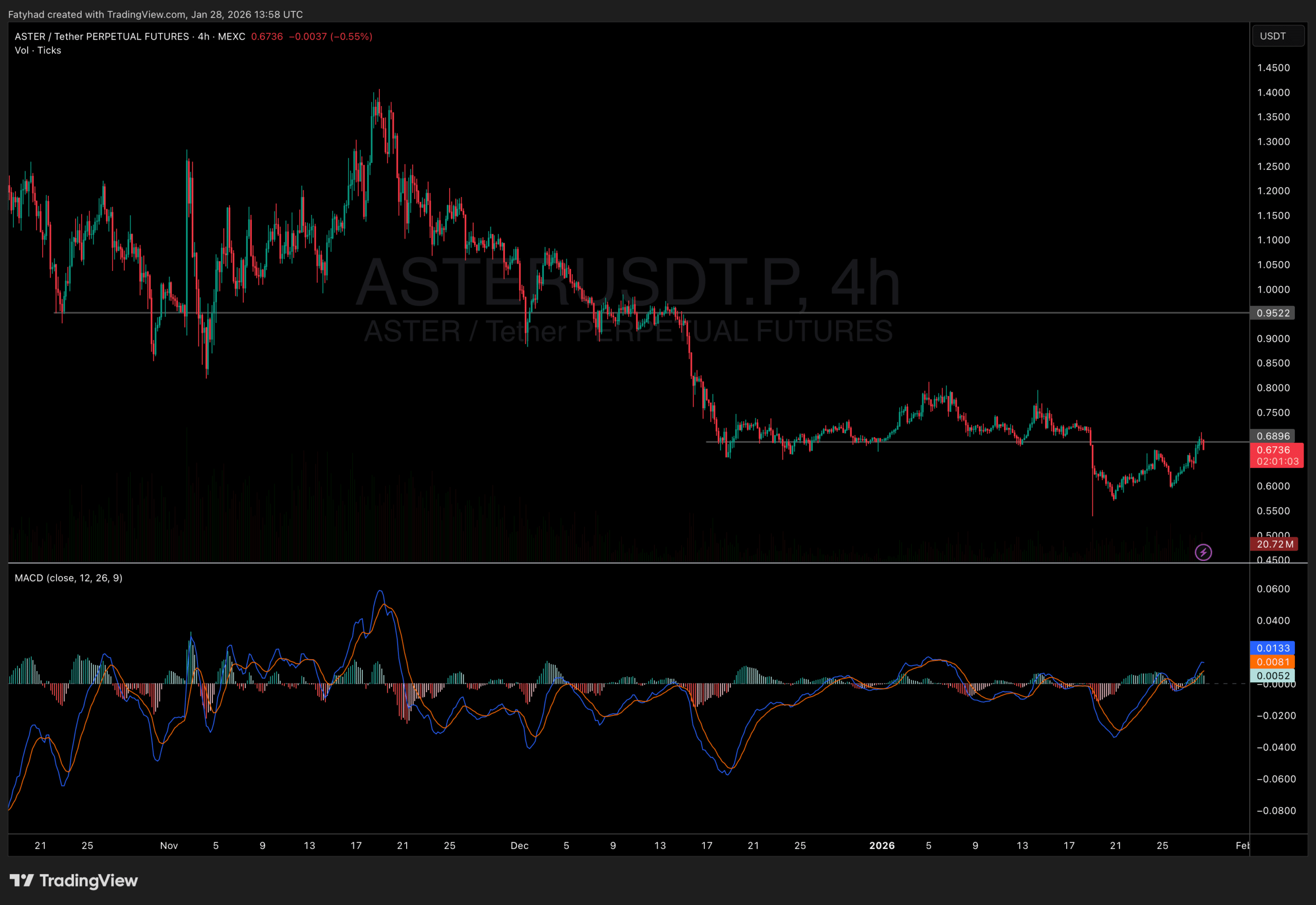

ASTER currently holds near $0.67, up slightly after dipping to lows around $0.55 earlier in January. It sits above short-term support at $0.60. Resistance at $0.69–$0.72, where profit-taking could cap gains, followed by stronger resistance near $0.90-0.95.

Momentum indicators are mixed: RSI hovers in neutral-to-oversold territory (around 43 earlier, now climbing), suggesting room for upside if volume picks up, but MACD shows fading strength, meaning fresh catalysts are needed to sustain the move.

Over the past week, the token has gained modestly, though monthly performance remains negative amid sector unlocks and increasing competition. Longer-term predictions vary, with some models eyeing $0.90–$2+ by mid-2026 if the Aster Chain L1 mainnet launches smoothly in Q1 and staking/governance rolls out in Q2.

Competition stays intense. Aster’s buyback-heavy approach sets it apart, but execution matters more than promises.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post ASTER Crypto Price Jumps on Buybacks and CZ Backing appeared first on 99Bitcoins.