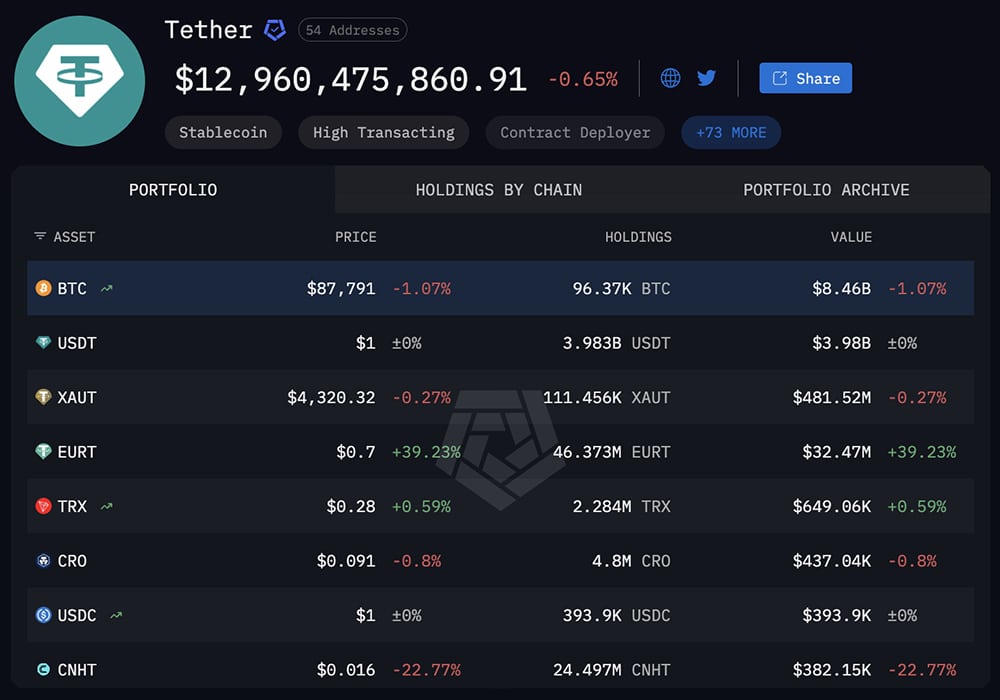

Mama! Tether is at it again; they have bought 8,888 more BTC. This happened while Bitcoin traded in a tight range after the news, as we weighed the bullish signal of more institutional buying against worries about stablecoin risk. This comes while regulators and rating agencies increase scrutiny on stablecoins and their backing.

Tether acquired 8,888.8888888 BTC in Q4 2025.https://t.co/vMh1uzv1wO

— Paolo Ardoino

(@paoloardoino) December 31, 2025

What Does Tether Buying More Bitcoin Actually Mean?

Tether issues USDT, the largest stablecoin, which tracks $1 the way a casino chip tracks a dollar at the cage. You use the chip to play, but you trust that the casino keeps enough real cash in the back. In crypto, USDT plays that role on exchanges.

Since 2023, Tether has followed a policy of sending about 15% of its profits into Bitcoin, with regular purchases of roughly 8,888 BTC a quarter. Their stack grew to over 92,000 BTC earlier in 2025, and a later addition of 8,889 BTC in Q4 pushed total BTC reserves to around $9.7 billion.

Tether now holds Bitcoin as about 5.6% of its total reserves, more than $8 billion of its $12 billion total crypto holding. That slice adds upside if Bitcoin runs higher, but it also means a chunk of the “$1 tokens” people use every day depends on a volatile asset.

(source – Arkham)

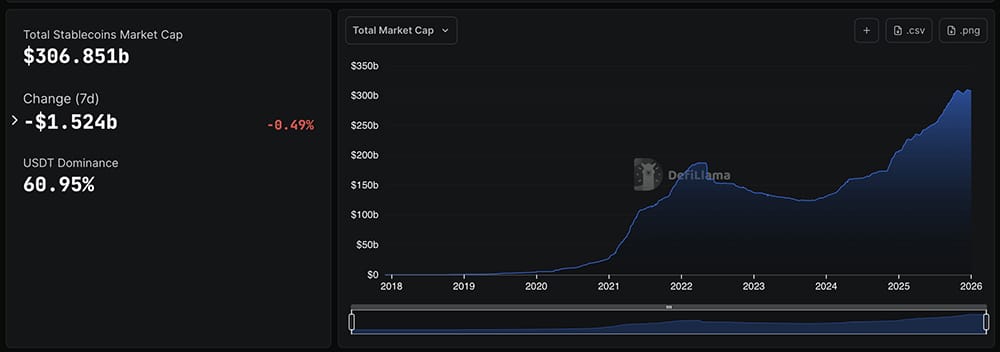

Why does this matter to us? Because Tether controls about 61% of the global stablecoin market and more than $185 billion USDT circulates worldwide, processing over $500 billion a month in transfers. If you trade on a big exchange, chances are you already use USDT, even if you never think about Tether’s balance sheet.

If you want to see how large players behave when they build big Bitcoin positions, you can compare this to earlier Bitcoin whale accumulation cycles and other cases of institutional BTC accumulation.

(source – Defillama)

DISCOVER: 10+ Next Crypto to 100X In 2026

How Could Tether’s BTC Bet Impact Our Crypto Risk?

On the bullish side, Tether keeps removing large chunks of BTC from the market and locking them away in reserves. Less liquid Bitcoin on exchanges often helps long-term holders because it reduces the available supply when new demand shows up.

Every time a major player accumulates BTC, it also sends a narrative signal: “We treat Bitcoin as a reserve asset.” That can attract more institutions, similar to how corporate treasuries or funds add BTC over time. For us, this supports the idea that Bitcoin behaves more like a long-term savings asset than a quick trading token.

But there is a real trade‑off. S&P recently downgraded the quality of Tether’s reserves because of its extra exposure to Bitcoin and other risk assets, according to the Financial Times. Rating agencies worry about exactly what you might worry about: “What happens to my stablecoin if Bitcoin dumps hard?”

We already saw how shaky design and risky backing can hurt a stablecoin in cases like algorithmic coins and over‑engineered yield products. For more background on how reserve choices affect trust, check our explainer on stablecoin reserves and why traders sometimes flee riskier designs.

What Should We Do Now?

First, do not panic‑swap all your USDT just because Tether holds some Bitcoin. A 5–6% BTC share in reserves does not equal a house of cards. But you should treat stablecoins the same way you treat banks: do not keep your entire net worth in any one issuer.

Spread your “cash” exposure. Holding a mix of USDT, USDC, or even moving some idle funds back to your bank account reduces single‑issuer risk. Competitors like USDC and new products such as Tether’s planned USAT target different regulatory setups, so you don’t need to marry one coin forever.

Second, separate your strategies. Use stablecoins for short‑term trading and payments. Use Bitcoin for long‑term savings if that fits your risk profile. Just because Tether blends Bitcoin into its reserves does not mean you should blur your own “cash vs investment” line.

And third, size your bets like an adult. Institutional Bitcoin adoption is exciting, but it does not remove the downside. Assume Bitcoin can still drop 50% from any level and plan your exposure so a crash hurts your pride, not your rent money.

As Tether keeps stacking sats and regulators circle the stablecoin sector, expect more headlines and more emotion. Your edge comes from something boring: understanding what backs your coins and keeping your own risk spread out, no matter what the whales do.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Tether Loads Up 8,888 BTC Again: Smart Reserve Play or Risky Game? appeared first on 99Bitcoins.