The crypto market is under close watch as traders prepare for Friday’s $22 billion Bitcoin and Ethereum options expiry. With just a few days left in this bearish September, bears are calling for another possible drop to $107K before October, which has historically been a more bullish month for BTC. The main question is whether the recent downturn has run its course, or if more volatility is still ahead. For investors, finding the best crypto to buy during this uncertain phase is a key focus.

REMINDER

$21 BILLION WORTH OF $BTC AND $ETH OPTIONS WILL EXPIRE TODAY.

EXPECT HIGH VOLATILITY! pic.twitter.com/FbkITm1V06

— Max Crypto (@MaxCryptoxx) September 26, 2025

Bitcoin BTC ▼-0.16% is currently priced around $109,426, while Ethereum

ETH ▲2.31% trades near $3,922. Both have seen losses in recent sessions, triggering over $275 million in liquidations of leveraged long positions.

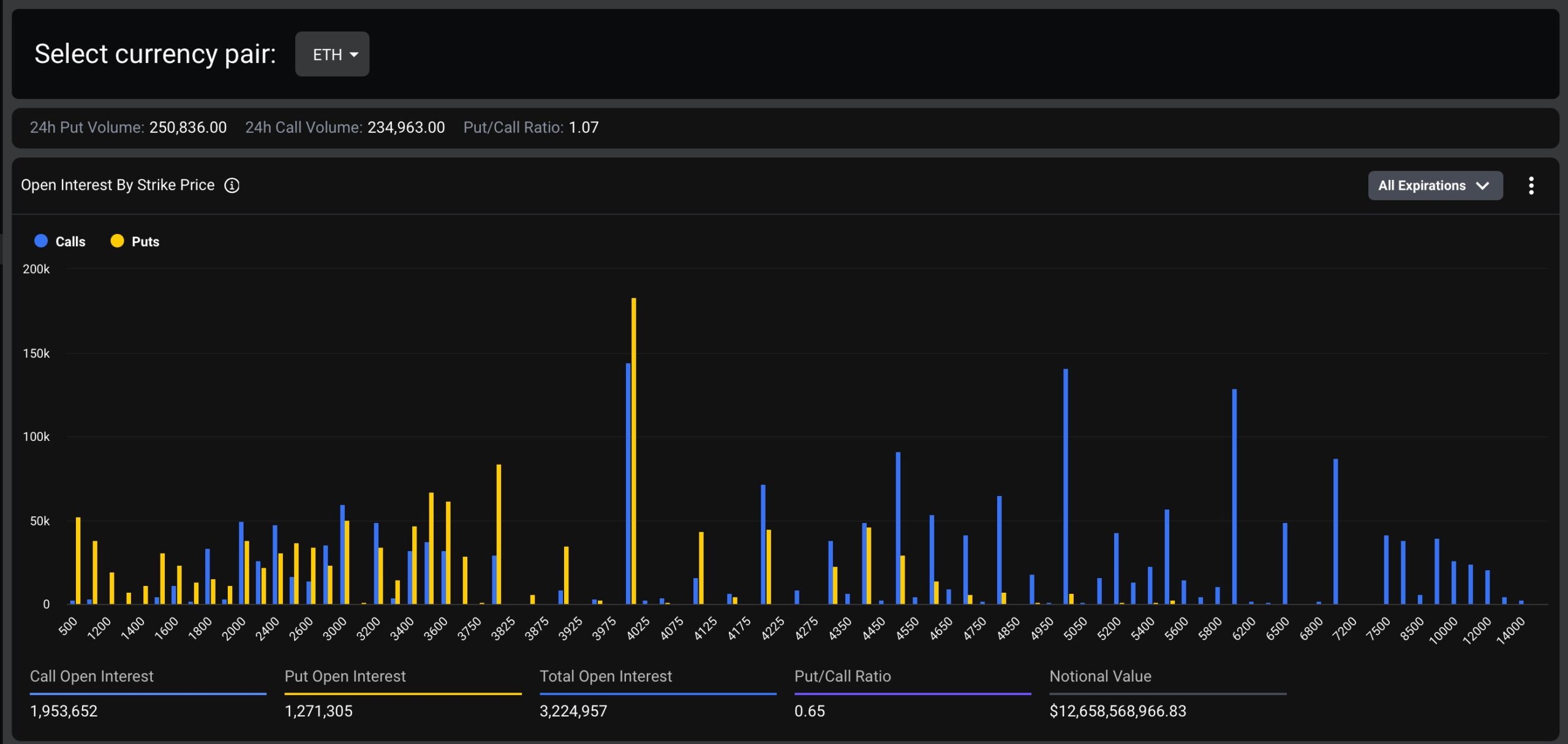

ETH options are heavily clustered around $3800–$4000. That makes this range a likely “magnet” for price into expiry. A decisive move above $4000 or below $3800 would create momentum, but staying in the middle benefits the option sellers most.

Data shows that if BTC closes below $110,000, sellers could gain a $1 billion advantage from expiring put options. However, Bitcoin ETFs recorded $241 million in inflows this week, suggesting ongoing institutional interest despite market pressure.

DISCOVER: 10+ Next Crypto To 100x In 2025

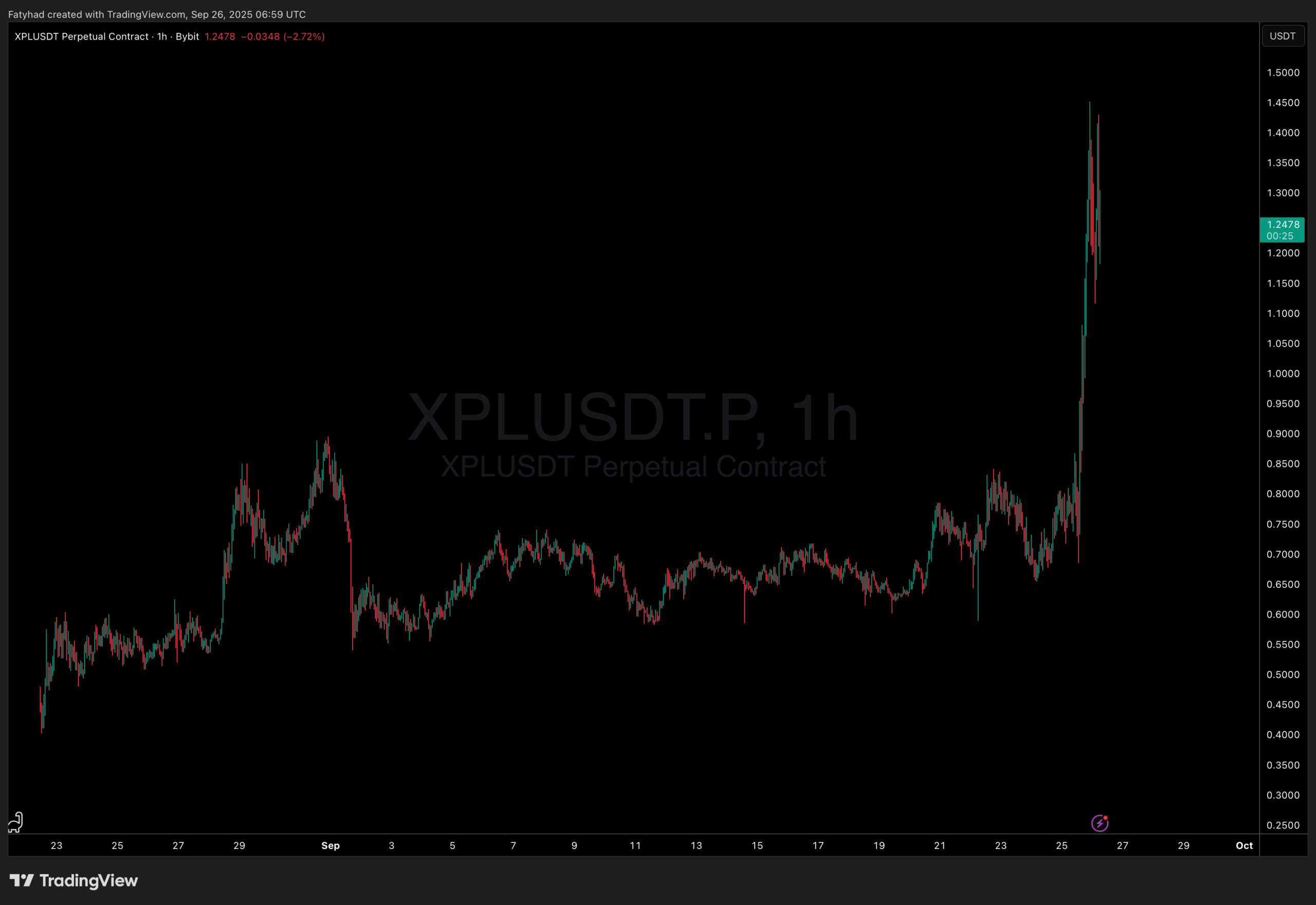

Best Crypto to Buy Amid High Volatility – Plasma’s XPL Token Launch

Even in this red market, some projects are printing green candles. One new project drawing attention is Plasma’s XPL token, which debuted this week on Binance and OKX with a market capitalization above $2.4 billion. XPL is designed as a multifunctional asset: it powers transactions as a gas token, secures the network through staking, and rewards validators. Alongside the token launch, Plasma introduced Plasma One, a stablecoin-native neobank aimed at broadening access to digital dollar payments and savings.

(Source: Coingecko)

The wider market has yet to confirm a recovery. Ongoing concerns about global economic conditions, including the potential U.S. government funding lapse and monetary policy uncertainty, continue to weigh on sentiment.

While selling pressure could ease after Friday’s expiry, traders should be prepared for continued fluctuations. For now, careful positioning and watching early-stage projects like Plasma may help investors navigate the coming weeks.

Mira (MIRA) Launches as Blockchain “Trust Layer” for AI

Mira (MIRA) has officially launched, positioning itself as a blockchain-based verification layer for artificial intelligence. Designed to tackle issues like bias and hallucinations in AI outputs, Mira aims to provide users with verifiable, reliable results through decentralized cross-checking of AI data across blockchain nodes.

The project’s token, MIRA, is now live for trading, with initial pairs including USDT, USDC, BNB, FDUSD, and TRY. At launch, ~19.1% of the total 1 billion MIRA supply is circulating.

In addition to standard trading, MIRA was distributed to early supporters through a retroactive airdrop, rewarding long-term holders with a portion of the token supply. Mira also plans future allocations for marketing and community growth, signaling strong long-term ambitions.

Mira’s decentralized AI verification system has drawn comparisons to Bitcoin in its approach to building trust without centralized authority.

Following launch, MIRA reached an all-time high of $2.25 and currently trades at $1.69.

U.S. August Core PCE Inflation Holds at 2.9%, In Line With Forecasts

The U.S. Commerce Department reported that the Core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, rose 2.9% year-over-year in August 2025, matching market expectations.

Headline PCE inflation increased 2.7% annually and 0.3% month-over-month, pointing to steady but contained price pressures. Analysts note the figures support the Fed’s cautious stance, keeping rate cuts on the table but not rushing the timeline.

Financial markets responded modestly, with Treasury yields easing and equities edging higher, as investors weighed the data’s implications for monetary policy heading into the final quarter of the year.

Is PUMP Crypto Ready For A +100% Bounce? Focus Also On Best Crypto Presales

The past 24 hours have been a rollercoaster for the crypto market. BNB crypto is back below $1,000, while Bitcoin is now trading below $110,000 at press time. Amid this turbulence, PUMP crypto is sticky at around critical support levels. Despite being one of the top performers in Q3 2025, surging by over +230% from August to September, the uptrend momentum is worringly waning.

As of press time,  PUMP ▲0.00% is changing hands at around $0.0052, down -40% from its all-time high of $0.009. The recent sell-off has been ruthless, shaking out speculators chasing the $0.01 mark.

PUMP ▲0.00% is changing hands at around $0.0052, down -40% from its all-time high of $0.009. The recent sell-off has been ruthless, shaking out speculators chasing the $0.01 mark.

Plasma TVL Erupts After Mainnet: XPL Price Prediction For October?

When Stablecoin L1 Plasma goes live, billions in liquidity follow, putting new pressure on XPL’s first-month trading range.

Plasma, a Bitfinex-backed Layer 1 blockchain built for stablecoins, launched its mainnet beta and native token XPL on Sept. 25. The rollout included integrations with major DeFi protocols and immediate listings on leading exchanges, signaling a strong market entry.

The new global financial system is here. pic.twitter.com/pkpXia30FS

— Plasma (@PlasmaFDN) September 25, 2025

The post Crypto News Today, September 26 – Is The Crypto Market Done Crashing? $22 Billion Bitcoin And Ethereum Options Expiring – Best Crypto to Buy Amid This High Volatility? appeared first on 99Bitcoins.