The MSM has absolutely no coverage of precious metal price appreciation and the insane silver price run-up in 2026. The economy is blowing up in real time and they’re not even telling you about it.

I assume everyone else has been frantically stacking silver since the pandemic, right? At this point it is significantly outperforming BTC.

Silver is no longer trailing gold but leading the entire commodities parabolic price action. Prices surged into the $90s-$110 range this month, capping a historic run that has now delivered roughly 53% gains year-to-date in 2026, on top of a 50% rally in 2025.

Less than nine months ago, silver traded near $33. The move since then has been vertical. Here’s what you need to know if the silver price will outperform BTC.

DISCOVER: 20+ Next Crypto to Explode in 2026

Why Is Silver Price Pumping? Industrial Demand Is Driving a Physical Supply Squeeze

Unlike gold, silver’s rally is being powered by industrial necessity. Data compiled by the Silver Institute shows industrial consumption hit roughly 680 Mn ounces in 2024, accounting for nearly 60% of total global demand.

Energy transition demand for AI, tech and all the shiny new EVs that Elon Musk is bragging about are doing most of the heavy lifting:

- Solar PV installations are projected to reach ~665 GW in 2026, consuming an estimated 120–125 Mn ounces.

- Electric vehicle output is forecast at 14–15 Mn units, adding another 70–75 Mn ounces.

- Grid upgrades and data center expansion contribute an additional 15–20 Mn ounces.

“Silver breaking through $100 is not a normal correction. This is a physical short squeeze that overtook forecasts by years,” said market analyst Bartoszek.

Meanwhile, mine supply has stagnated. Global production peaked around 2016 and has been drifting lower since.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2026

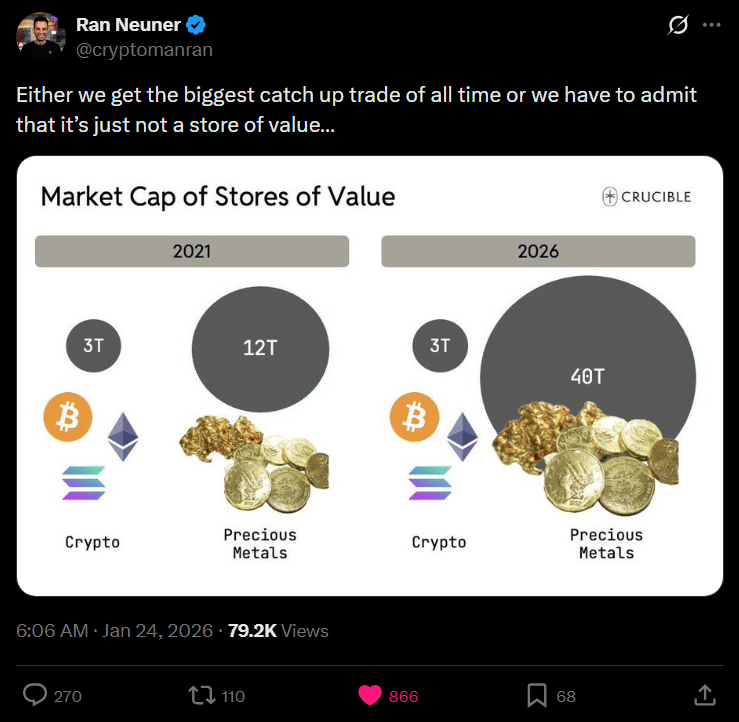

Crypto Weakness Highlights Capital Rotation Into Hard Assets

From a technical standpoint, silver has decisively cleared the $100 psychological level and closed above it, turning former resistance into support. The 200-day EMA, still near $52, highlights how extended and powerful this move has been.

99Bitcoins analysts are now floating upside targets between $200 and $375, based on historical log-scale breakouts.

The gold-silver ratio has collapsed from roughly 120:1 in April 2025 to about 46:1 today, its lowest level since 2011. Historically, sustained ratio compression has coincided with silver outperforming late-cycle commodities and risk assets alike.

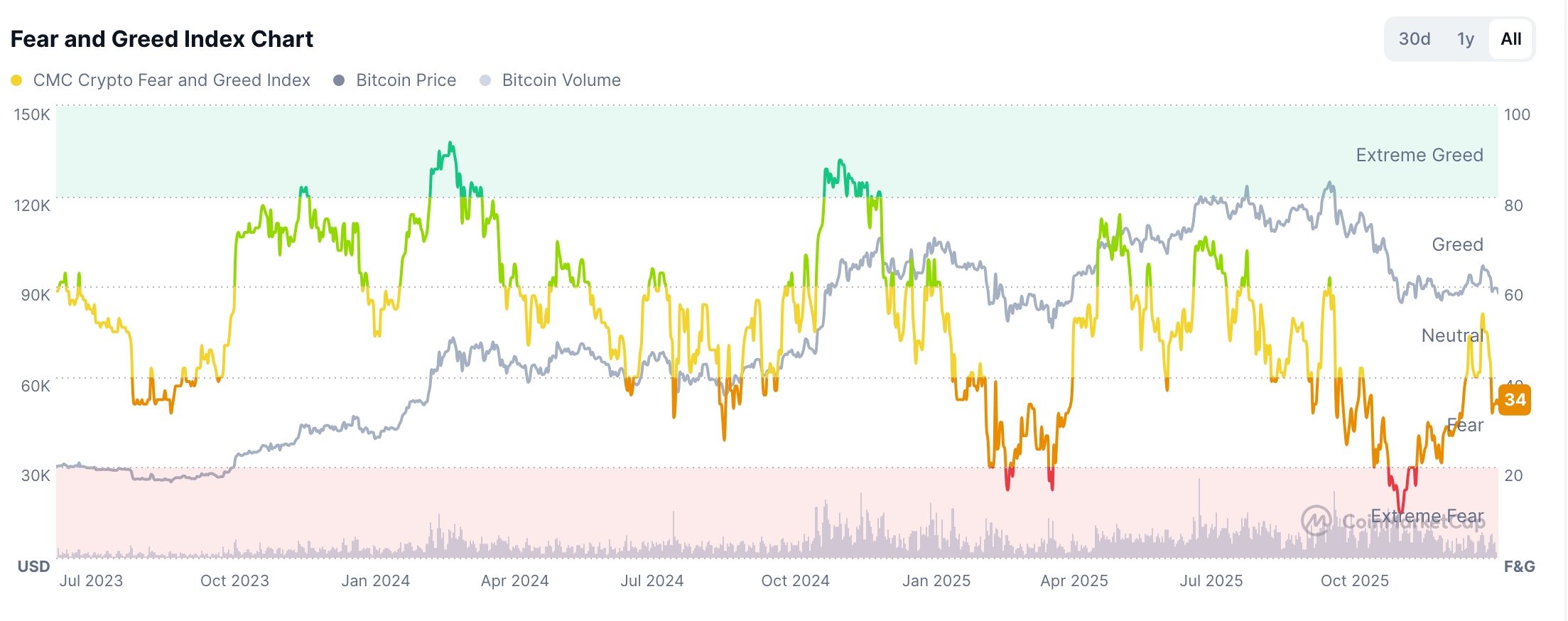

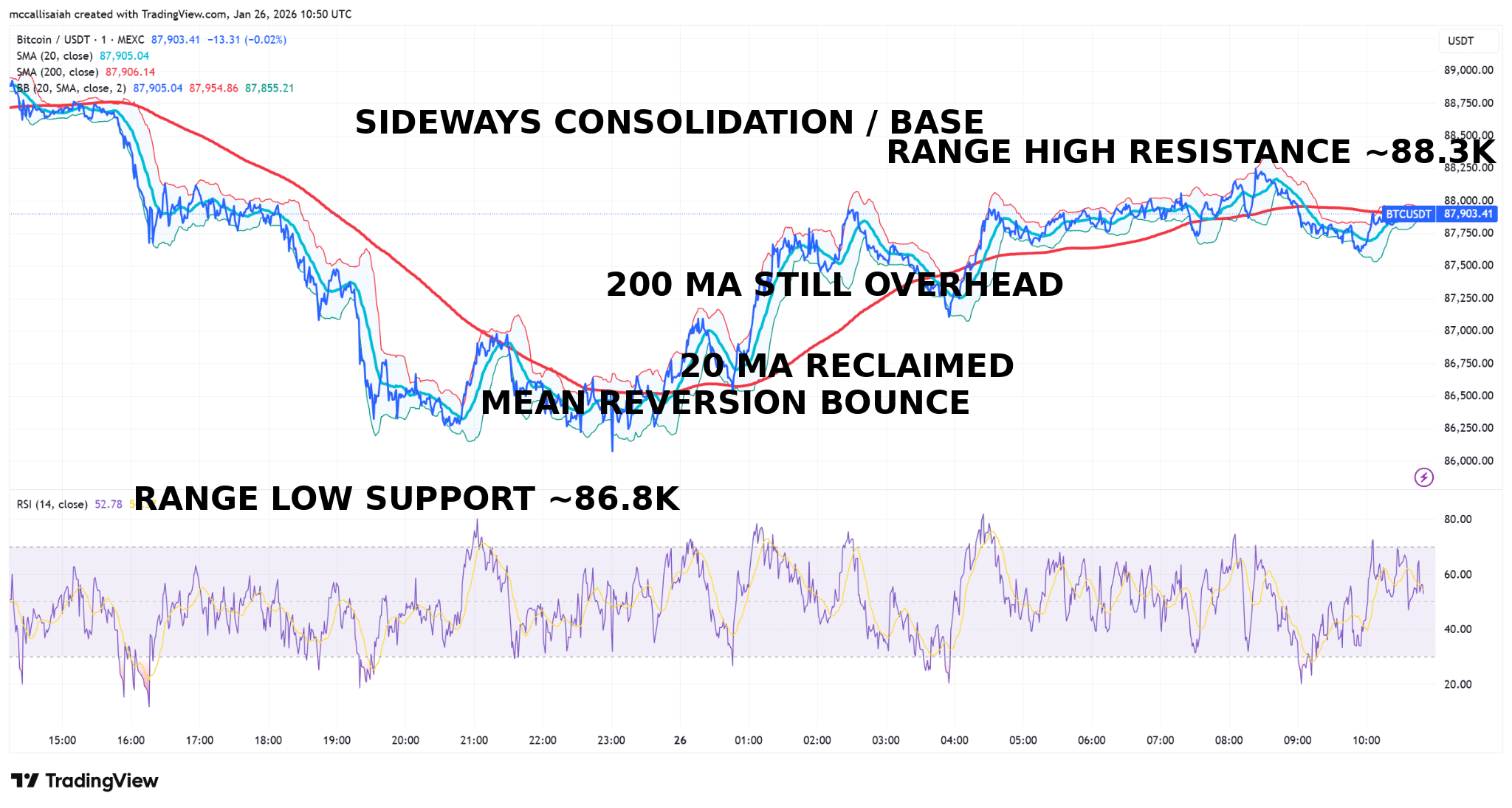

While silver and gold hit record highs, crypto bleeds out. Bitcoin dropped under $88,000, Ethereum fell toward $2,800, total market cap sank below $3 Tn. The Fear and Greed Index sits at 34-deep in panic mode.

ETF flows confirm it with Bitcoin funds shedding over $1 Bn year-to-date while gold and silver ETFs pulled in billions. When liquidity dries up and narratives collapse, hard assets win.

Speaking as a long time silver stacker, many of the loudest silver investors are tourists here. They FOMO’d in at $55 and think they’re Ray Dalio. Real OG’s remember when Bitcoin lagged behind Gold’s 2020 rally, and started going up 7 months later, giga pumped 3 times harder and longer.

It might not seem like it now but that scenario is still likely to play out.

EXPLORE: King of The Decade? Analyst says Bitcoin Price Returns Will Beat Gold and Silver

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

Key Takeaways

- The BTC USD pair and US dollar, in general, is getting cooked. We are beginning to see hyperinflation.

- The MSM has absolutely no coverage of precious metal price appreciation and the insane silver price run-up in 2026. The economy is blowing up.

The post Silver Price Vs BTC USD: Which Is a Better Investment in 2026? appeared first on 99Bitcoins.