The Bitcoin price has clawed back more than 10% from its September lows and is once again eyeing the $124,514 ATH.

Traders are split debating if this is the start of another leg higher, or just another setup for a bull trap?

Bitcoin Price: Why Are Wall Street Analysts Turning Bullish on Bitcoin?

Citigroup has laid out three scenarios for

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

1.83%

Bitcoin

BTC

Price

$122,774.48

1.83% /24h

Volume in 24h

$73.55B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

over the next 12 months. Their base case predicts a 50% rally to $181,000, while the bull case projects a surge to $231,000, representing a 93% increase from current levels.

“The premium grows as institutional demand expands while supply shrinks on exchanges,” Citi wrote in its note to clients.

Citi introduces new 12-month price targets for digital assets:

Bear Base Bull

BTC $82k $181k $231k

ETH $2k $5.4k $7.3k pic.twitter.com/AlpWPaK2YW— matthew sigel, recovering CFA (@matthew_sigel) October 2, 2025

BlackRock has gone even further, suggesting Bitcoin could eventually reach $700,000 in the long run. Ark Invest’s Cathie Wood reiterated her call for BTC above $2.4M, citing its role as a disruptive monetary technology.

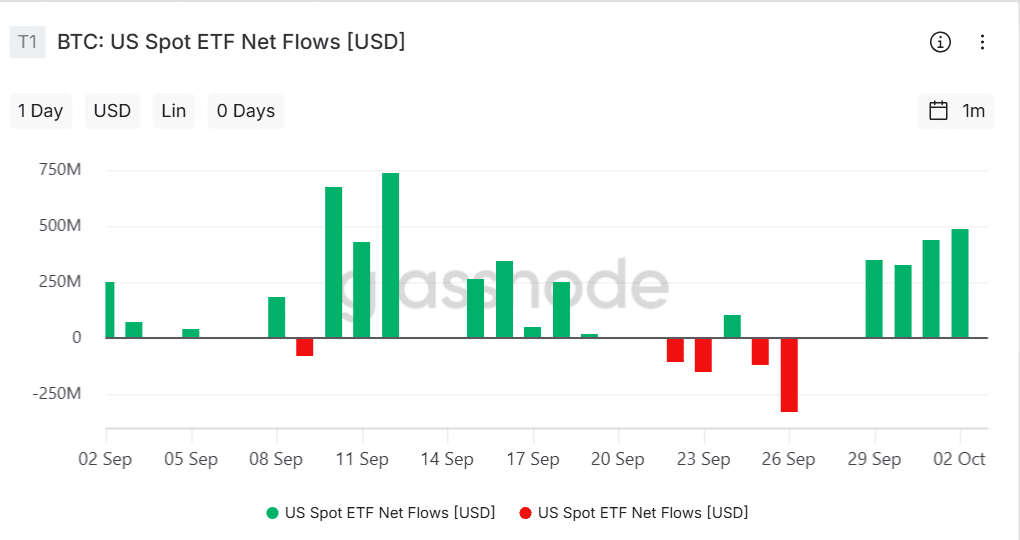

Spot Bitcoin ETFs have attracted more than $54Bn this year, while Glassnode indicates that exchange balances are at their lowest point since 2017. Supply is shrinking just as institutional demand keeps rising.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Data Points That Strengthen the Case: Can BTC Break $150k in 2025?

The supply squeeze is measurable for BTC. Glassnode reports that miner difficulty is at an all-time high, and more than 70% of Bitcoin’s circulating supply has remained unchanged for over a year. This illiquid supply amplifies the impact of new institutional inflows.

Meanwhile, Bitcoin’s correlation with the S&P 500 and Nasdaq has declined, according to FRED, reinforcing its emerging role as a “digital gold.” BlackRock noted in a white paper that BTC consistently outperformed traditional assets following crises, from the Covid crash to the war in Ukraine.

The charts are equally compelling. BTC has reclaimed the 50-day EMA at $113,830 and is now forming a bullish flag structure. Traders are eyeing the following milestones:

- First stop: $124,200, the year-to-date high.

- Psychological barrier: $125,000.

- Overshoot target: $131,250, based on Murrey Math Lines.

DISCOVER: 20+ Next Crypto to Explode in 2025

The Macro Wild Card

Rate cuts, oil-driven inflation, and ETF demand have pushed Bitcoin to $120K, which is why Wall Street is bullish. Supply on exchanges keeps thinning, institutions keep buying, and more traders are eying Citi’s $231K target for next year.

The path is bullish, but we will continue to see turbulence along the ride.

EXPLORE: Is Standard Chartered Set to Pump Polygon? POL Price Prediction For Uptober

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The Bitcoin price has clawed back more than 10% from its September lows and is once again eyeing the $124,514 ATH.

- Spot Bitcoin ETFs have pulled in more than $54 billion this year, while Glassnode shows exchange balances at their lowest point since 2017.

The post New Wall St. Bitcoin Price Prediction: Can BTC Push Toward $231K? appeared first on 99Bitcoins.