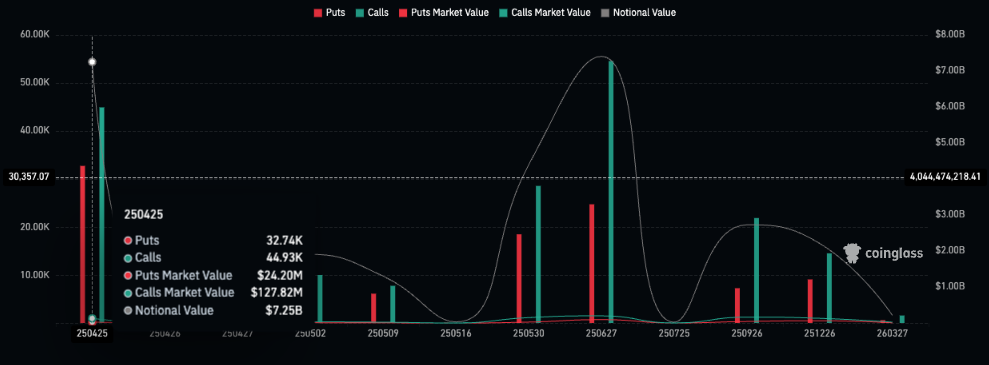

Bitcoin is gearing up for a major volatility occasion, triggered by $7.25 billion in choices which might be set to run out.

Bitcoin’s (BTC) spinoff market might quickly turn out to be a catalyst for main strikes for BTC. On April 25, $7.25 billion in Bitcoin choices are set to run out, sometimes triggering vital volatility. Nonetheless, the course of this volatility stays unsure.

In accordance with Marcin Kazmierczak, co-founder and COO of oracle supplier RedStone, Bitcoin has proven notable resilience. In comparison with conventional markets, crypto belongings have fared comparatively properly amid current macroeconomic uncertainty.

“Tomorrow’s expiry appears notably spicy, coming at a time when the market appears undecided about its subsequent main transfer,” Kazmierczak mentioned in a word despatched to crypto.information.

On April 25, a complete of 32.74k put contracts and 44.93k name contracts are set to run out. The market worth of those contracts stands at $24.20 million for places and $127.82 million for calls. The numerous hole between places and calls, with calls outnumbering places by roughly 5x, means that merchants are leaning towards a bullish final result.

Good cash is betting on volatility: Kazmierczak

Kazmierczak acknowledges that choices expiry occasions typically contribute to vital market swings. If all contracts had been exercised, their whole notional worth could be $7.25 billion, a determine that might have a noticeable influence on BTC’s value. For that reason, he believes that sensible cash is getting ready for volatility.

Good cash is probably going positioning for some dramatic swings, making this an ideal second for each alternative seekers and cautious buyers to pay shut consideration,” Marcin Kazmierczak, RedStone.

On the identical time, he highlights the continued maturation of the crypto ecosystem. This offers long-term buyers with an opportunity to capitalize on volatility and safe extra favorable entry factors.

“Whereas we might face volatility round choices expiries, the underlying fundamentals stay exceptionally robust, with stablecoin volumes, Bitcoin adoption, and real-world asset tokenization all displaying outstanding development trajectories.”

Kazmierczak additionally famous that the crypto markets have remained comparatively regular compared to equities. In distinction, conventional markets have confronted notable turbulence, largely on account of fears surrounding the influence of Donald Trump’s tariffs on main buying and selling companions.

“It’s value noting that crypto markets have demonstrated shocking resilience in comparison with conventional markets, which have been rocked by tariff considerations – an indication that digital belongings could also be establishing their very own market dynamics much less correlated to conventional monetary turbulence.”