Rocket Pool RPL is surging, adding 30%. Strengthening Ethereum prices played a role, but the team is also shipping updates ahead of the Saturn upgrade. Rocket Pool TVL is up 43% in one month. Will RPL break $10?

Yesterday, without any apparent reason or fundamental trigger, UNI, the governance token of the major DEX Uniswap, surged above $7 before cooling off.

Meanwhile, top DeFi tokens like MKR, the governance token of the Sky Protocol (formerly Maker), also climbed, posting double-digit gains.

As these leading DeFi tokens rose, attention shifted to another key Ethereum player critical to decentralizing the first smart contracts platform: Rocket Pool.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in May 2025

RPL Crypto Surges 30%

The native token powering Rocket Pool, RPL, soared nearly 30% in 24 hours, extending gains from early June and solidifying its position among the top 30 largest DeFi protocols by total value locked (TVL).

According to Coingecko data, RPL gained against the greenback, ETH, BTC, and some of the best cryptos to buy.

Technically, there is room for growth.

With RPL adding nearly 30% yesterday, buyers are eyeing resistance levels at $7 and $10. If this psychological barrier is broken and RPL reaches new Q2 2025 highs, there is a high probability that the token could double to $20 in late H1 2025 or early H2 2025.

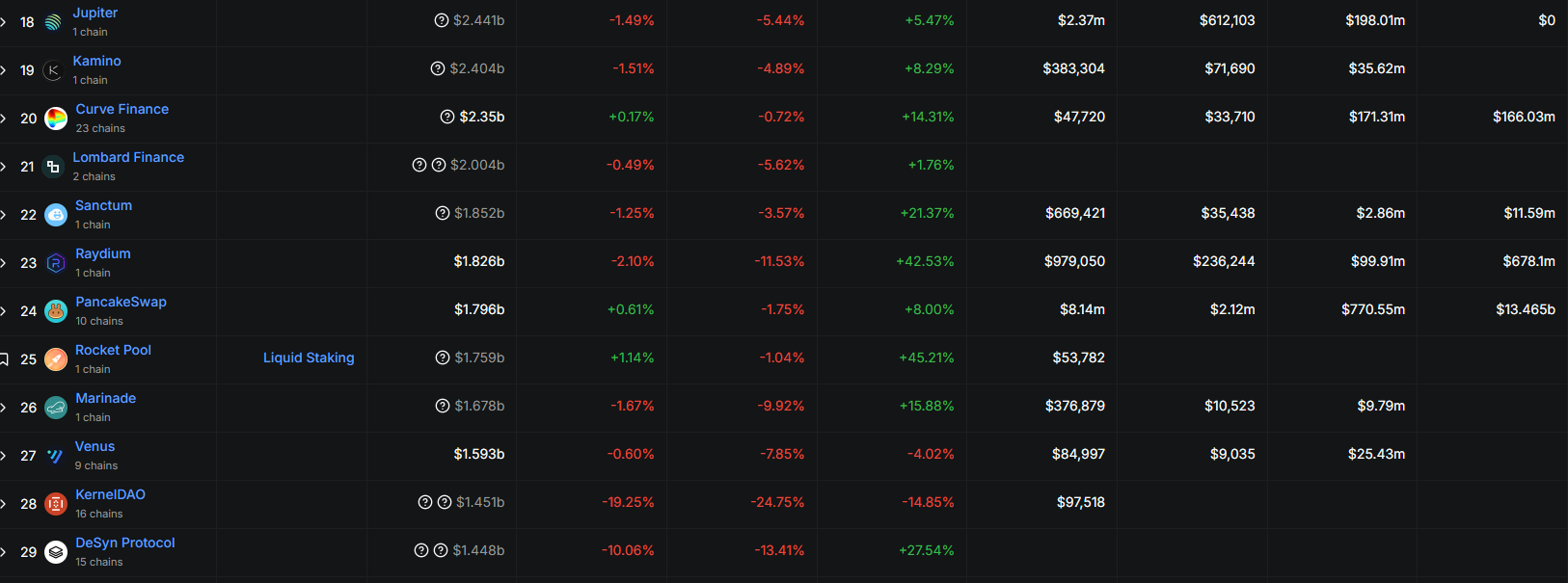

DeFiLlama data shows that Rocket Pool is the 26th largest DeFi protocol, managing over $1.7 billion in assets on Ethereum. With rising prices, its TVL increased 1% in 24 hours.

(Source)

However, the surge in inflows over the past month stands out, with the Rocket Pool TVL rising by 45%, outpacing most protocols in the top 30.

Raydium, the DEX powering Solana token swaps, saw a 42% TVL increase in the last month, signaling that traders may be returning to trade some of the best Solana meme coins.

Meanwhile, Morpho, EigenLayer, and Pendle also drew massive inflows, pushing the total DeFi TVL to $113 billion.

Will ETH Help Sustain Momentum?

Interest in Ethereum staking may explain this revival.

Notably, the spike in the Rocket Pool TVL coincided with a surge in ETH prices in May.

The second most valuable crypto broke above $2,000 before accelerating to nearly $2,800. Although prices have stabilized above $2,400, there are hints that buyers are accumulating, and a breakout above $3,000 is inevitable.

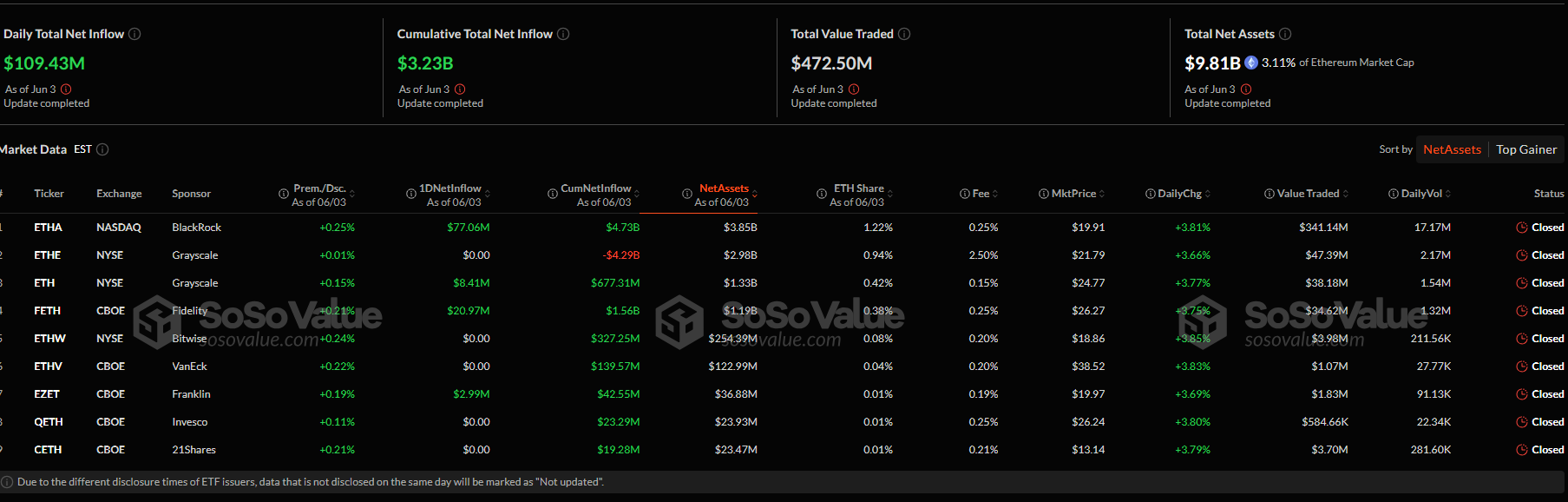

On June 3, institutions in the United States purchased over $109 million worth of spot Ethereum ETF shares, increasing their holdings to over $9.8 billion, representing roughly 3% of the Ethereum market cap.

(Source)

If Ethereum prices rise, Rocket Pool’s TVL will likely expand, boosting RPL demand. This momentum could be further fueled by positive ecosystem developments in recent weeks.

Over $14m worth of ETH was staked with Rocket Pool yesterday, fully clearing the validator minipool queue!

If you’re thinking about becoming a node operator, now could be a good time to start – you just need 8 ETH, with $RPL optional to earn more commission pic.twitter.com/UUbOPe72q0

— Rocket Pool (@Rocket_Pool) May 25, 2025

DISCOVER: Top 20 Crypto to Buy in May 2025

What’s Driving Rocket Pool Demand?

Analysts are closely monitoring progress on the upcoming Saturn Upgrade.

Ahead of this key update, the team has released smart contracts for Saturn devnet-3 and is working on the Smart Node stack. Additionally, developers are preparing devnet-4, which, though less complex, will play a pivotal foundational role in the release scheduled for late Q3 2025.

The team has also completed an internal code review for Saturn and is now engaging external blockchain security firms to audit the code thoroughly before the upgrade.

Security before deployment is critical because Saturn will introduce scaling features, including “Megapools,” which aim to improve validator throughput and dynamic fee splits to enhance protocol efficiency and RPL utility.

Beyond Saturn, Rocket Pool updated its Smartnode software in April and May to ensure compatibility with Ethereum’s Pectra hard fork. The team addressed concerns about client integration, relay processing, and validator reliability, enabling node operators to continue staking on Ethereum with minimal disruption.

The increasing interoperability with other DeFi protocols could also drive RPL prices. With expanded use cases for rETH, holders stand to benefit, encouraging more adoption of Rocket Pool.

rETH <> wETH liquidity pool is LIVE!

Provide liquidity, earn rewards

• Get ETH staking yield on Ronin

• Earn boosted rewards in the Ronin Blitz

• Combine rETH with other DeFi primitives

Provide rETH liquidity on Katana nowHere’s what’s… pic.twitter.com/UkZe4XVjjK

— Ronin (@Ronin_Network) May 23, 2025

After joining the Balancer Alliance Program, which unlocks revenue sharing for rETH/ETH, Rocket Pool also integrated with the Ronin Network, adopting Chainlink’s CCIP.

DISCOVER: 15 Next Crypto to Explode in 2025: Expert Cryptocurrency Predictions & Analysis

Rocket Pool RPL Up 30%, Ethereum Steady: Are DeFi Tokens Back?

- RPL is up 30%; will the token push above $10?

- Rocket Pool DeFi TVL up over 45% in one month

- Developers shipping updates ahead of the Saturn upgrade

- Ethereum staking boom and rising ETH demand driving DeFi tokens

The post Rocket Pool RPL Crypto Up 30%: Are DeFi Tokens Back? appeared first on 99Bitcoins.

:

: