Algorand just lined up two fresh catalysts: stablecoin liquidity and leadership, giving bulls a clean October narrative to trade.

The Algorand Foundation has partnered with cross-chain protocol Allbridge to roll out a dedicated stablecoin bridge for the Algorand network, with the launch set for the fourth quarter of 2025.

The new bridge will enable native stablecoins such as USDC to move directly into the Algorand ecosystem from other blockchains using Allbridge Core.

The move is expected to improve liquidity and broaden the use of stablecoins across Algorand-based applications.

What Does the Allbridge Integration Mean for Algorand Users?

According to an official announcement, the integration builds on Allbridge’s multi-chain infrastructure. The protocol supports more than 20 networks and provides developer APIs for in-app bridging.

Algorand is integrating with @Allbridge_io to launch a dedicated stablecoin bridge in Q4 2025.

This will give users and developers seamless access to stablecoin liquidity across multiple blockchains, strengthening Algorand as a hub for on-chain finance. pic.twitter.com/HcFcGr7ux7

— Algorand Foundation (@AlgoFoundation) September 30, 2025

Allbridge is also part of Circle’s Alliance Program, which aims to expand the reach of USDC.

The announcement comes a day after Algorand appointed former Ripple engineering lead Nikolaos Bougalis as its new chief technology officer.

We’re thrilled to announce that @nbougalis is joining the Algorand Foundation as our new CTO. pic.twitter.com/g2HuOmJtGv

— Algorand Foundation (@AlgoFoundation) September 29, 2025

Bougalis will oversee the network’s 2025 roadmap focused on decentralization, security, and scalability.

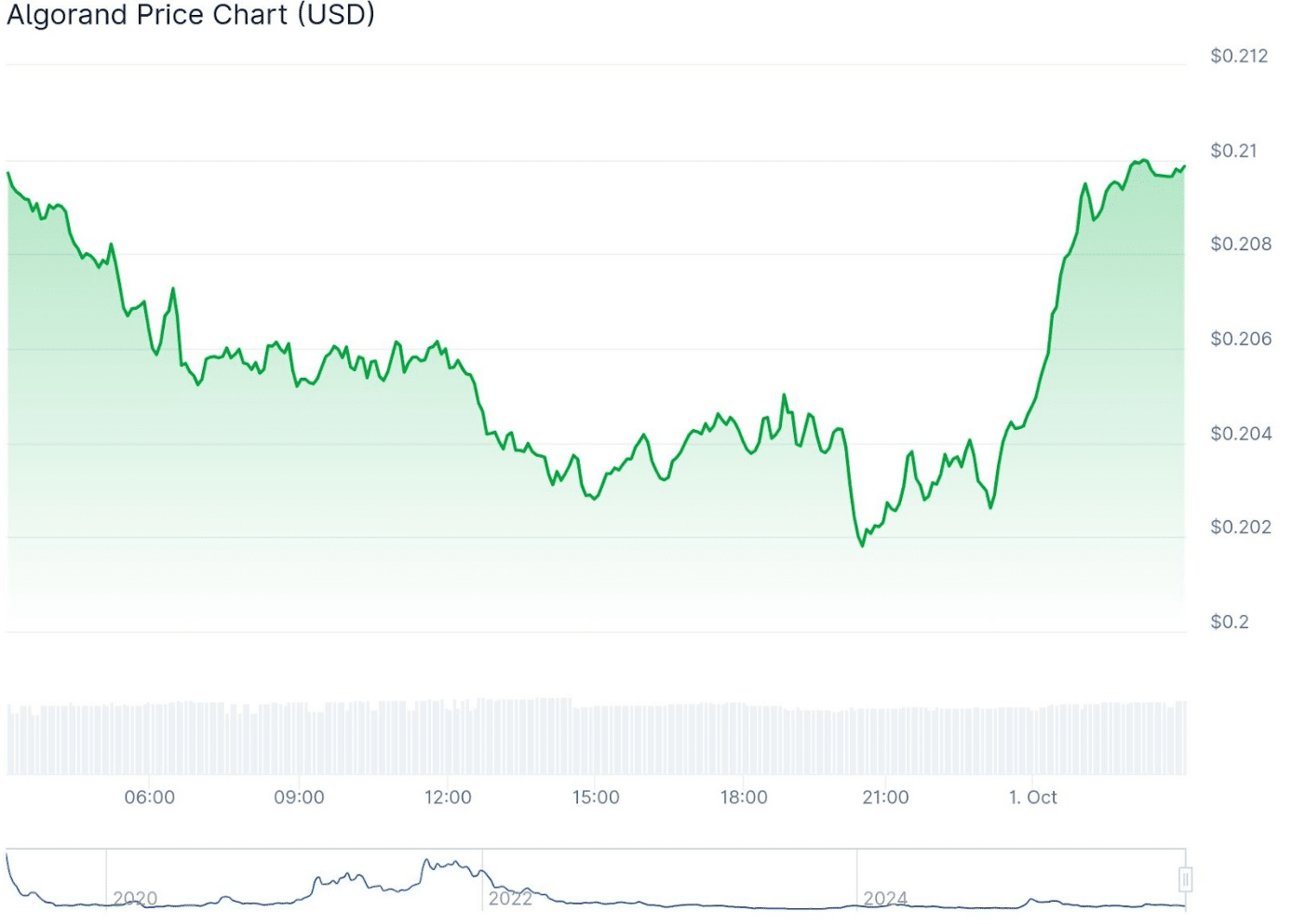

According to CoinGecko data, Algorand’s native token ALGO trades at around $0.21, showing a slight increase of +0.1% over the past 24 hours, with daily volume near $100M.

DISCOVER: 20+ Next Crypto to Explode in 2025

According to DefiLlama data, the network currently holds about $47.5M in stablecoins, with USDC accounting for roughly 95% of that market share.

Daily decentralized exchange (DEX) volume stands at $530,000, while around 38,000 addresses were active in the past day.

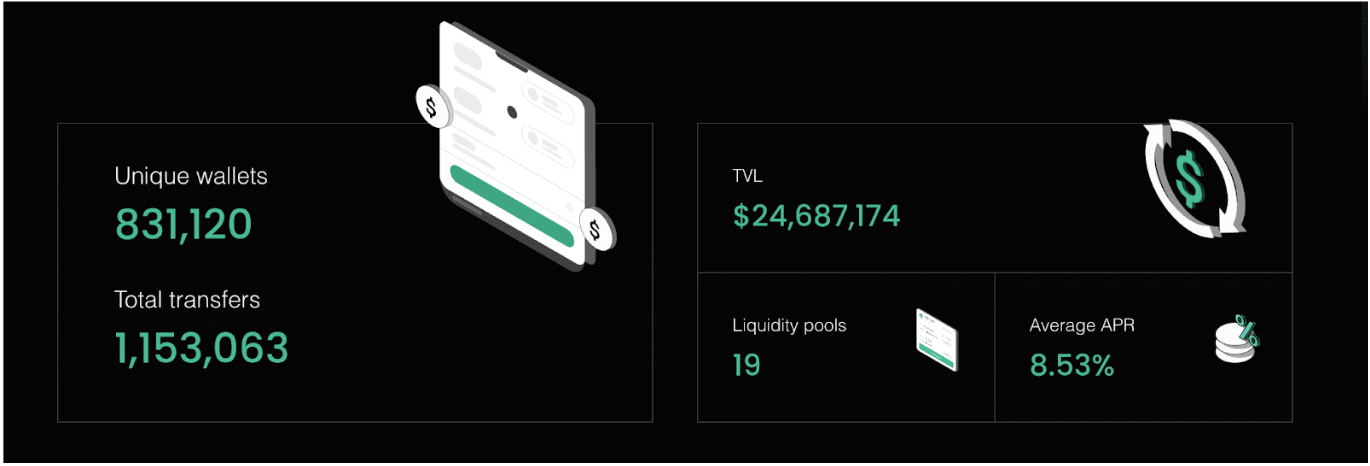

For Allbridge, the integration extends its existing cross-chain activity. The protocol has processed more than 1.15M transfers across 831,120 wallets, with total value locked at about $24.68M.

Algorand’s business chief, Min Wei, said stablecoin access is “fundamental to bridging the gap between TradFi and DeFi,” highlighting payments and tokenized real-world assets as key use cases.

Allbridge co-founder Andriy Velykyy noted that expanding Allbridge Core to Algorand will “open a new destination for USDC swaps and cross-chain transfers.”

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Algorand Price Prediction: What Are the Key Price Targets for Algorand (ALGO) in This Altseason?

Algorand (ALGO) is showing signs of fresh momentum, with analysts pointing to a wave structure that may set up the token for a major move.

One analyst noted that “ALGO price is a function of market cap,” laying out targets at $0.83 for Wave 3, $0.48 for Wave 4, and $2.06 for Wave 5.

Price is a Function of Market Cap

Altseason Targets

➼ Wave 3: $0.83

➼ Wave 4: $0.48

➼ Wave 5: $2.06All Math, All Day

pic.twitter.com/HBF6Y9n3Ls

— Quantum Ascend (@quantum_ascend) September 29, 2025

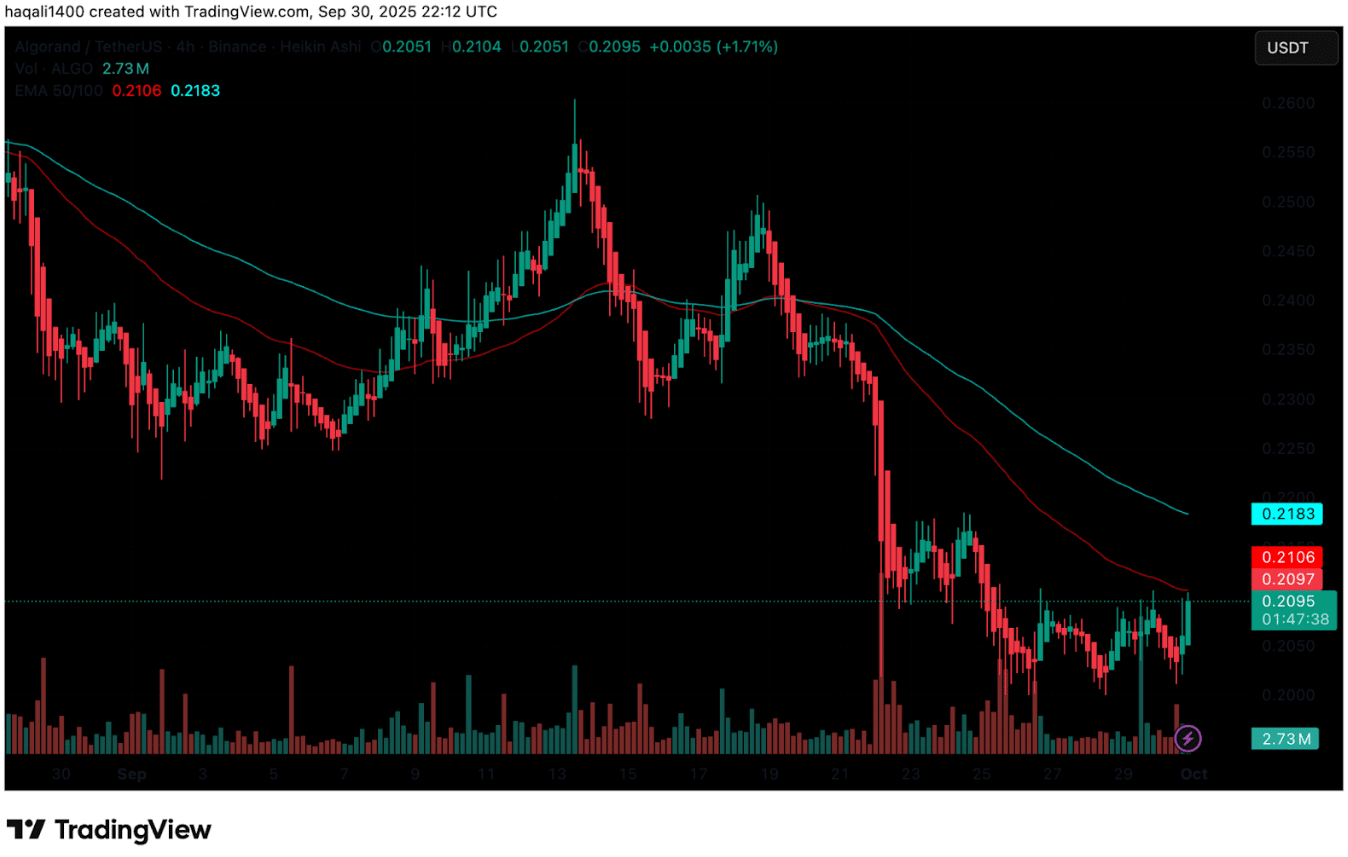

The ALGO/USDT chart on TradingView shows the token holding above support after bouncing back from September lows.

Higher lows are forming on the 4-hour chart, a sign of steady accumulation. Resistance has formed between $0.31 and $0.33, where trading volume is clustering. A push through this zone could open the way to the next target near $0.83.

(Source: ALGO USDT, Tradingview)

Short-term moving averages are turning upward, while the RSI sits in neutral territory, leaving room for more upside. If buying fades, a pullback to $0.48 is possible. But the broader Elliott Wave count points to a longer-term climb that could extend toward $2.06.

The price structure matches a typical Elliott Wave pattern, where Wave 3 is often the strongest advance.

Recent developments on the network, including Algorand’s new cross-chain stablecoin bridge with Allbridge, may support liquidity growth and fuel market interest in the months ahead.

For now, traders are watching whether ALGO can hold its support base and clear resistance. A breakout would confirm the wave targets and strengthen the case for an altseason rally. Volatility remains a risk, but the chart suggests momentum is building in Algorand’s favor.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Algorand News Could Trigger Major Breakout in October: Here’s Why appeared first on 99Bitcoins.