Bitcoin is clinging to $110,000 amid the boring crypto market, while Ethereum Layer-2 like Arbitrum is making news today. The total crypto market cap sits at $3.9 trillion, but the 24-hour volume is recorded at a huge $124 billion. People are now waiting for September, as August is historically bad for crypto.

This is a huge deal for Arbitrum, the ability to have optimistic (aka cheap) transactions for general use and then optionally use Zk Proofs when you want faster finality for things like bridging and withdrawal. https://t.co/9n2oM4osOJ

— Matt Hamilton (@HammerToe) September 3, 2025

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Crypto Market News Updates for Today: WLFI Dropping, Ena Pumping, ARB Altering Ethereum Layer-2

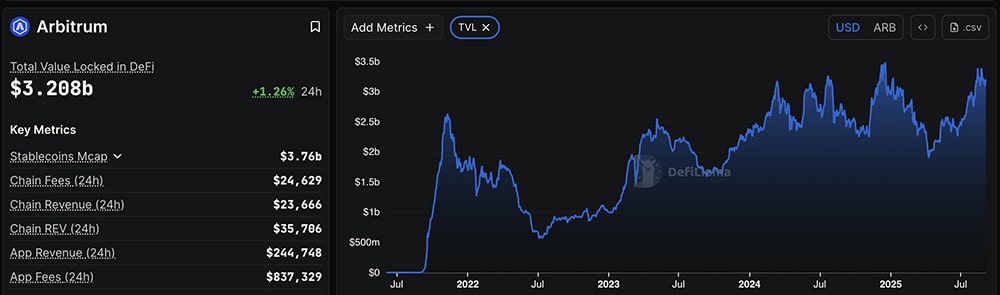

Arbitrum recently launched its $40 million DeFi incentive program, which impacts its liquidity and apps. Its total value locked has now exceeded $3.2 billion, edged out rivals like Polygon and Mantle.

ARB Layer-2 share grows with integrations like Ronin for Web3 gaming. Fees drop to $0.0001 per swap on some chains. Ex-Ripple insights highlight how this alters Ethereum’s ecosystem, favoring efficiency over mainnet costs.

(source – Defillama)

On the other side, Trump,s Media coin, WLFI ▼-22.83%, alhough dumping 45% from its top, is still outperforming ENA ▼-2.44% in market cap at $5 billion versus $4.66 billion. Community proposals have pushed for WLFI buybacks, especially with rumours of insider dumping.

ENA, even if its lower in market cap than WLFI, edges up 2% to above 70 cents, driven by $50 million weekly revenue from USDe stablecoin. Its delta-neutral hedging is drawing whales, which send it running 10% this week.

(source – CoinGecko)

Beside the above coins, today also saw news from Metaplanet who stacks another 1,009 Bitcoin from the market, and now holding 20,000 worth over $2 billion in crypto.

August has seen hacks that drained $163 million across platforms, and Solana’s Alpenglow upgrade aims 150-millisecond finality, heating up Layer-1 competition.

Bitcoin price has decoupled from stocks, up 0.2% while S&P dips -1.48%, and hashrate surge is showing miner confidence.

WLFI is sparking debates, but with $1 billion in 24-hour volume post-listing, a perfect signal that crypto is still on.

Now, can WLFI blast above its all-time high after hitting an all-time low a few hours ago?

Follow us here for today crypto market news updates.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

September Trap on Avax and XLM: Avalanche and Stellar Underpeforming, What Crypto to Buy Instead

As September 2025 begins, the crypto market is showing early signs of a rebound after a super volatile August.

This month has historically been tricky for the crypto market. Known as the “September trap,” it often brings 4% average losses for Bitcoin and steeper 30–50% drops for altcoins every year. Liquidity tends to dry up after the summer, and while institutional capital is starting to return, it’s moving slowly.

However, interestingly, memecoins are bucking the trend. FARTCOIN, for example, has gained over 3,100% year-over-year, driven almost entirely by community hype.

Read the full story here.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Will There Be Ethereum Supply Shock in September: Corporations Drain ETH Exchange Reserves

Ethereum is entering September under extreme supply pressure, with institutional buying and ETF demand slashing exchange reserves to historic lows. If demand stays steady, ETH could see a violent upside move this month.

Corporate treasuries, staking platforms, and ETFs are locking up billions in ETH, creating artificial scarcity. With reserves near multi-year lows, even modest buying could trigger a full-blown supply crunch.

Read the full story here.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

The post [LIVE] Latest Crypto Market News Today, September 4 – Arbitrum to Alter Ethereum Layer-2, Bitcoin Price Hovers at $110,000, and WLFI Still Above ENA appeared first on 99Bitcoins.