Voltage, a leading Bitcoin infrastructure provider based in Texas, has just launched a financial product that could bridge the gap between traditional banking and crypto payments. The company introduced a USD-settled revolving credit line designed specifically for the Lightning Network, changing the game for enterprises that want speed without volatility.

This announcement follows a massive milestone for the network: a successful $1 million transaction between Secure Digital Markets (SDM) and Kraken earlier this year, which Voltage facilitated.

By offering credit in US dollars while using Bitcoin’s payment rails, Voltage aims to make instant, low-fee global payments accessible to businesses that are too nervous to hold cryptocurrency on their balance sheets.

DISCOVER: Top 20 Crypto to Buy in 2026

Why Does This Matter For Bitcoin Payments?

To understand why this is a big deal, you have to look at the hurdles businesses face today. Until now, if a company wanted to use the Lightning Network for its near-instant speed and low fees, they generally had to buy and hold Bitcoin first.

For a conservative CFO, holding Bitcoin is risky because the price can swing wildly. As analysts note, while the Bitcoin boom-and-bust era may be ending, volatility remains a major concern for corporate treasuries.

Think of Voltage’s new product like a corporate travel card. When you travel abroad, you swipe your card to use the local financial system, but you pay your bill in US dollars when you get home. Similarly, Voltage allows companies to utilize Bitcoin’s fast “rails” to move value, but settles the debt in USD. You get the technology without the currency risk.

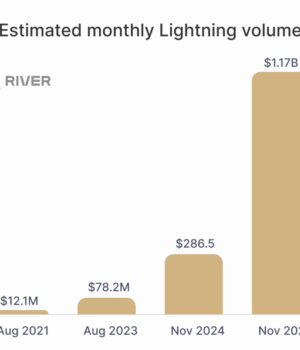

(Source:

This creates a hybrid model that uses the best of both worlds—Bitcoin’s tech and the dollar’s stability. It mirrors similar moves in the industry, such as Stripe’s acquisition of a bridge company to secure banking charters, proving that traditional finance is actively trying to plug into crypto infrastructure.

DISCOVER: Best New Cryptocurrencies to Invest in 2026

How The Voltage Credit Line Actually Works

This credit facility addresses a specific “structural gap” in corporate finance. Traditional banks usually won’t lend money based on Bitcoin revenue, and crypto lenders typically demand you lock up Bitcoin as collateral. Locking up Bitcoin is inefficient and can trigger messy tax events.

Voltage takes a different approach. According to their statement, they use “revenue-based underwriting.” This means they look at a company’s transaction volume to decide how much credit to offer. There are no origination fees, and interest is applied as a fixed annual percentage rate (APR) on the balance you actually use.

“Until now, using Bitcoin for payments meant managing cryptocurrency on your balance sheet,” said Voltage CEO Graham Krizek. “Voltage Credit eliminates that tradeoff.”

Today we’re launching Voltage Credit.

The industry’s first programmatic revolving line of credit built on top of Bitcoin payment rails.

Send payments with instant finality over BTC/Lightning.

Repay your credit line in USD from a standard bank account or in Bitcoin.

Pay…

— Voltage

(@voltage_cloud) February 19, 2026

The system is built on proven success. The $1 million pilot transaction between SDM and Kraken demonstrated that the Lightning Network is ready for institutional-sized money, not just buying coffee. This product allows capital to be deployed toward growth rather than being stuck in a cold wallet as collateral.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Voltage Launches USD Credit for Lightning Network appeared first on 99Bitcoins.