Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Solana shows mixed signals as TVL tops $11b, while fintech newcomer Digitap surges past $1m in presale.

Summary

- Digitap’s presale surges past $1m as its token doubles; investors eye its crypto-powered banking platform.

- Digitap merges crypto and traditional finance with a Visa card, enabling instant, low-cost global payments.

- Audited by SolidProof and Coinsult, Digitap’s fast-growing presale reflects strong trust in its fintech vision.

Solana’s (SOL) price action and underlying metrics are telling a mixed story. On one hand, the price action shows a lower high (i.e., failing to reclaim prior peak levels), yet its on-chain fundamentals remain solid. Notably, the network’s total value locked (TVL) remains solidly above $10 billion at $11.06 billion.

Meanwhile, Digitap (TAP), an emerging fintech-focused owner and operator of the world’s first “omni-bank,” is gaining in value during its presale round while smashing key metrics. Recently, Digitap surpassed the $1 million raised mark much faster than expected.

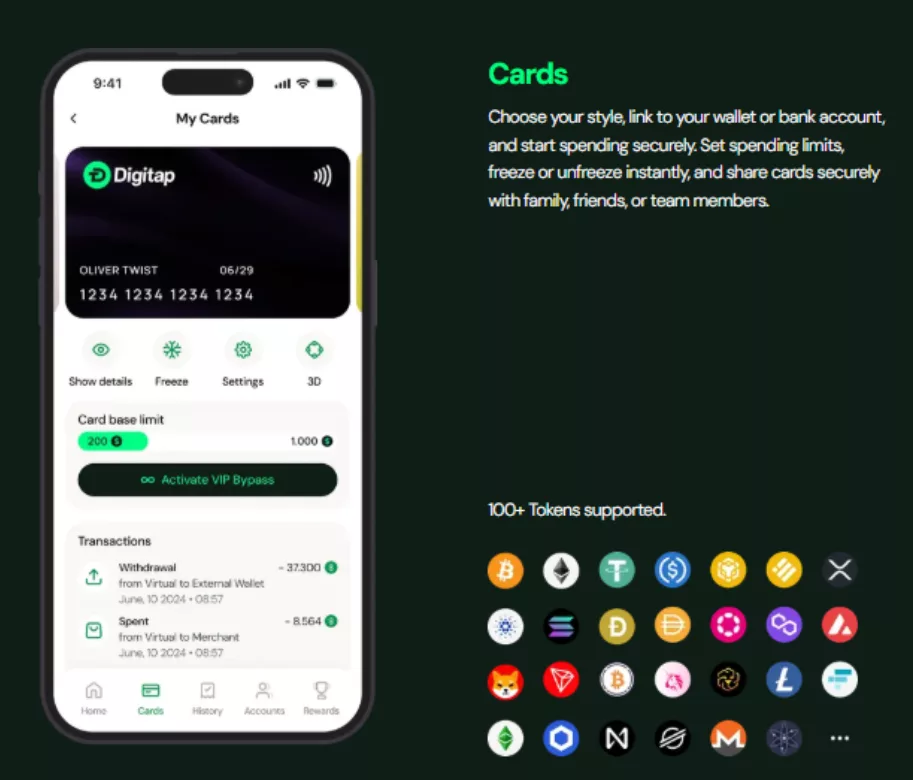

Use Digitap’s Visa card to spend crypto like cash

Digitap is a fintech platform built on crypto rails. Its goal is to provide users with a single banking app that merges traditional banking with crypto services. This means that a fiat bank account, a crypto wallet, and a Visa-branded payment card all blend together in one application.

Digitap’s strategy focuses on real-world financial utility. It lets users spend crypto as easily as cash and send money across borders. An optional no-KYC sign-up process offers basic features to the more than one billion people worldwide who lack access to banking and reside in areas where identification is difficult to obtain.

The team behind Digitap is on a noble mission to disrupt legacy financial players. For example, remitting money to friends and family costs, on average, 6.2% and takes several days.

Transfers on Digitap cost under 1% and settle within minutes, if not seconds. Once the receiver receives the money, it can be spent immediately through the integrated Visa card, which works everywhere a Visa card is accepted.

Early raise tops $1m as token doubles and rounds accelerate

Digitap is in its early fundraising phase. The seven-digit raise is an unusually strong start for a new altcoin, suggesting that investors see promise in Digitap’s use case. Case in point: the token has doubled in value from the first-round selling price of $0.0125 to $0.0268.

Due to strong investor demand, the next-round price of $0.0297 is scheduled for next week. Prior rounds required three to four weeks to complete, but a snowball effect is speeding up the stages to one to two weeks.

The key to Digitap’s early success lies in the product itself. Prospective investors can download the live banking app and see for themselves if it delivers on its claims. Once confident in the app’s capabilities, the decision to buy this hidden crypto gem is a bit easier.

The project has been audited by SolidProof and Coinsult, which examined the smart contracts and other key features vital to users. Additionally, only 1% of the token’s 2 billion total supply is allocated to Digitap’s team, suggesting that management is very bullish long-term on Digitap’s ability to generate revenue and grow.

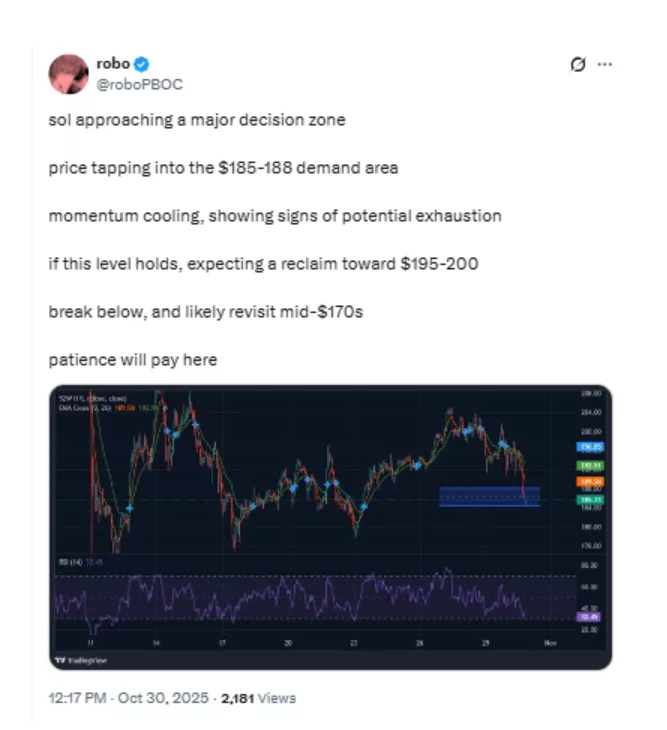

Solana’s metrics surge, but price keeps setting lower highs

Unlike Digitap, which is recording new highs and impressing investors with strong metrics, Solana is flashing mixed signals. Solana’s fundamentals suggest a robust and growing ecosystem, yet investors clearly aren’t convinced.

Solana’s TVL was under $1 billion just a few years ago, but now remains near record highs at around $11 billion. This makes it clear that many users trust Solana’s ecosystem with significant capital. Third-quarter transactions per day totaled more than 93 million, indicating the high-performance blockchain boasts massive scale.

Meanwhile, a new Solana ETF was launched in Hong Kong, giving Asian investors direct exposure to Solana. In the U.S., a Bitwise ETF stakes SOL to earn around a 7% return. Institutional buying activity from Solana treasury companies remains robust, with firms dedicating billions of dollars to future SOL purchases.

The end result? A series of lower highs for Solana as it drifts further away from the elusive $200 level, and a chart that doesn’t scream confidence.

Digitap momentum builds; Solana’s progress faces price drag

Digitap’s momentum is driven by a record-breaking presale, backed by its real-world utility. This showcases that even new crypto projects shouldn’t be overlooked by investors who are distracted by following the top-10 coins by market cap.

Meanwhile, Solana’s weak recent trading action shouldn’t diminish its fundamental progress. The fact is, Solana’s fundamentals confirm the blockchain’s mainstream relevance. However, investors are speaking with their wallets.

Solana is an established player that has already rewarded long-term investors with a lifetime return of 22,000%. This implies the upside potential is modest at best, even with convincing metrics.

Digitap, on the other hand, is the young upstart crypto project where early investors are up just 100%. Digitap has proven its potential in the presale and could deliver Solana-like returns over the long term, making it one of the best ICO presales.

To learn more about Digitap, visit its presale, website, and socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.