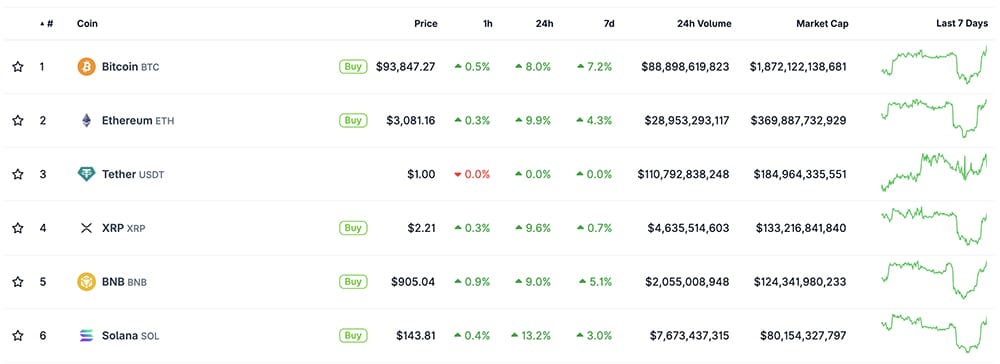

In crypto news today, the pump in BTC and ETH against USD, and the anticipation around the Fusaka upgrade are the talking points. BTC USD breaking above $93,000 and ETH USD reclaiming the $3,000 level, it almost feels like déjà vu for anyone who has lived through previous crypto cycles.

However, the tone is different this time. All four key drivers, BTC USD momentum, the behavior of ETH USD, the market’s appetite for risk, and the imminent Fusaka upgrade collided in a way that can push sentiment higher, as violent moves upward can come after yesterday’s butchery.

BTC USD Strength Pushes Crypto Into Overdrive

The biggest news catalyst hitting crypto today is coming from Bank of America, with them publicly advising clients to allocate up to 4% of their portfolios to Bitcoin and crypto.

For Bitcoin and crypto, such an endorsement from a legacy institution is massive. It adds credibility at a moment when the total crypto market cap jumped by $180 billion in a single day, while many major alts gained between 8–13%. These gains, of course, are closely related to BTC USD and ETH USD pumps.

(source – CoinGecko)

But the day also comes with ironic twists. Trader James Wynn (who has unintentionally become another Jim Cramer meme) posted a bearish take right before BTC USD reversed upward. We know Wynn has been making his way up trading in HyperLiquid before he got himself zeroed out with countless liquidations.

Relief rally (as called and expected in a downtrend/bear market)…

Bulls out in full force. Enjoy it.

– Wynn

— James Wynn (@JamesWynnReal) December 2, 2025

His call was followed by a sharp flip in momentum, underscoring yet again how unpredictable short-term sentiment can be. Moments like these remind long-term holders why simply sticking with spot positions often outperforms attempts to time volatility.

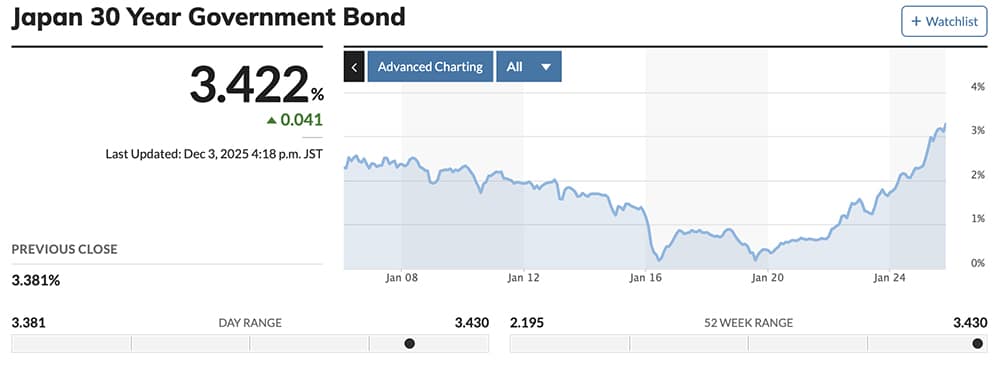

However, there are some macro forces that also crept into the picture. Japan’s 30-year bond yield hit 3.41%, its highest level ever recorded. If the Federal Reserve cuts rates while the BOJ hikes in December, the long-standing US-Japan rate gap could collapse.

(source – Marketwatch)

A strengthened yen would force the yen to carry trade, historically a setup that drains liquidity from global risk assets. The last major unwind helped form a major low in Bitcoin. If repeated, it could pressure BTC USD again, even as fundamentals strengthen.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

ETH USD Braces for the Fusaka Upgrade and Market Reversal Potential

Early today, an original Ethereum ICO participant moved and sold 23,000 ETH. ETH dipped against USD briefly, but quickly reversed, almost the same pattern seen during previous upgrade cycles.

Back in May, during the Pectra update, Ethereum chopped around before eventually pumping afterward, a trend consistent with historical “sell-the-news then recover” behavior.

(source – ETH USD, TradingView)

Tonight’s Fusaka upgrade could be even more impactful. It introduces PeerDAS, letting nodes sample only fragments of transaction data, enabling as much as an eight-fold capacity increase while lowering fees for layer-2 rollups.

Fusaka also raises the block gas limit to 60 million, and adds secure passkey support so ETH users can sign transactions via Face ID or fingerprints, no seed phrase required. For ETH, this upgrade improves scalability and boosts value accrual through increased blob-fee burns.

1/ The Fusaka upgrade is coming December 3rd.

Ethereum is securely scaling.

Are you ready to support the changes?

Here’s what developers across the ecosystem need to do to prepare

pic.twitter.com/aHArhmJWnX

— Ethereum (@ethereum) December 1, 2025

Will it strengthen it against the USD? Time will tell, but likely.

With the news talking about how strong BTC USD is and ETH USD preparing for the Fusaka upgrade, crypto, today, points toward the healthiest momentum the market has seen all year.

DISCOVER: 10+ Next Crypto to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Bitcoin Price Back Above $93K Lagging Stock and Bond Recovery: Did Vanguard Save BTC Price? Time To Go Parabolic After FOMC?

The Bitcoin price bears are multiplying. Bitcoin’s sharp November reset triggered something traders haven’t seen since early 2023: BTC USD briefly dipped below its Metcalfe network value. This level has historically marked late-stage washouts rather than fresh downtrends.

Here’s the bad news:

- No public hype outside a few desperate 40YO boomers

- NFT’s 100% dead

- SOL coins got about a month of activity after Trump won, but now they’re dead

-

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

1.40%

Bitcoin

BTC

Price

$93,170.51

1.40% /24h

Volume in 24h

$51.83B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

couldn’t pull off a 2x. It spent nearly a year hovering above 100k doing nothing

- Alts got nothing

- Ethereum holders BTFOed as always

The good news is that people like Network economist Timothy Peterson say Bitcoin’s recent price action appears only after leverage has been flushed out and speculative excess has burned off.

“While this does not necessarily signal a bottom, it does indicate that most leverage has been removed and the bubble has deflated.” – Timothy Peterson, Cane Island

Here’s what’s next for the Bitcoin price and an all-new Bitcoin-based presale that is gaining hype.

ETH USD Reclaims $3,000 Ahead of Fusaka Mainnet Launch: Another Take by Isaiah McCall

I was discussing an Ethereum price prediction here in Japan, and someone curtly said, “Yeah, also invest in some horse manure while you are at it.”

How rude! But it was nice to know I understood what they said in Japanese. Meanwhile, Ethereum’s Fusaka upgrade went live on December 3, delivering the most meaningful throughput expansion since EIP-4844.

Unfortunately, I don’t know how to say that in Japanese…

Tomorrow: Fusaka

Ethereum’s second major upgrade this year.

→ Feature highlight: PeerDAS – Unlocking up to 8x data throughput. For rollups, this means cheaper blob fees and more space to grow.

Learn more. https://t.co/3TOda5KjY2 pic.twitter.com/sEfeiTamy9

— Ethereum (@ethereum) December 2, 2025

The update is setting the stage for cheaper rollup fees heading into 2026. The fork introduces PeerDAS, doubles block gas capacity, and establishes the technical foundation for two blob-parameter expansions arriving later this month and in January.

“While not an official translation, ‘sloping side road’ reflects the playful fusion of Fulu and Osaka.” – Ethereum Editor’s Note

By allowing validators to verify blob data through sampling instead of downloading full payloads, Ethereum can begin scaling blob throughput by roughly an order of magnitude. Here’s what you need to know for the Ethereum price:

Read the full article here.

Binance Blockchain Week Starts With Pierre Gasly: Top 3 Binance Meme Coins to Buy Now?

The Binance Blockchain Week hype is back – and this year it opens with a turbo-charged burst of excitement as Formula 1 driver Pierre Gasly steps on stage. The opening day at Dubai’s Coca-Cola Arena instantly put Binance in the global spotlight, blending motorsport adrenaline with crypto innovation.

With Richard Teng, Michael Saylor, Brad Garlinghouse, and Gasly headlining, the event signals a fresh surge of retail attention — right as meme coins in the Binance ecosystem begin to heat up again. As momentum builds, three standout picks are emerging across the BNB Chain: Broccoli, 哈基米 (Hajimi), and the explosive presale phenomenon Maxi Doge.

Read the full story here.

Aave Brings Out the Knives For Low-Value Chains: Are zkSync Crypto, METIS Price and Sony’s Soneium Really Cooked?

The crypto conversation around Aave chain crosshair on zkSync, Metis, and Solenium has taken a sharp turn this week. What was once just another governance check suddenly turns into a line in the sand as Aave chain decided that it is no longer interested in spreading itself thin across networks. Especially those that aren’t pulling their weight.

Following the decision, zkSync, Metis, and Solenium fall well below the proposed threshold of $2 million in annual revenue needed for continued crypto support.

Numbers from recent reports show zkSync is at around $20,000 annualized revenue, Metis barely cracking $3,000, and Solenium around $52,000, microscopic when held up against Ethereum’s $142 million in its crypto revenue. It’s obvious why people inside the Aave chain ecosystem are calling these deployments “dead weight.”

Read the full story here.

Hottest Meme Coins Rise From Ashes of Crypto Crash: BRETT, PENGU, MAXI, BUILDon, PEPENODE

The hottest meme coins are rising again after one of the sharpest crypto crashes of late 2025. Bitcoin fell from $93K to under $84K during the December 1 liquidation storm, vaporizing more than $200Bn in market value as high-leverage positions were flushed and back to $93K today.

But in classic meme-coin fashion, the sector is now showing early signs of life. Tokens like BRETT, PENGU, and BUILDon are bouncing back with renewed strength, each backed by strong narratives, bullish technical setups, and significant community momentum heading into December.

Read the full story here.

The post Crypto Market News Today, December 3: Holy Moly!! Crypto is Back as BTC USD Blasts $93K, ETH Back Above $3K with Fusaka Upgrade Looming appeared first on 99Bitcoins.