Buying Bitcoin now is like trying to catch a falling knife. For all that’s clear, sentiment is in tatters. Crypto has been in turmoil for the past few weeks.

After Bitcoin crashed below $100,000, it has been a one-way trip. There have been dead cat bounces here and there, but sellers are pretty much in charge.

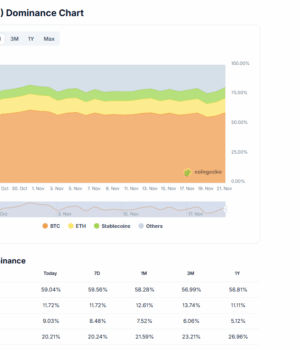

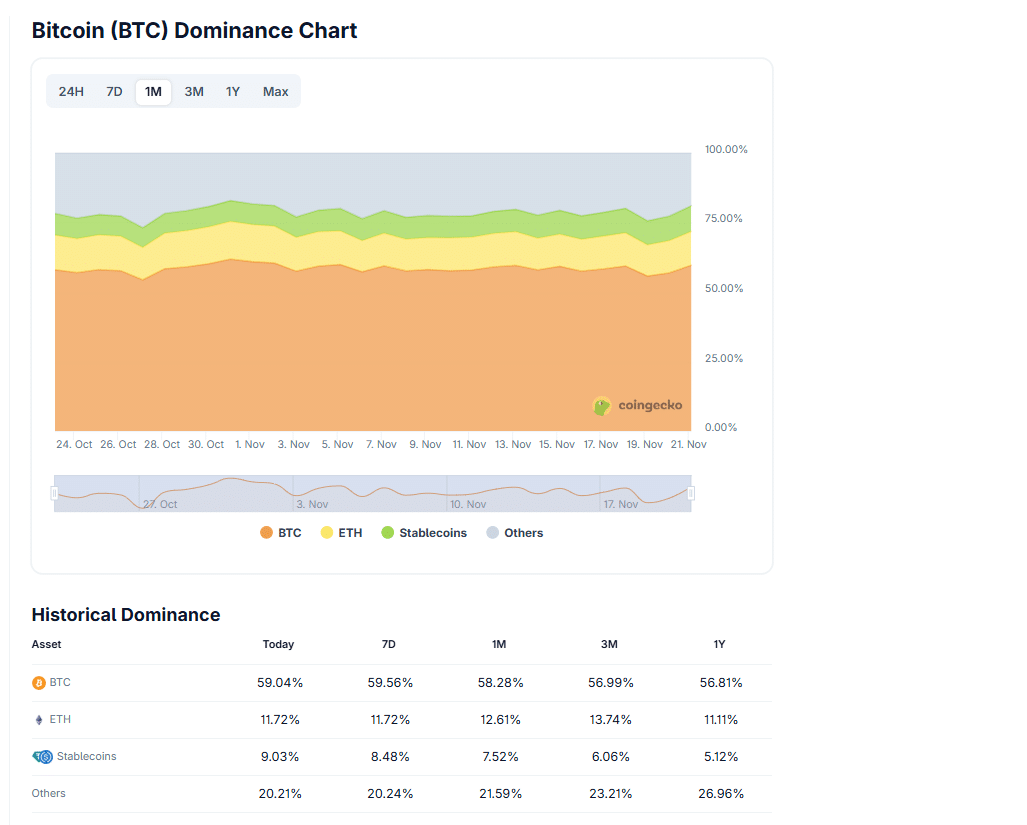

Following the dip below $90,000, the total crypto market cap is below $2.9 trillion. What’s more? As retailers dump, there is a clear rotation to stablecoins. The Bitcoin and Ethereum dominance is falling, while that of stablecoins like USDT has increased over the last week of trading.

(Source: Coingecko)

DISCOVER: 20+ Next Crypto to Explode in 2025

Why is Bitcoin Falling?

There have been several theories explaining why Bitcoin and the crypto market have been dumping in recent weeks.

On X, one analyst pinned the recent sell-off, including that of 1000X cryptos, to an entity on Binance, the world’s largest crypto exchange, who has been consistently selling during the NY market open over the last two weeks.

This $BTC seller on Binance is starting to look less like random flow and more like a single entity (or a tightly-coordinated group).

For two weeks straight, they’ve hit the sell button exactly at 9:30 EST, every US market open, without fail.

That kind of consistency usually… pic.twitter.com/vskoYNeOrh

— Front Runners (@frontrunnersx) November 20, 2025

The analyst observes that the seller on Binance has been hitting the “sell button exactly at 9:30 EST, every US market open, without fail.”

During this time, the BTC USD price has lost nearly 20%, reversing gains of the last year. So far, the Bitcoin price is in red, losing 14% YoY. It gets worse: Over the last 30 days, the digital gold is down 22%, dragging the rest of the market with it.

Given the consistency, the analyst speculates that the entity is working under “specific mandates or time windows.”

For optimistic traders, they can only watch, hoping the unwinding stops soon. However, for realists, it is only when the entity stops unloading that they can start considering longs, since the depth of their bag is unknown.

DISCOVER: 10+ Next Crypto to 100X In 2025

Are The Big Boys Rebalancing their Portfolios? Long-Term Holders Absorb 186,000 BTC

Overall, Bitcoin and top Solana meme coins failed to pick up the much-needed momentum following the dump on October 10.

The sell-off, which temporarily forced BTC USD to as low as $102,000, caused massive liquidations, forcing some blue-chips, including Cosmos ATOM crypto, to zero.

Sentiment recovered for a bit, but the drop below $100,000 forced traders to reconsider their positions. It was only necessary: $100,000 was not only a random number but a key support and psychological level.

Crypto Fear and Greed Chart

1y

1m

1w

24h

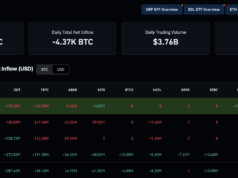

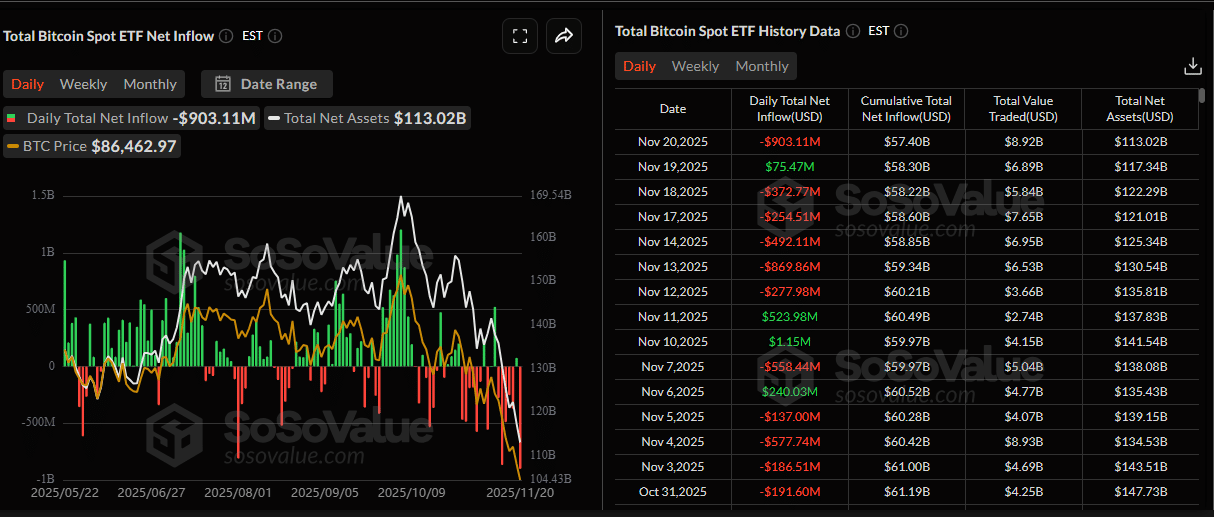

Apart from the minor inflow of $75 million on November 19, spot Bitcoin ETF issuers have been mostly redeeming shares. Before the close below $100,000 on November 13-14, over $1Bn of spot Bitcoin ETF shares were redeemed.

(Source: SosoValue)

Redemption means selling the underlying BTC for cash on regulated exchanges, likely Coinbase and Kraken. Inevitably, in the current environment, bulk sales tend to drive prices lower.

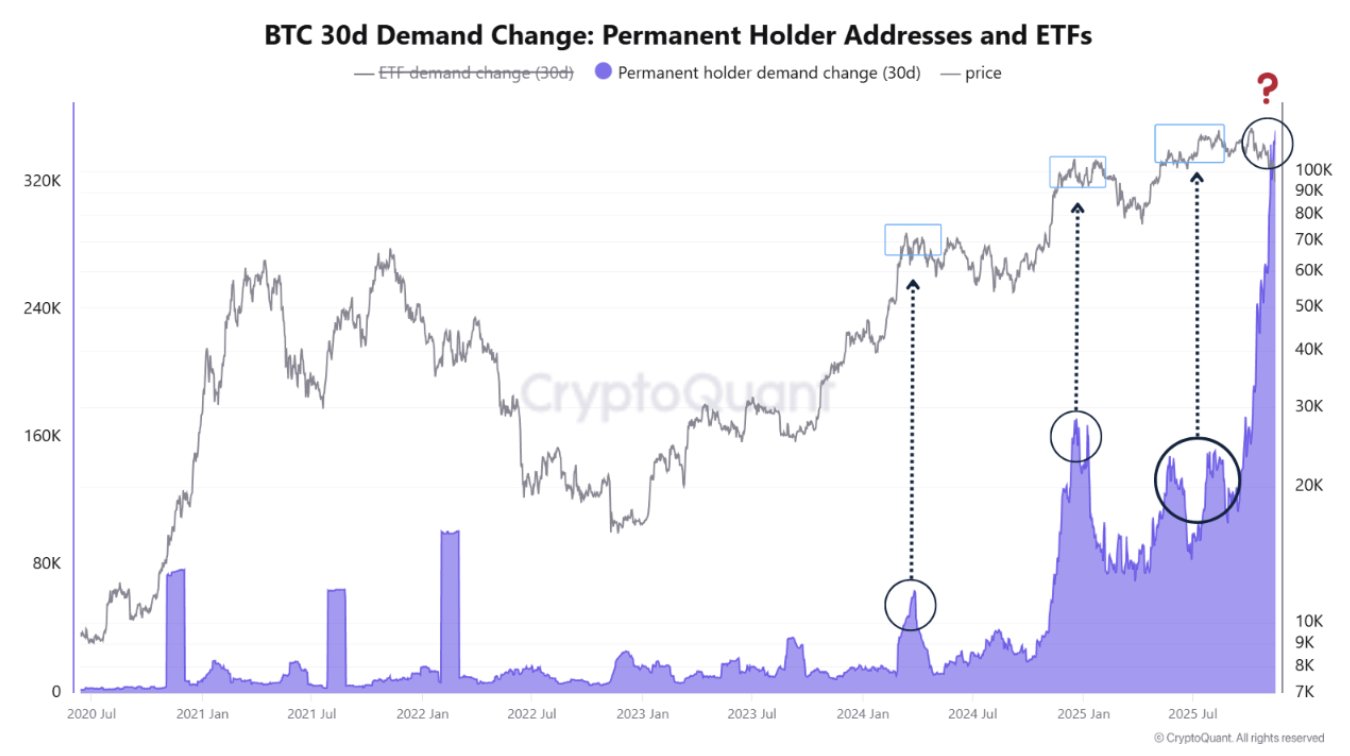

Still, even as Wall Street sells, long-term holders have absorbed a record 186,000 BTC in the last six weeks.

(Source: CryptoQuant, X)

Technically, this massive absorption could, a relief for HODLers, ignite a massive short squeeze and aggressively send prices upward.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

When Will This Bitcoin Seller on Binance Stop Dumping?

- BTC USD price falls below $90,000

- Crypto sentiment remains in negative territory

- Entity on Binance has been dumping BTC over the last two weeks

- Long-term holders absorb over 186,000 BTC

The post When Will This Bitcoin Seller On Binance Stop Dumping? Long-Term Holders Absorb 186,000 BTC Or $15.5Bn In 6 Weeks appeared first on 99Bitcoins.