Grayscale has just paid out Ethereum staking rewards to U.S. ETF holders for the first time, transforming its ETHE fund into a yield-generating crypto product. The fund distributed $0.083178 per share from Q4 2025 staking income.

This fits a bigger shift where crypto ETFs are no longer just “price trackers” but start to behave more like income products for mainstream investors.

DISCOVER: Best Meme Coin ICOs to Invest in 2026

What Does Grayscale’s ETH Staking Payout Actually Mean for Beginners?

First, quick translation. “Staking” is like earning interest at a bank, but for crypto. You lock your ETH to help secure the network and, in return, you earn rewards paid out in ETH. Personally, I enjoy staking.

Until now, U.S. investors who bought Ethereum ETFs got price exposure only. No yield. On October 6, 2025, Grayscale added staking to its Ethereum products, and ETHE has now passed those rewards through to investors for the first time, as reported by Connor Sephton.

That $0.083178 per share might look small, but the real story is access: you earn staking rewards without running your own validator or touching a DeFi protocol. If I hated the crypto ecosystem but loved the gains, I would like it.

Today, Grayscale Ethereum Staking ETF (Ticker: $ETHE) became the first U.S. Ethereum ETP to distribute staking rewards back to investors.

Note: $ETHE is trading ex-dividend today as of the open.

Read the press release: https://t.co/oDOSk9B2pG

— Grayscale (@Grayscale) January 5, 2026

Grayscale manages billions in ETH exposure and almost half of all U.S. Ethereum ETP assets. So when Grayscale changes how it treats staking, it doesn’t just tweak one product. It nudges the whole market toward yield-paying Ethereum exposure that feels more familiar to stock and bond investors.

If you want more big-picture Ethereum context, we recently covered record on-chain activity in our piece on Ethereum stablecoin transfers. When you combine rising usage with easy access to staking yield, you get a clearer story for why many long-term investors care about ETH beyond short-term price moves.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

How Could ETH Staking ETFs Change Crypto Investing?

Think of a regular spot ETF as a glass window. You can see the asset price, but you never touch the underlying thing. A staking ETF turns that window into a window plus a small dividend stream. You still don’t custody ETH yourself, but now your shares reflect some of the yield that on-chain stakers earn.

Competition is heating up fast. REX‑Osprey’s ESK ETF offers ETH plus staking with monthly distributions, and Bitwise already launched a yield-focused altcoin product with its Solana ETF.

When issuers compete on yield and fees, investors often get better products, but risk also spreads to a wider audience who may not fully understand what “staking risk” means.

ETH staking exit queue is basically empty

No one wants to sell their staked ETH

But all analytics are quiet pic.twitter.com/TzTzpEemKO

— rostyk.eth (@rostyketh) January 5, 2026

For ETH itself, these products can quietly increase demand. Big funds and advisors who will never run a staking setup at home now have a compliance-friendly way to earn yield from ETH. That matches a trend we already see in institutional Ethereum interest, like growing institutional ETH accumulation.

More locked ETH and more long-term holders usually mean less sell pressure in calm markets.

For you as a beginner, the practical shift is simple: “Ethereum in my brokerage account” no longer has to mean “no yield.” You can now buy a ticker like ETHE and get both price exposure and a trickle of staking income, similar to holding a dividend stock or a bond ETF.

What Are the Risks Behind “Safe” Staking ETFs?

This all sounds like free money, but it isn’t. When a fund stakes ETH, it takes on extra risks beyond just holding ETH in cold storage. Slashing (penalties if validators misbehave), smart contract bugs in third‑party staking services, and legal changes around staking rewards all matter, even if you never see the technical details.

There is another trade‑off. Many staking ETFs charge higher fees to manage the staking process and keep part of the rewards. So while you earn yield, you usually earn less than someone who stakes ETH directly. You pay with a lower return in exchange for simplicity and regulation.

Also, remember: the ETF wrapper does not protect you from ETH price swings. If ETH drops 40%, a few dollars of staking income will not save your portfolio. Treat staking yield as a bonus on top of a very volatile asset, not as a replacement for an emergency fund or a savings account.

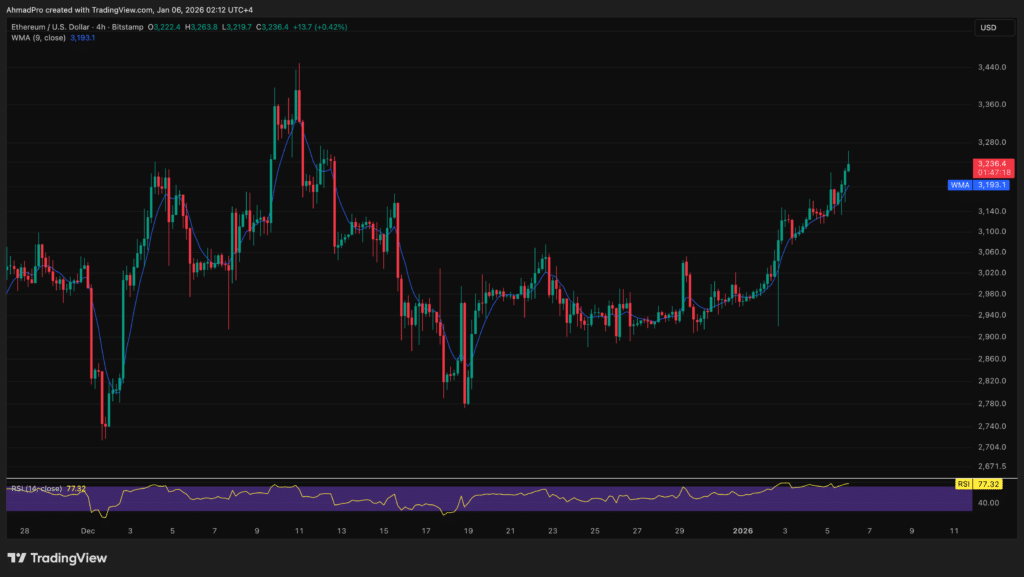

(Source: ETHUSD / TradingView)

So how do you act on this? If you already wanted ETH exposure in a regular brokerage account and you understand the price risk, then a staking ETF can be a smarter version of what you planned to buy anyway. If you feel tempted to buy just because of the word “yield,” step back, review our coverage of broader Ethereum market dynamics, and never move money you need for rent or debt payments into ETH or any staking product.

As more issuers roll out yield-bearing crypto ETFs, expect a steady race to add staking to more coins and more funds; your edge will come from understanding that yield always rides on top of real risk, not instead of it.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Grayscale Starts ETH Staking Payouts, Pushing ETFs Into Yield Era appeared first on 99Bitcoins.