After months of underperforming compared to BTC USD, Ethereum crypto is now in focus. Not only has it been resilient, absorbing selling pressure, but after the disappointment in H1 2025, the coin is on the cusp of breaking 2021 highs. At spot rates, ETH USD is trading above $4,500 after surging to over $4,900 over the weekend. Although prices were rejected and fell to current levels, the uptrend remains.

From the daily chart, BTC USD has found key support around the $110,000 level. Notably, the drop seen in the past few hours today is a continuation of the sell-off posted on August 24, when bears completely reversed the gains of August 22. Technically, as long as BTC USD is capped below $118,000, bears are in control, and they may pierce through $110,000 in a bear trend continuation, confirming losses from August 14.

(Source: TradingView)

Meanwhile, ETH USD bulls are optimistic. Based on Coingecko data, Ethereum crypto is up 22% in the past month and an impressive 67% in the last year of trading. Despite the shakeout in Bitcoin over the weekend, ETHUSDT is up nearly 8% in the last week of trading.

Technically, the gains of August 22 define the short-term price action. Buyers have the upper hand as long as prices trend above $4,200, the low of August 22. Once $4,900 breaks, ETH USD will enter new territory, possibly setting a solid foundation for a leg up to $10,000.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Bitcoin Bulls Dominate as Liquidity Dries Up

While confidence is high among Ethereum holders, traders should be cautious, considering Bitcoin’s high market dominance. As of August 25, Bitcoin controls 56% of the total crypto market, while ETH crypto has risen to 14%. This high market dominance means that if Bitcoin drops below critical support levels, such as $110,000, the odds of BTC USD dragging other altcoins, including some of the top Solana meme coins, are high.

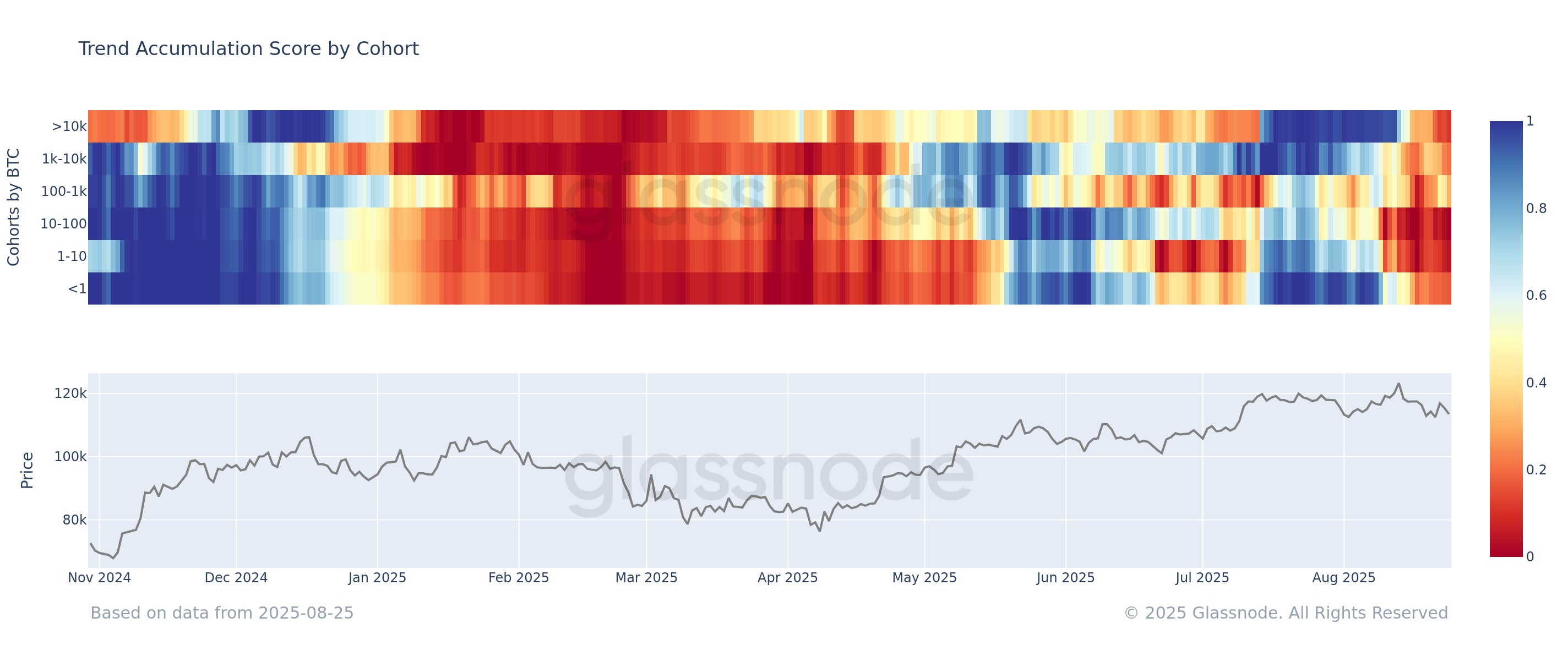

The odds are stacking up against Bitcoin. According to Glassnode, as of August 25, all Bitcoin cohorts, from small retail holders to whales, are in distribution mode, selling or preparing to sell. Analysts note that those holding between 10 and 100 BTC are leading the charge.

(Source: Glassnode via X)

Multiple factors, including profit-taking after the recent surge to new all-time highs, could drive this broad sell-off. Macroeconomic uncertainties, such as softening labor markets and rising inflation, are also considerations. Though the Federal Reserve might consider slashing rates in September, BTC USD could face immense selling pressure from holders in the short term.

As holders sell, onchain data shows that Bitcoin liquidity is also falling. The Spent Volume metric, which measures the total value of BTC transacted daily, is shrinking, averaging 529,000 BTC in the last week. This drop suggests that downside momentum may wane, though analysts advise traders to proceed cautiously.

GM!

Spent Volume (BTC)- the total volume of coins spent per day. This metric reflects liquidity flow, though it remains sensitive to internal transfers by exchanges and services. This week, its average value dropped to a minimum of 529K BTC per day.

This indicates that the… pic.twitter.com/h390vBjFCj

— Axel

Adler Jr (@AxelAdlerJr) August 23, 2025

DISCOVER: 20+ Next Crypto to Explode in 2025

Institutional Shift to Ethereum: A Boon for ETH USD?

Besides declining liquidity, large sellers are active across all major exchanges. One analyst observes that many of these sellers are unaware of time-weighted average price (TWAP) strategies, adding to the volatility.

It’s a bit concerning that large sellers are showing up on exchanges who don’t seem to know about TWAP.

Overall, CEX Netflow is still green, but it’s getting close to the point where sellers will outnumber buyers.

Right now would be the perfect time for Saylor & Co. to step up… pic.twitter.com/nOxmf8eVDw— Axel

Adler Jr (@AxelAdlerJr) August 25, 2025

Net flow to exchanges remains positive, which is bearish for BTC ▼-2.69% since more coins parked at exchanges are more likely to be sold for cash or blue-chip altcoins, primarily ETH and other best cryptos to buy.

This is happening, as analysts note that more institutions are pivoting to ETH. Last week, Bitmine, the Ethereum Treasury Company led by Tom Lee, a known Bitcoin bull, bought $2.2 billion worth of ETH. The firm now holds over 1.71 million ETH and 192 BTC.

NEW: Tom Lee explains how $6.6 billion in Ethereum generates over $200 million in net income.

"If you hold $ETH and you agree to stake it and validate transactions, you earn the staking fee, which is 3%."

He plans to use the income to pay BitMine holders a cash dividend.… pic.twitter.com/DrLMAJ3Fgl

— CryptosRus (@CryptosR_Us) August 22, 2025

According to Lee, thanks to this substantial stash, Bitmine generates over $200 million in net revenue from staking.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

BTC USD Falls As Ethereum Surges: Will ETH USD Break $5K?

- BTC USD hovers around $110,000 support

- ETH USD is up 22% in a month, trading above $4,500

- Bitcoin holders looking to dump BTC

- Bitmine bought $2.2 billion of ETH last week

The post BTC USD Feels the Pressure as Big Players Shift to Ethereum: What’s Next? appeared first on 99Bitcoins.