In today’s crypto market news, there’s a weird and interesting blend of signals coming from the institutional space, especially with BlackRock, JP Morgan, and a series of new Russia crypto policy changes all landing at once.

BlackRock and Fidelity keep grocery shopping Bitcoin during a sale. JP Morgan is suddenly speaking about crypto as if it’s part of the traditional macro tool kit, and Russia is loosening the screws on access to crypto-linked products. All of that together paints a far different picture than what most people expected even a few months ago.

JPMORGAN: "CRYPTO IS MOVING AWAY FROM RESEMBLING A VC STYLE ECOSYSTEM TO A TYPICAL TRADABLE MACRO ASSET CLASS SUPPORTED BY INSTITUTIONAL LIQUIDITY RATHER THAN RETAIL SPECULATION."

— The Wolf Of All Streets (@scottmelker) November 26, 2025

Blackrock and Fidelity Continue Their Crypto Buying Spree, JP Morgan and Its Macro Argument, and Russia Crypto Expansion

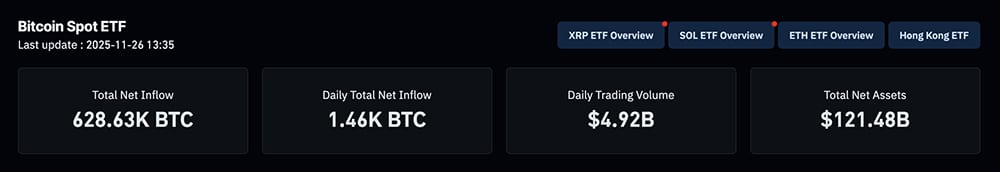

The most bullish news today comes from BlackRock crypto flows into the IBIT ETF, which haven’t slowed down at all. During the little wobble in Bitcoin’s price, they have just kept buying.

Fidelity’s FBTC inflows look similarly steady, stubborn, and reassuring, as they are coming from institutional behavior. It has now become a running theme in this week’s crypto market news that these firms aren’t waiting for the perfect entries. They’re averaging in and becoming long-term investors instead of dip hunters.

(source – CoinGlass)

The one eyebrow raiser today comes from JP Morgan crypto analysts. They’re now openly calling Bitcoin and other cryptos tradable macro instruments, on the same table as bonds or foreign exchange. Just a few years ago, this same idea would’ve been laughed off TV. Now it’s showing up in actual portfolio strategy notes. It’s yet another reminder that the line between crypto and traditional finance is dissolving.

Meanwhile, Russia crypto rules are shifting in a surprisingly inclusive direction. The old “super-qualified investor” label is basically being retired. Instead, Russia is rolling out tiered access depending on someone’s experience level. That means a far larger chunk of the population can buy crypto-linked and related assets without jumping through hoops. These moves matter more than people think, especially for global adoption.

RUSSIA EXPANDS OPTIONS FOR INVESTMENTS IN CRYPTO-LINKED ASSETS

— *Walter Bloomberg (@DeItaone) November 25, 2025

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

ETH Support Holds While Total3 Starts Turning Up

Moving to alts, Ethereum has held its support above $2,900 after shaky weeks. Is this the start of a capital rotation event? The Total3 altcoin market cap without BTC and ETH has started curling upward again, giving us a classic early altseason.

(source – Total3, TradingView)

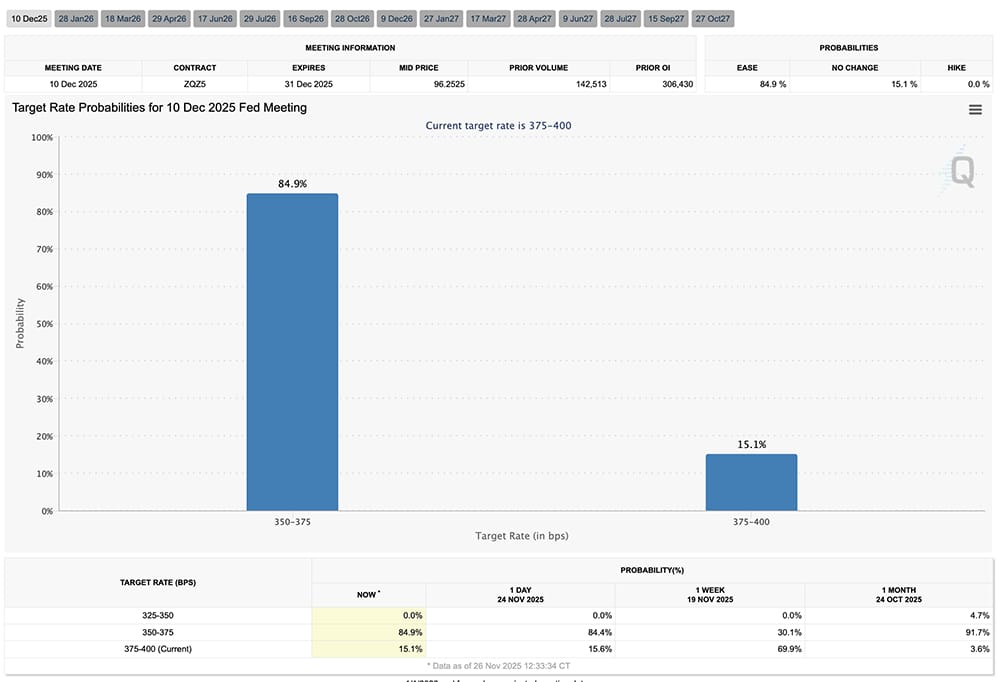

Rate cut odds for December rocketed from 27% to 85% in a matter of days, basically a firehose of liquidity for risk assets. And Polymarket getting its CFTC approval adds yet another door for mainstream participation.

(source – CME FedWatch)

Across the web3 space, BlackRock, JP Morgan, and Russia crypto developments are lining up in a bullish way. If you are bearish, start thinking to shapeshift into a bull.

DISCOVER: 10+ Next Crypto to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Will Bitcoin Price Hodl Support? BTC USD Price Prediction, 3 Reasons Why The Crypto Market is Crashing Explained

The question dominating trader sentiment today is simple: why is the crypto market crashing, and whether Bitcoin can hold the line after a brutal multi-week correction. As of late November 2025, BTC USD has dropped from its $126,000 ATH to lows near $80K, wiping out more than $600Bn in market value.

With the BTC price currently hovering around $87K, Bitcoin crypto sentiment has swung into extreme fear, and traders are anxiously debating whether this significant support will hold or whether a deeper downturn is coming.

Read the full story here.

HIP-3 Is The Future of Finance: Everything to Know, Hyperliquid Price Prediction December 2025, Will SBET List on HIP-3?

The conversation around Hyperliquid’s price and its rapidly expanding ecosystem has completely changed since the rollout of the HIP-3 upgrade. This transformative upgrade turns Hyperliquid from a single-perpetuals exchange into a fully decentralized, permissionless “exchange-of-exchanges”.

With new markets launching daily, trading fees slashed by over 90%, and builders pouring into the ecosystem, HIP-3 is being described as a pivotal shift toward the future of on-chain finance. This article breaks down what HIP-3 is, why it matters, where Hyperliquid may be heading in December 2025, and whether SBET could eventually list on the new system.

Read the full story here.

The post Crypto Market News Today, November 26: BlackRock and Fidelity Keep Buying Bitcoin, JP Morgan Bullish, Russia Tapping on Crypto as Total3 Reverse appeared first on 99Bitcoins.