On November 20, Texas became the first U.S. state to buy Bitcoin for its Strategic Reserve, acquiring $10 million at roughly $87,000 per BTC, according to Lee Bratcher, President of the Texas Blockchain Council.

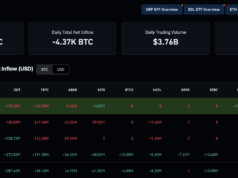

The purchase was made through BlackRock’s iShares Bitcoin Trust (IBIT) while the state finalizes plans for self-custody.

The move signals growing state-level interest in Bitcoin as a reserve asset. Texas had previously explored strategic Bitcoin legislation last year, wanting to create a Bitcoin reserve without using taxpayer funds.

In June of this year, the Texas governor signed the legislation into law, creating a state Strategic Bitcoin Reserve.

Institutional investors are increasingly following suit. Harvard University’s endowment recently tripled its IBIT holdings to $442.8 million, making it the university’s largest publicly disclosed investment.

Emory University and Abu Dhabi’s Al Warda Investments have also significantly increased Bitcoin ETF exposure.

Bitcoin’s price is currently trading near $87,500, roughly 30% below its all-time high. Lee Bratcher was the first to disclose this news.

“Texas will eventual self-custody bitcoin,” Bratcher said, “but while that RFP process takes place, this initial allocation was made with BlackRock’s IBIT ETF.

Bratcher is the President and Founder of the Texas Blockchain Council, an industry association with over 100 member companies and hundreds of individuals promoting Texas as a hub for Bitcoin and blockchain innovation.

He actively championed the state’s Bitcoin reserve legislation, working on the ground to guide it through the state Senate.

Texas isn’t the only state interested in buying bitcoin

In the legislation explored last year, Texas State Representative Giovanni Capriglione filed a bill to create a Strategic Bitcoin Reserve for the state.

The legislation proposed that the state buy and hold bitcoin as a strategic asset, store it in cold storage for at least five years, allow resident donations, and enable state agencies to accept and convert cryptocurrencies to bitcoin.

It also mandated transparency through yearly audits and reports. Modeled after a federal proposal by President Donald Trump and Senator Lummis, the bill mirrored the growing global interest of bitcoin.

Earlier this month, New Hampshire became the first government worldwide to approve a $100 million Bitcoin-backed municipal bond. The state’s Business Finance Authority (BFA) authorized the conduit bond, allowing private companies to borrow against over-collateralized Bitcoin held in custody, with repayment risk resting solely on the collateral.

Borrowers must post roughly 160% of the bond’s value in Bitcoin, and automated liquidation protects bondholders if values drop. Fees and any BTC appreciation will fund the state’s Bitcoin Economic Development Fund.

This move follows New Hampshire and Arizona’s earlier creation of a Strategic Bitcoin Reserve.