Regardless of macroeconomic uncertainty, Bitcoin miners are displaying confidence in additional upside, as secure reserves sign their perception in continued market development.

Bitcoin (BTC) miners have proven no important indicators of capitulation, with on-chain knowledge persevering with to sign a bullish outlook, analysts at Bitfinex Alpha wrote in a latest analysis report.

They famous that regardless of macroeconomic turbulence and a 32% drop from Bitcoin’s all-time excessive in 2024, miner reserves have remained secure. As of Could 5, reserves had been at 1,808,674 BTC, displaying little fluctuation from December 2024 ranges, suggesting a cautious holding technique, with miners refraining from important promoting.

“On condition that miners usually must liquidate a portion of their holdings to finance operational

bills — similar to electrical energy, upkeep, and salaries — their continued restraint from promoting

speaks volumes about expectations of future worth appreciation.”Bitfinex Alpha

The analysts famous that the very fact miners are nonetheless holding onto the latest 32% restoration from the April lows helps the concept, regardless of latest volatility and macro uncertainty, “we could not have seen the ultimate leg of the present bull cycle.”

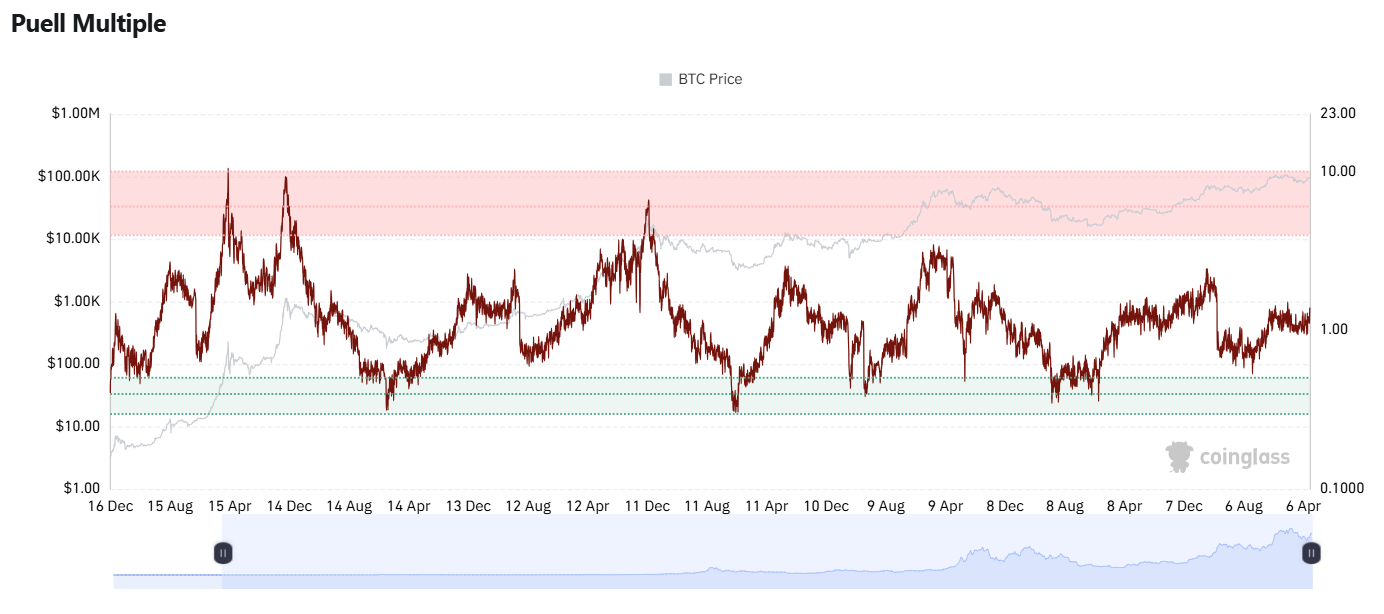

The Puell A number of, a key indicator of miner profitability, additionally stays nicely beneath traditionally elevated thresholds, additional confirming miners’ lack of incentive to promote. Sometimes, values above 2 sign a rise in promoting exercise, however the present degree of the Puell A number of means that large-scale miner promoting is unlikely.

These secure reserves and low promoting stress reinforce the concept Bitcoin miners stay assured within the asset’s potential for future features. Whereas the market stays inclined to short-term fluctuations, the structural indicators recommend that the present cycle should still have room to develop, with miners holding onto their positions in anticipation of additional upside, the analysts clarify.