Crypto news today is just bullish. The Federal Reserve just injected billions into the system, and the Bitcoin price jumped past $94,000 subsequently. In fact, the crypto market added more than $260 billion in just under the first week of 2026. It’s been a while since we’ve seen global liquidity expand this fast, and we, who are noticing, should be ready.

The Fed’s $74.6 billion repo injections eased funding pressure across markets, which boosted risk assets like crypto, and eventually sent Bitcoin to hold strong above key price levels. And with Bitcoin dominance slipping below 60%, altcoins are starting to see some action too.

Honestly, I feel bullish myself, and for me, altcoin season might be on the horizon.

BREAKING:

FEDERAL RESERVE TO INJECT $8.16 BILLION IN LIQUIDITY TODAY. pic.twitter.com/lLwrUS2s0Y

— STEPH IS CRYPTO (@Steph_iscrypto) January 6, 2026

Federal Reserve Driving Bitcoin Price?

Number-wise, BlackRock’s Bitcoin ETF pulled in $287 million, the biggest inflow in 3 months, while total spot funds added $471 million. Bitcoin price itself has been holding above the Bollinger Bands, which usually signals a possible pause after a big rally, though the momentum is still there.

On the other hand, Tom Lee is sticking with his $250,000 Bitcoin price target for 2026, pointing to historical cycles and whale accumulation. And sure, Bitcoin could dip toward $90,000 before climbing back toward $100,000, but that’s just part of the game. Crypto news today is showing that the Federal Reserve isn’t just nudging Bitcoin price as it sets the stage for what could be months of market movement.

JUST IN: Tom Lee says #Bitcoin could reach $250,000 in 2026 if the 4-year cycle breaks

pic.twitter.com/Zr7ca45NOn

— Bitcoin Magazine (@BitcoinMagazine) January 5, 2026

DISCOVER: 10+ Next Crypto to 100X In 2026

Altcoins Step Up as Bitcoin Holds

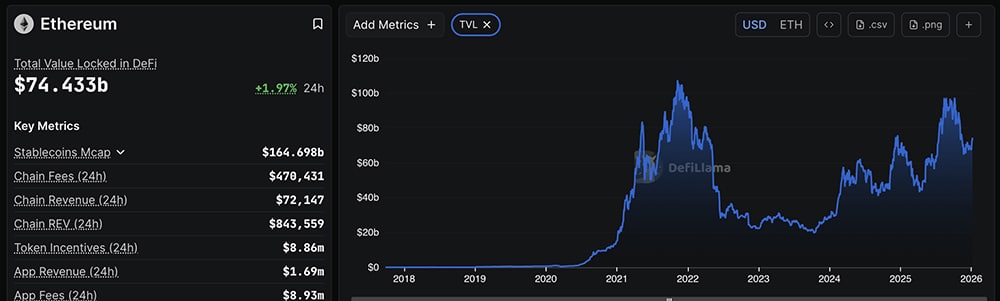

With Bitcoin price steady, altcoins are getting their bullish moment. Ethereum’s total value locked (TVL) is now at $74 billion, with DeFi and stablecoins thriving, and a hit of $8 trillion is stablecoin transfer. Validator exit queues are down to 32 ETH, the lowest since last summer.

(source – Defillama)

While Vitalik Buterin keeps reminding everyone that Ethereum prioritizes resilience over speed, which seems to reassure investors, Ethereum is just bullish. Because when Ethereum starts moving, most altcoins will follow.

Ethereum was not created to make finance efficient or apps convenient. It was created to set people free” – Vitalik Buterin

In the end, the Federal Reserve liquidity push is not just about Bitcoin, and it is not about price. Although the $260 billion in new capital is helping altcoins. Crypto news today is maybe is suggesting that 2026 could be a year where the market moves in tandem. Bitcoin usually leads, but altcoins follow with bigger gains.

This is what we live for. Decentralisation is king or will be king. It is not a matter of if, but when.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

There are no live updates available yet. Please check back soon!

The post Crypto Market News Today, January 6: Bitcoin Price Hits $94,000 as Federal Reserve Pumps Liquidity appeared first on 99Bitcoins.