At the beginning of July, everywhere you looked, you could see a Solana target price of $200 or more by August. After a strong start, which saw SOL surge by +10% from $145 to over $167, many projections indicated that Solana (SOL) could reach a target price of over $200 by August.

However, a sharp overnight sell-off caused the sixth-largest digital asset by market cap to drop by 4%, bringing its price below $160, with many now wondering whether Solana can hit $200 this month.

(SOURCE)

SOL Weekly Support At $160 – If Reclaimed, Bullish Momentum Could Continue

While Solana has fallen below its weekly support level of $160, it is currently trading at $159.9, just a few pennies away from reclaiming that important level.

The main Solana price target from traders and analysts was overwhelmingly $200 by August, and if SOL can flip $160 into support, this target remains a realistic possibility.

Although $160 is a key level for SOL, right now $155 represents a strong support zone, which should act as a safety blanket for Solana as it attempts to regain its bullish momentum from the last three weeks.

High-timeframe Solana price targets are expected to be between $500 and $ 1,000 by the end of this cycle, but there is a lot of work to be done for the asset to reach that goal, and clearing $200 in the short term is the top priority.

SOL is just 45% down from its all-time high of $293, which it reached in January of this year. Flipping $200 will provide the perfect backboard for a run toward $300, which should set Solana up for a run toward those lofty $500+ price targets.

Technical indicators to watch for on SOL include the hourly MACD, which is gaining momentum in the bearish zone on the SOL/USD pair. The RSI (relative strength index) for SOL is sitting at 55.42, putting it firmly in the neutral zone.

Major support levels are $158 and $155; a daily close below $155 could indicate a larger move to the downside. On the other side, major resistance levels sit at $162 and $168 on a 1-day timeframe, and the longer SOL ranges here could make a push through these barriers more difficult.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Solana In The Spotlight With The BONK Ecosystem Flourishing And The PUMP Launch Spiking SOL Volume

lets see how this goes with $PUMP, fingers crossed these lows hold. funding looking healthier now overall and i'm still long (albeit underwater) https://t.co/ukmBLa29Gg pic.twitter.com/4KmgKvMdct

— Altcoin Sherpa (@AltcoinSherpa) July 15, 2025

Whether positive or negative, Solana is in the spotlight right now, with the continued success of the BONK ecosystem and the recent launch of Pump.fun’s PUMP token.

Since launching yesterday (July 14), PUMP has traded within a tight range, between $0.0051 and $0.006, and is still settling before a clear direction is established.

Although the PUMP price hasn’t broken out in either direction yet, over $1.2 billion in trading volume has been processed in around 18 hours, highlighting the demand and hype surrounding the token.

This level of attention on PUMP and the BONK ecosystem can only be a positive for Solana, as it attracts fresh liquidity to the network, with the majority of traders swapping these tokens against SOL.

SOL Spot ETF Decisions Looming: This Could Drive The Solana Price Target Of $200+

(SOURCE)

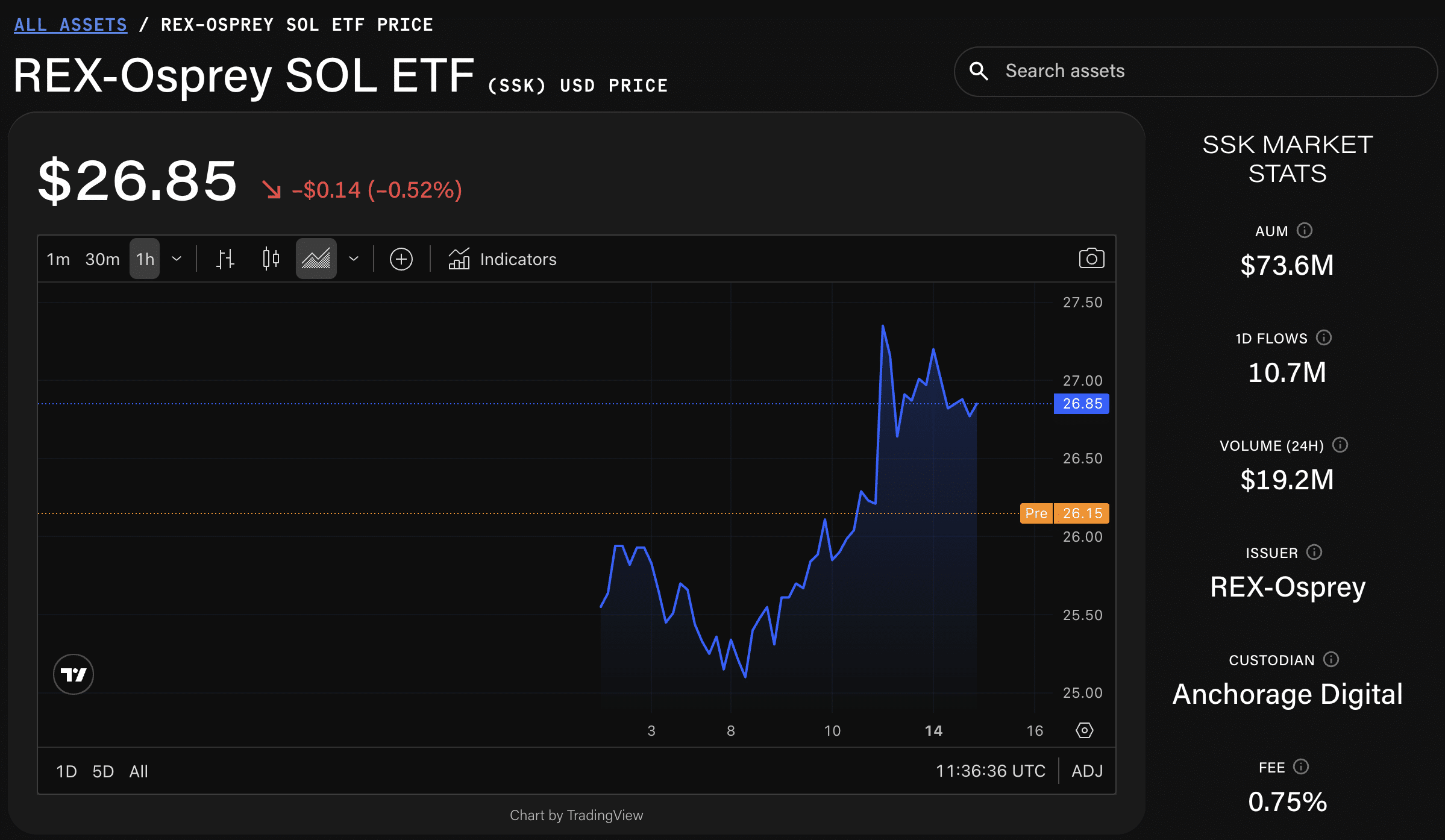

The Rex-Osprey SOL Staking ETF went live earlier this month, the first of its kind for a US-based company. It has since amassed over $73 million in assets under management, and its daily flow sits at +$10 million with over $19 million in daily volume.

These numbers are bullish and indicate a demand for regulated Solana products. With over ten spot SOL ETFs currently pending approval with the SEC, a series of approvals would likely provide the catalyst for SOL to reach $200 and beyond in the short term.

There are several smaller-scale Staking Solana ETFs available on the market currently, but it is the pure spot ETFs from companies like BlackRock, Fidelity, 21Shares, Franklin Templeton, among others, that the market is eagerly anticipating.

At the end of June, it was announced that VanEck’s SOL Spot ETF had been listed by the Depository Trust and Clearing Corporation (DTCC). This move typically signals backend preparations in anticipation of a green light from the SEC, pointing toward an approval of a spot SOL ETF before long.

Bloomberg Analysts predict a 90% chance of a spot SOL ETF approval in 2025, and the prediction market platform Polymarket has its ‘Solana ETF approval in 2025’ market sitting at a 99% chance of happening.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Solana Target Price Of $200 In July Wavering As SOL Drops 4% Overnight appeared first on 99Bitcoins.