It seems crypto adoption is on the rise again, as we enter 2026. The Ethereum price jumped above the $3,200 mark, following the announcement that Jeff Bezos’ space company, Blue Origin, will start accepting ETH and other cryptocurrencies for space tourism payments.

Traders framed the move as another real-world use case for ETH, supporting price action after a choppy start to the year. It fits a bigger story where major brands now treat crypto not just as a bet, but as a payment option for high-ticket experiences.

DISCOVER: Best Meme Coin ICOs to Invest in 2026

What Exactly Did Blue Origin Do, and Why Does ETH Matter Here?

Blue Origin, the space travel firm founded by Amazon’s Jeff Bezos, now accepts Ethereum (ETH), Bitcoin (BTC), Solana (SOL), and the stablecoins USDT and USDC for its New Shepard suborbital flights. The company plugged crypto into its checkout system through a partnership with Shift4, a public payments processor listed on the NYSE.

JUST IN:

Jeff Bezos' Blue Origin now accepts Ethereum for trips to space, per report.

Going to space boys

— MrBanks

(@Mrbankstips) January 4, 2026

Think of Shift4 as the “card machine” in a fancy store, except it also understands crypto. Blue Origin routes payments through providers like Coinbase and MetaMask, so a customer can send ETH from a wallet instead of wiring fiat.

This marks the first time any Bezos-owned company accepts crypto directly, which sends a message to institutions that still sit on the fence.

For context on Ethereum’s growing role in payments, we recently covered how huge stablecoin transfers on Ethereum helped drive activity across the network in 2025; you can read more in our piece on Ethereum stablecoin transfers.

Blue Origin now sits on the same narrative track: high-value, global payments settling on Ethereum rails instead of old banking wires.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

How Does a Space Company Accepting ETH Affect Regular Investors?

Neither you nor I is probably going to book a $200,000+ space flight tomorrow. But the signal matters. When a high-profile brand accepts ETH for something this expensive, it tells other luxury and travel businesses that crypto payments are not just a gimmick. It turns the question from “if” to “when”.

Blue Origin competes with players like SpaceX, which holds Bitcoin on its balance sheet but still takes traditional payments only. Blue Origin did not just buy ETH; it decided to accept it from the public. That step matters more for you because it directly affects how easy it becomes to spend and move crypto in the real world.

A look back at 2025. The milestones, the mission, and the momentum. pic.twitter.com/chZ5iNJm9s

— Blue Origin (@blueorigin) December 31, 2025

When more merchants accept ETH, they create organic demand from people who want to pay with it. That demand adds a new layer on top of traders and speculators.

Is This Bullish Signal Enough To Change Ethereum’s Long-Term Story?

News like this acts more like a vote of confidence than a full rewrite of ETH’s value. One space company accepting Ethereum will not double the price by itself. But it stacks on top of other adoption milestones: stablecoin flows, DeFi growth, and institutional positions in ETH futures and spot markets.

Blue Origin plans to expand beyond New Shepard flights into bigger projects like New Glenn and lunar missions.

If crypto payments remain in place for those programs, ETH and other supported coins become part of a long-term payment stack for a new industry, space tourism and commercial space services.

On the flip side, price still reacts more to market structure events, like options expiries and macro data, than any single merchant integration. We recently covered how a large options expiry added pressure around key ETH levels in our article on the Ethereum Options market.

Space news gives a narrative boost, but derivatives and liquidity still drive the short-term chart.

What Ere The Risks And How Should Beginners Treat This News?

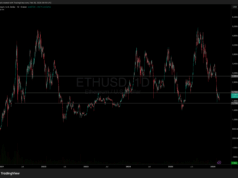

(Source: ETHUSD / TradingView)

This is not a signal to FOMO into ETH because “space travel accepts it now.” Crypto stays volatile.

Ethereum can move hundreds of dollars in a week. If you buy, treat ETH as a long-term, high-risk asset and never use money you need for rent, debt payments, or emergencies.

For you as a beginner, the healthy takeaway is simple: watch adoption stories like this as confirmation that Ethereum keeps finding real-world niches. Use that as one ingredient, alongside your risk tolerance, time horizon, and portfolio mix, when you decide how large your ETH position should be.

As Blue Origin pushes crypto payments beyond Earth’s atmosphere, Ethereum’s real test stays grounded: can it keep winning merchant trust, developer attention, and user activity during the next market cycle?

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Ethereum Surges Past $3.2K as Blue Origin Accepts ETH appeared first on 99Bitcoins.