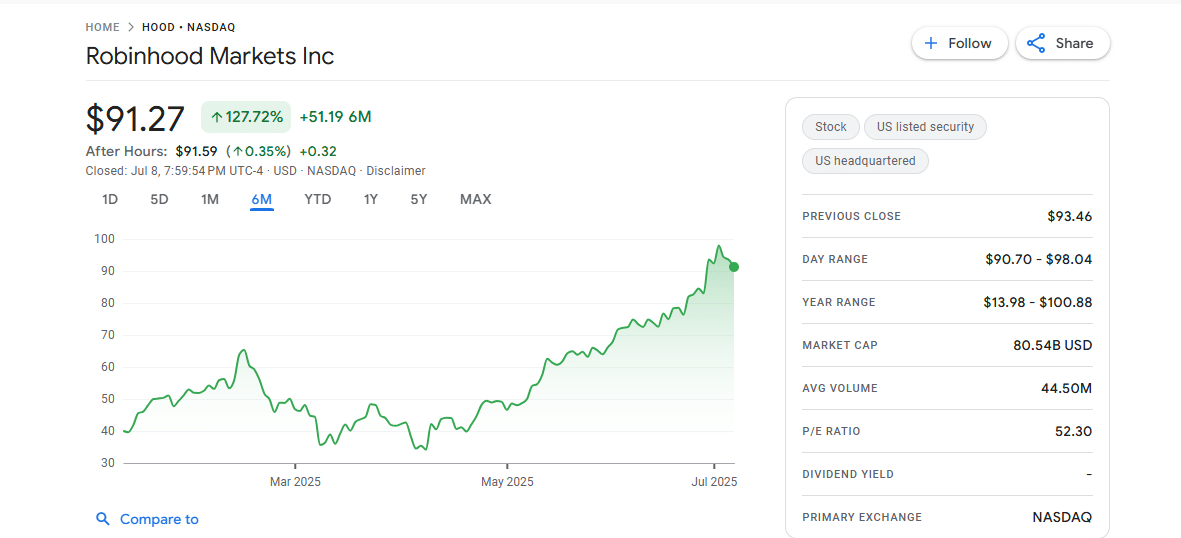

Robinhood is trending, and share prices spiked 26%. The broker has acquired crypto exchange Bitstamp and is tokenizing U.S. stocks and making them available to European traders.

On a day when the crypto market was see-sawing and even red at some point, the stock market was pumping, with Robinhood among the top gainers. Records show that HOOD, the share of Robinhood, rose 26% following key strategic announcements.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

The Rise Of Robinhood, Acquisition of Bitstamp

The surge was primarily propelled by the recent launch of its tokenized equities platform for European Union traders.

Moreover, completing their $200 million acquisition of Bitstamp, a crypto exchange regulated in the European Union (EU), fanned demand.

Johann Kerbrat, General Manager of Robinhood Crypto, said their acquisition of Bitstamp allows them to expand their footprint outside the United States.

For analysts and traders, the deal further cemented the broker’s pivot toward crypto and blockchain, drawing the attention of institutions and retailers tracking some of the best meme coin ICOs.

Slowly but surely, Robinhood is slowly bridging tradFi with DeFi, and crypto investors are closely tracking its moves, especially as it pushes to bring tokenized United States securities to European traders.

Since rolling out crypto trading in 2018, Robinhood has steadily grown. As of May 2025, its user base rose to over 25 million funded accounts and more than 14 million monthly active users.

Its commission-free model, sleek interface, and suite of over 10 crypto assets, including some of the best cryptos to buy, like , make Robinhood a retail favorite.

The mass appeal also stems from the fact that, though the Robinhood interface is simple, the broker is compliant with United States laws.

As such, by adding Bitstamp into its fold, it automatically integrates over 50 global licenses from the crypto exchange, bolstering its regulatory clout, especially in Europe.

DISCOVER: 20+ Next Crypto to Explode in 2025

Focus on RWA Tokenization

Although there are some questions about the legality of their tokenized stock receipts tied to popular United States stocks like Tesla, the goal was to enable 24/7 trading via Arbitrum, the Ethereum layer-2. However, Robinhood plans to launch its layer-2 later.

All settlements will still be handled in the traditional markets.

At our recent crypto event, we announced a limited Stock Token giveaway on OpenAI and SpaceX to eligible European customers. While it is true that they aren’t technically “equity” (you can see the precise dynamics in our Terms for those interested), the tokens effectively give…

— Vlad Tenev (@vladtenev) July 2, 2025

To address concerns, especially those raised by OpenAI, a representative of the Bank of Lithuania, which regulates Robinhood in the European Union, said they are “awaiting clarifications regarding the structure of OpenAI and SpaceX stock tokens as well as the related consumer communication” After they receive and evaluate this information, they will “assess the legality and compliance of these specific instruments. The information for investors must be provided in clear, fair, and non-misleading language.”

Even with this hitch, Vald Tenev, the CEO of Robinhood, believes the tokenization of securities will eventually address inequalities and boost access. This drive mirrors the platform’s mission of democratizing finance for all.

By expanding to Europe, Robinhood is tapping into the more permissive regulatory environment under MiCA. Under this framework, regulated entities can offer tokenized assets without investor restrictions, as in the United States.

At the same time, the broker is taking advantage of the more supportive crypto environment in the United States. By innovating and tapping into the blockchain, Robinhood is directly improving trading efficiency and transparency.

DISCOVER: 10 Best Crypto Presales to Invest in July 2025 – Top Token Presales

Robinhood Soars 26% On Bitstamp, RWA Tokenization Drive

- Robinhood share price jumps 26%

- Broker acquires Bitstamp for $200 million

- Robinhood to tokenize U.S. stocks for European traders

- Broker linking TradFi with DeFi

The post Robinhood Shares Soar 26% on the Back of Tokenized Equities Launch and Bitstamp Acquisition appeared first on 99Bitcoins.